Worldwide Jet Engine Warranty Expenses:

In 2024, the global aircraft engine manufacturers paid $1.004 billion in warranty claims, with an average warranty claims rate of 0.81%, and set aside $1.16 billion in warranty accruals, with an average warranty accrual rate of 0.93%.

For the past few weeks, we've been discussing the warranty expenses associated with the major global airframe manufacturers; we looked at the past five years of warranty costs for the global airframe OEMs in our newsletter "Worldwide Aviation Warranty Expenses," and took a macro view of how decisions made in the latter half of the 20th century set the stage for the major warranty problems of Boeing and Airbus in 21st century in "Commercial Aviation Warranty Expenses."

The story of the global commercial airframe manufacturers in the past two decades is shaped by major warranty debacles. As suppliers, the jet engine manufacturers are more insulated from spikes in warranty costs due to snafus with certain airliner models.

In contrast to last year's version of this report, this year, we are presenting GE's segmented warranty expenses just for its aerospace sector, starting in 2022. As we detailed in our March 2025 newsletter "GE's Warranty Expenses by Industry," GE officially completed its split into three separate companies, GE Aerospace, GE Vernova, and GE HealthCare, in April 2024. Technically, the parent General Electric renamed itself GE Aerospace, and spun-off the other two entities.

In February 2025, GE Aerospace (formerly GE Aviation) and GE Vernova (formerly GE Renewable Energy, GE Power, GE Digital, and GE Energy Financial Services) both filed separate annual reports, which conveniently contained not just 2024 warranty data, but also historical data from 2023 and 2022 as well.

The parent GE never segmented its warranty expenses in its annual reports. Now, we know that the former parent GE's warranty expenses were approximately 60% GE Vernova, 25% GE Aerospace, and 15% GE HealthCare. As such, the total warranty expenses across the global jet engine industry decreased significantly, because it turns out that GE was paying much more in warranty expenses on its wind turbines than it was on its jet engines. The spin-off of GE Vernova has given us amazing insight into the segmentation of GE's warranty expenses, and we can confidently say that this Worldwide Jet Engine Warranty Report is the most accurate we have ever published.

To create this warranty report, we first identified the top global jet engine manufacturers. Next, we perused their annual reports, and gathered three key warranty metrics: the amount of claims paid, the amount of accruals made, and the balance of the warranty reserve fund at the end of each fiscal year.

In addition, we gathered data on each jet engine manufacturer's product sales revenue, and used these to calculate two additional warranty expense rates: claims as a percentage of product sales (the claims rate), and accruals as a percentage of product sales (the accrual rate).

Since the global jet engine manufacturers report their expenses in U.S. dollars, British pounds, and Euro, we converted all data to U.S. dollars using the IRS Yearly average currency exchange rates table for ease of comparison.

Global Jet Engine Industry

The global jet engine industry is characterized by a few key players, along with many additional joint ventures between them. Some of them are "pure plays," only making jet engines, while others are huge aerospace, defense, security, and communications conglomerates.

As is common in the aerospace sector, it's important to note that all of these jet engine manufacturers are also defense contractors. However, they only report the warranty expenses associated with commercial jet engine sales.

Military sales do not come with traditional product warranties attached. Instead, they come with a unique type of "military service contract." As such, we do not factor revenue generated from defense contracts into the segmented product sales revenue figures.

Rolls-Royce Holdings plc, based in the United Kingdom, is one of the largest pure play jet engine OEM. This Rolls-Royce is not to be confused with Rolls-Royce Motor Cars, which has been a subsidiary of BMW since 2003.

GE Aerospace is new to being an aircraft engine pure play, since the spin-offs of its other businesses were completed in April 2024.

There's also the Germany-based MTU Aero Engines AG, which was initially formed as a joint venture between MAN Turbo and Daimler-Benz back in 1968. However, the company traces its origins back to when BMW spun-off its aircraft engine division in 1934, and still uses the same plant in Allach, near Munich. MTU became an independent company through a sale to a private equity firm, which then listed all of MTU's shares on the stock exchange.

U.S.-based Williams International is also a jet engine pure play, but does not report its financial data since it is privately owned.

The other three companies in this report, RTX, Honeywell, and Safran, are significant global defense conglomerates.

RTX Corp. was formerly known as Raytheon Co. After acquiring United Technologies in 2020, Raytheon renamed itself RTX. Pratt & Whitney, a significant global aircraft engine brand and former subsidiary of United Technologies, is now owned by RTX.

Honeywell Aerospace, which makes aircraft engines and avionics, is a division of global aerospace and defense conglomerate Honeywell International Inc. Safran Aircraft Engines, formerly known as Snecma, is a division of the France-based aerospace and defense conglomerate Safran SA.

There are also several notable joint ventures among these players, along with some of the major global airframe OEMs.

In the United States, The Engine Alliance is a 50/50 joint venture between GE Aerospace and Pratt & Whitney. Cross-Atlantic, CFM International is a 50/50 joint venture between GE Aerospace and Safran Aircraft Engines. Boeing and Safran also have a 50/50 joint venture to design, build, and service auxiliary power units.

There's also PowerJet, a 50/50 joint venture between Safran Aircraft Engines and the Russian aircraft engine manufacturer NPO Saturn, a division of United Engine Corporation, which in turn is owned by the Russian state-owned defense conglomerate Rostec. As one might expect, France's sanctions against Russia following the 2022 invasion of Ukraine have led to PowerJet terminating service for its engines, including parts, technical support, engine maintenance, and repair services. The sanctions have created a fascinating warranty work situation in Russia, similar to what we saw in Iran in the 2010s.

And notably, there's International Aero Engines (IAE) AG, formed in 1983 as an engine consortium consisting of Pratt & Whitney, Rolls-Royce, MTU Aero Engines, Italy-based Fiat Avio, and the Japanese Aero Engine Corporation (JAEC). After Fiat Avio and Rolls-Royce exited the consortium (though both remain parts suppliers), IAE is now 50% owned by Pratt & Whitney, 25% owned by MTU, and 25% owned by JAEC.

The former Fiat Avio was sold by the Fiat Group in 2003, to a consortium 70% owned by the American private equity firm The Carlyle Group, and 30% owned by the Italian Finmeccanica S.p.A., now known as Leonardo S.p.A. The Carlyle Group later sold its portion of Avio S.p.A. to the British private equity firm Cinven Limited. The company was then split in two, with Avio's aviation division spun-off and acquired by General Electric 2012, while Avio's space division retains the Avio S.p.A. name, and continues to be jointly owned by Cinven and Leonardo, collaborating with the European Space Agency.

ITP (Industria de Turbo Propulsores) Aero was formed in 1989 as a joint venture between Spanish conglomerate SENER and Rolls-Royce. And in turn, it belongs to the Europrop International (EPI) GmbH consortium, which was founded in 2002, and consists of MTU Aero Engines, Safran Aircraft Engines, Rolls-Royce, and ITP Aero.

There's also EuroJet Turbo GmbH, which is a consortium founded in 1986, which consists of Rolls-Royce, MTU, ITP, and Avio.

Of course, there are also more jet engine manufacturers, defense contractors, joint ventures, and consortium counterparts of these manufacturers based in Russia and China, as we indicated with our mention of Rostec's previous collaboration with Safran. However, as one would expect, there's no publicly available warranty data for these companies.

In the following charts, we present data from GE, RTX, Safran, Rolls-Royce, Honeywell, and MTU. These six represent almost all of the warranty expenses of the worldwide civil aircraft engine industry, and all six luckily publish their warranty expenses in their annual reports.

Warranty Claims Totals

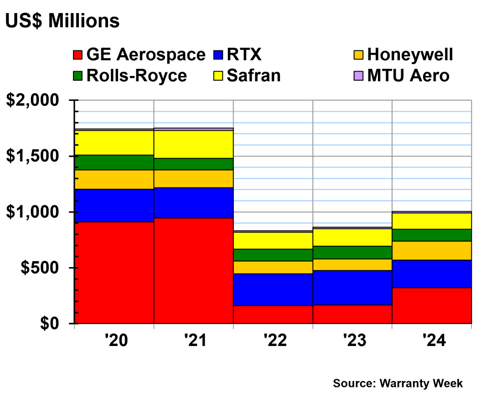

Figure 1 shows the total annual civil product warranty claims paid by the top global jet engine OEMs, from 2020 to 2024.

Figure 1

Top Jet Engine Makers Worldwide

Claims Paid per Year

(in millions of U.S. dollars, 2020-2024)

In 2024, the top six global jet engine manufacturers paid a total of $1.004 billion in warranty claims, an increase of 16% from 2023.

GE Aerospace paid $321 million in warranty claims in fiscal 2024. While this total is only about one-third of what we saw from the parent GE before the split, this was about double what the GE Aerospace division reported paying in warranty claims in 2022 and 2023 before the spin-offs were finalized.

RTX paid $247 million in warranty claims in 2024, a -20% decrease from 2023. Honeywell paid $171 million in warranty claims in 2024, a 61% increase form 2023's total of $106 million.

Rolls-Royce paid $107 million in claims in 2024, a -5% decrease. Safran paid $145 million in claims, a -8% decrease. And MTU Aero Engines paid $13 million in warranty claims in 2024, a 6% increase from 2023.

Warranty Claims Rates

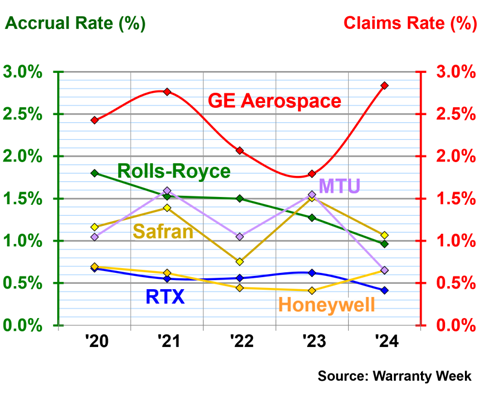

Figure 2 shows the annual warranty claims rates of these six aircraft engine manufacturers. We calculate the claims rate by dividing each manufacturer's warranty claims paid by its total product sales revenue over the same period.

Figure 2

Top Jet Engine Makers Worldwide

Warranty Claims Rates

(as a % of product sales, 2020-2024)

The six largest global aircraft engine manufacturers had an average warranty claims rate of 0.81% in 2024.

In 2024, GE Aerospace had a warranty claims rate of 2.84%, an increase of almost two-thirds from 2023. GE Aerospace had a much higher claims rate than any of its direct competitors in 2024.

Safran had a claims rate of 1.07% in 2024, a decrease of about one-third from 2023. Rolls-Royce had a claims rate of 0.96% in 2024, a decrease of about one-quarter from 2023.

MTU Aero had a claims rate of 0.65% in 2024, a decrease of almost two-thirds from 2023's claims rate of 1.55%. Honeywell also had a claims rate of 0.65% in 2024, about a two-thirds increase in the claims rate from 2023.

RTX had a warranty claims rate of 0.41% in 2024, a decrease of one-third from 2023.

Warranty Accrual Totals

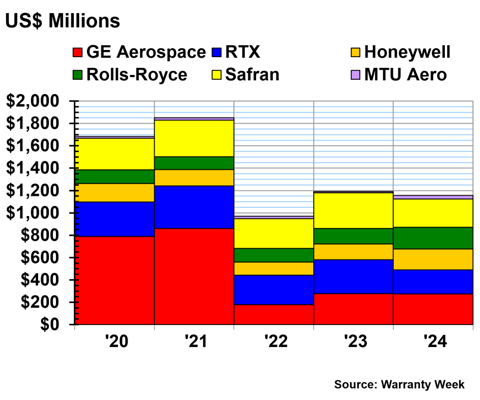

Figure 3 shows the total warranty accruals made by the largest global jet engine manufacturers, from 2020 to 2024.

Figure 3

Top Jet Engine Makers Worldwide

Accruals Made per Year

(in millions of U.S. dollars, 2020-2024)

In fiscal 2024, the jet engine manufacturers set aside a total of $1.16 billion in warranty accruals, a -3% decrease from 2023.

GE Aerospace set aside $275 million in warranty accruals in fiscal 2024, a mere -1% decrease from 2023. Safran set aside $253 million in accruals in 2024, a -21% decrease. RTX set aside $216 million in accruals, a -29% decrease.

Rolls-Royce set aside $195 million in warranty accruals in 2024, a 40% increase from 2023. Honeywell set aside $186 million in warranty accruals, a 34% increase.

MTU Aero set aside $32 million in warranty accruals in 2024, almost triple 2023's total of $12 million.

Warranty Accrual Rates

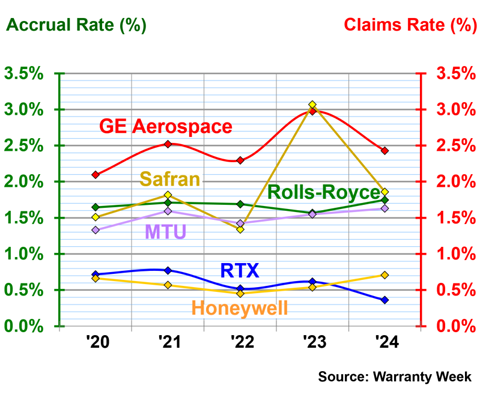

Figure 4 shows the warranty accrual rates of these six manufacturers, from 2020 to 2024.

Figure 4

Top Jet Engine Makers Worldwide

Warranty Accrual Rates

(as a % of product sales, 2020-2024)

The jet engine manufacturers had an average warranty accrual rate of 0.93% in 2024.

GE Aerospace had a warranty accrual rate of 2.43% in 2024, down a bit from 2023, but still at the top of the pack.

Safran had a warranty accrual rate of 1.86% in 2024, down about one-third from 2023. Rolls-Royce had an accrual rate of 1.75% in 2024, up a bit from 2023. MTU Aero had an accrual rate of 1.63%, about the same as the year prior.

Honeywell had an accrual rate of 0.71% in 2024, up about one-third from 2023. And RTX had an accrual rate of 0.36% in 2024, down about two-fifths from 2023.

Warranty Reserve Balances

Figure 5 shows the warranty reserve end-balance of each jet engine manufacturer, from 2020 to 2024.

Figure 5

Top Jet Engine Makers Worldwide

Reserves Held per Year

(in millions of U.S. dollars, 2020-2024)

The aircraft engine manufacturers held a total of $3.47 billion in warranty reserves at the end of fiscal 2024.

Safran held $1.17 billion in warranty reserves at the end of fiscal 2024, a 5% increase from 2023. RTX held $993 million in reserves at the end of 2024, a -9% decrease from the end of the year prior.

At the end of fiscal 2024, GE Aerospace held $592 million in warranty reserves, a decrease of -7% from 2023. Rolls-Royce held $436 million in reserves, a 15% increase. And Honeywell held $237 million, an 8% increase.

MTU Aero held $37 million in warranty reserves at the end of fiscal 2024, a 79% increase from a balance of $21 million at the end of 2023.