Mid-Year U.S. Auto Warranty Expenses:

Ford, GM, and Tesla all hit new record high warranty reserve fund balances in the middle of 2025. Ford and Tesla saw their warranty claims and accrual rates rise in the first quarter of 2025, and then drop in the second quarter, while GM's warranty expense rates increased from the first to the second quarter of 2025.

The quarterly warranty costs of the three major U.S.-based automakers, General Motors, Ford, and Tesla, increased in the first half of 2024, and have remained elevated in the year since. Warranty reserves held by the three manufacturers increased for the eleventh consecutive quarter in the middle of 2025. Claims and accruals remained high in the first two quarters of 2025, but have not risen above the level of warranty expenses we saw in the second half of 2024. Perhaps this is a new normal for the auto industry, as models and repairs continue to become more complex, especially with the increasing emphasis on electric vehicles and electronic touchscreen dashboards.

As we discussed in our February 27, 2025 newsletter "U.S. Auto Warranty Annual Reports," and our August 29, 2024 newsletter "Mid-Year U.S. Auto Warranty Report," Ford was in the news in mid-2024, blaming high warranty costs for a decrease in profit in the second quarter of 2024, which prompted the company's stock to plummet 18% in one day in July 2024. Take a look at those two newsletters for an in-depth exploration of that news story, and the data behind it.

As we highlighted in the "Mid-Year U.S. Auto Warranty Report," Ford's warranty woes last year were not tied to one specific large recall, such as GM's Chevy Bolt battery recall, or Tesla's autopilot software recalls. Although, we'd be remiss not to mention that Ford did recall over 2 million older Ford Explorers in January 2024.

In Ford's earnings call for the second quarter of 2024, CEO James Farley and CFO John Lawler blamed the increased warranty costs on two main issues: defects and quality issues popping up in older models between five and ten years old, and repairs becoming more expensive because of the complex technology and electronics present in newer vehicles.

This may be a new prevailing trend for the warranty expenses of the American automakers. Ford, GM, and Tesla, along with many of their global competitors, are including increasingly complex electronic panels and components, especially dashboard touchscreens, in their newest models. However, they're generally not hiring electricians at their dealerships, so when a customer brings in a vehicle to the dealership mechanic with an electronics issue, the mechanic will often replace the whole panel. Those are expensive parts to replace, rather than repair, and the costs have been adding up in the short-term.

There are positives to the increasing amount of electronic components of a vehicle, such as the ability to issue over-the-air (OTA) updates, and to do preventative maintenance. There's also a potential to detect problems earlier through connected software, all of which could theoretically help lower warranty costs in the future.

The U.S.-based automakers seem to believe that the long-term impact of using complex electronics and software in their vehicles will be positive. However, these components have undoubtedly contributed to increased warranty costs in the short-term. With EVs coming onto the scene, there's a concern that the average cost of a warranty repair could continue to increase.

The outlook at the middle of 2025 seems to be that 2024's elevated warranty costs were not an anomaly, but the new normal; although warranty costs didn't rise exponentially in the first half of 2025, they didn't fall back to pre-2024 levels either. Electronic components aren't the only thing contributing to the rising cost of repairs, though. There are also concerns with labor shortages, lagging enrollment in trade schools, and tariffs affecting the price of replacement parts.

To compile this newsletter, we perused the annual reports and quarterly financial statements of the three largest U.S.-based automakers, Ford Motor Co., General Motors Co., and Tesla Inc. We gathered three key warranty metrics: the amount of claims paid, the amount of accruals made, and the end-balance of the warranty reserve fund.

In addition, we gathered data on each manufacturer's total vehicle sales revenue, and used these to calculate our two warranty expense rates: claims as a percentage of sales (the claims rate), and accruals as a percentage of sales (the accrual rate).

Warranty Claims Totals

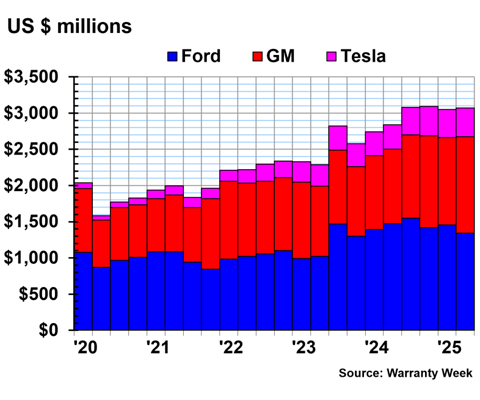

Figure 1 shows the total quarterly warranty claims paid by the three U.S.-based automakers, from 2020 to the second quarter of 2025.

Figure 1

U.S.-based Auto Manufacturers

Claims Paid per Quarter

(in millions of U.S. dollars, 2020-2025)

Ford paid $1.457 billion in warranty claims in the first quarter of 2025, and $1.344 billion in the second quarter of 2025. Ford's warranty claims costs reduced by -2% from the first half of 2024 to the first half of 2025.

GM paid $1.203 billion in warranty claims in the first quarter of 2025. Claims costs increased by 11% from the first quarter to the second quarter of 2025, up to $1.330 billion. GM's claims costs rose by 23% from the first half of 2024 to the first half of 2025.

Tesla paid $392 million in warranty claims in the first quarter of 2025, and $398 million in the second quarter of 2025. Tesla's warranty claims costs rose by 18% from the first half of 2024 to the first half of 2025.

Warranty Claims Rates

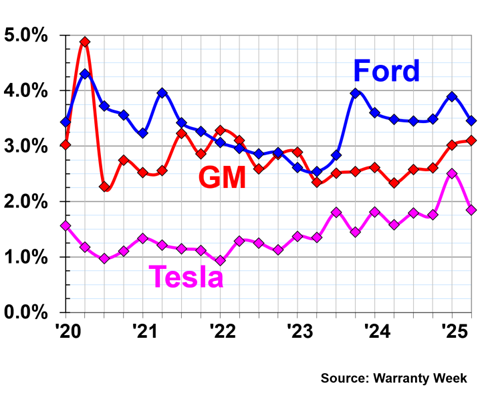

Figure 2 shows the quarterly warranty claims rate of the three automakers, from 2020 to the second quarter of 2025.

Figure 2

U.S.-based Auto Manufacturers

Warranty Claims Rates

(as a % of product sales, 2020-2025)

Ford, GM, and Tesla all saw their warranty claims rates rise from the fourth quarter of 2024 to the first quarter of 2025. Ford and Tesla both saw their claims rates fall again in the second quarter of 2025, but GM's increased a bit.

In the first quarter of 2025, Ford had a warranty claims rate of 3.9%, GM had a claims rate of 3.0%, and Tesla had a claims rate of 2.5%. In the second quarter of 2025, Ford had a claims rate of 3.5%, GM had a claims rate of 3.1%, and Tesla had a claims rate of 1.8%.

Warranty Accrual Totals

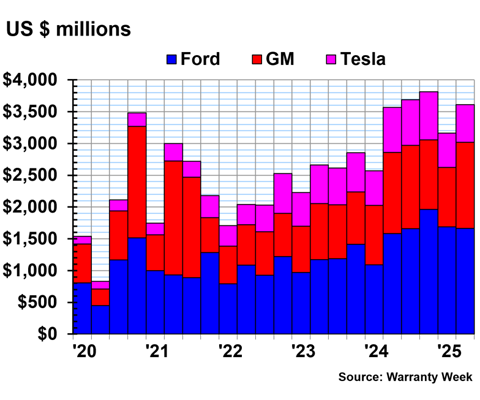

Figure 3 shows the total quarterly warranty accruals set aside by the three U.S.-based automakers, from 2020 to the second quarter of 2025.

Figure 3

U.S.-based Auto Manufacturers

Accruals Made per Quarter

(in millions of U.S. dollars, 2020-2025)

Ford's quarterly warranty accruals spiked in the fourth quarter of 2024, and fell a bit, but remained higher than typical, in the first two quarters of 2025. In the first quarter of 2025, Ford set aside $1.689 billion in warranty accruals. In the second quarter of 2025, Ford set aside $1.662 billion in warranty accruals. Ford's warranty accruals increased by 25% from the first half of 2024 to the first half of 2025.

GM set aside $932 million in warranty accruals in the first quarter of 2025, and $1.358 billion in warranty accruals in the second quarter of 2025. GM's warranty accruals increased by 4% from the first half of 2024 to the first half of 2025.

Tesla set aside $543 million in warranty accruals in the first quarter of 2025, and $591 million in warranty accruals in the second quarter of 2025. Tesla's warranty accruals decreased by -10% from the first half of 2024 to the first half of 2025.

Warranty Accrual Rates

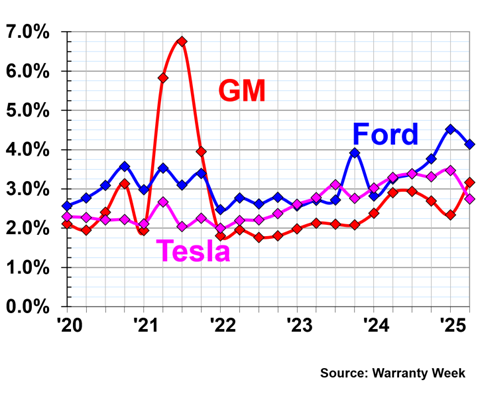

Figure 4 shows the quarterly warranty accrual rates of the three automakers, from 2020 to the second quarter of 2025.

Figure 4

U.S.-based Auto Manufacturers

Warranty Accrual Rates

(as a % of product sales, 2020-2025)

Ford's warranty accrual rate rose to a new record high of 4.5% in the first quarter of 2025, then decreased a bit to 4.1% in the second quarter of the year.

GM had a warranty accrual rate of 2.3% in the first quarter of 2025, and 3.2% in the second quarter.

Tesla had a warranty accrual rate of 3.% in the first quarter of 2025, and 2.7% in the second quarter of 2025.

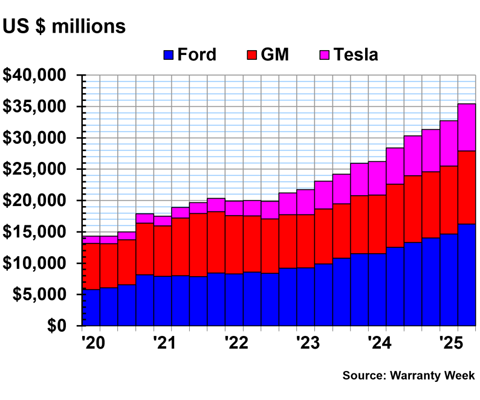

Warranty Reserve Balances

Figure 5 shows the quarterly end-balances of each automaker's warranty reserve funds, from 2020 to the second quarter of 2025.

Figure 5

U.S.-based Auto Manufacturers

Reserves Held per Quarter

(in millions of U.S. dollars, 2020-2025)

At the end of the second quarter of 2025, Ford, GM, and Tesla all set new record highs in the balance of their warranty reserve funds.

At the end of the first quarter of 2025, Ford held $14.649 in its warranty reserve fund. That balance rose another 11% to a new record of $16.237 billion held in warranty reserves at the end of the second quarter of 2025.

At the end of the first quarter of 2025, GM held $10.873 billion in warranty reserves. That figure rose another 8% to a new record high total of $11.698 billion at the end of the second quarter of 2025.

Tesla held $7.214 billion in warranty reserves at the end of the first quarter of 2025. The balance of the warranty reserve fund increased by another 4%, to a total of $7.512 billion held in warranty reserves at the end of the second quarter of 2025.

Check out these newsletters on 2024 international auto warranty expenses:

- "U.S. Auto Warranty Annual Reports"

- "European Automaker Warranty Expenses"

- "Japanese Automaker Warranty Expenses"