Other U.S. Product Warranties:

A variety of unexpected items come with product warranties, including e-cigarettes, exercise bicycles, diamond rings, scuba diving gear, player pianos, golf clubs, and karaoke machines. Meanwhile, very few U.S.-based consumer electronics manufacturers are reporting warranty expenses anymore.

This week, our series of 20-year industry warranty reports comes to a close. Over the past three months, we have summarized 80 quarters of product warranty claims, accrual, and reserve data across 18 manufacturing industries in the United States.

Today, we are taking a look at four industries that don't have a lot in common aside from the fact that their products don't fit into any other industry grouping. These industries are: consumer electronics, sports equipment, material handling, and security systems. Together, these four accounted for 1.5% of all warranty claims and accruals reported in the United States in 2022.

This story is not about the industry groups in the report, but rather about the individual companies featured. Many of these are newcomers to the world of product warranties, and represent evolution in the products that manufacturers are guaranteeing with warranties. Among the top 10 manufacturers in terms of accruals, six started reporting their warranty expenses after 2003. Two of our top three weren't even reporting 10 years ago.

To compile this report, we started with a list of 129 manufacturers primarily making material handling equipment, security systems, consumer electronics, sports equipment, or a few other things that didn't directly fit into a category. This includes unique companies that were difficult to categorize, and some items you might not expect to have product warranties attached to them, such as vapes, player pianos, guns, and breathalyzers.

From each manufacturer's annual reports and quarterly financial statements, we collected three key warranty metrics: the amount of claims paid, the amount of accruals made, and the ending balance of the warranty reserve fund on December 31 of each year. We time-shift the data for companies with fiscal years that do not correspond with the calendar year. We also collected product sales revenue data, and using these alongside the claims and accrual totals, we calculated our two warranty expense rates: the percentage of sales revenue spent on claims (the claims rate), and the percentage of sales spent on accruals (the accrual rate).

Who's In and Who's Out

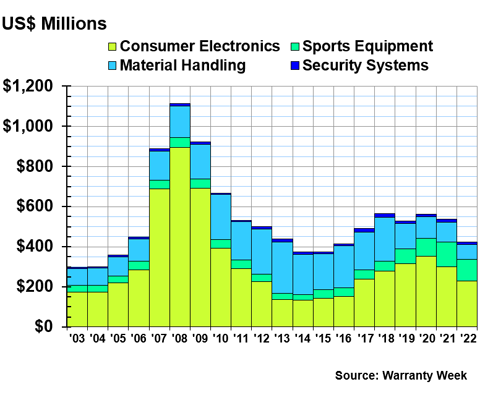

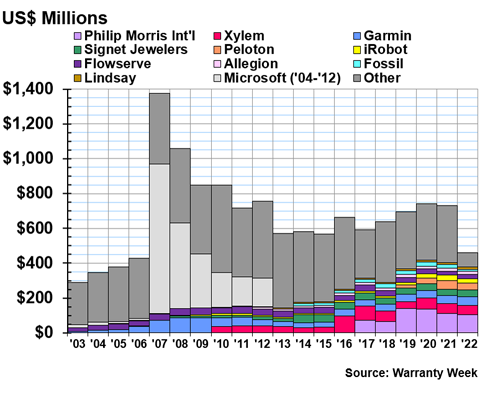

Figure 1 shows the past 20 years of warranty claims totals for each of the four industries we are discussing in this report. As we mentioned, we don't want to dwell too much on the industry totals, since some of the manufacturers, especially amongst the "sports equipment" category, are rather odd bedfellows. But this helps give a sense of the size of warranty expenses among each industry, and how the proportions between them have evolved over two decades.

Figure 1

Other Product Warranties by Industry

Claims Paid by U.S.-based Companies

(in US$ millions, 2003-2022)

Figure 1 illustrates that the U.S.-based consumer electronics industry used to occupy a much larger proportion of warranty expenses than it does currently.

A specter is haunting the consumer electronics data -- the specter of Microsoft Corp. Microsoft was never the most consistent or reliable reporter of its warranty data. But after the "Red Ring of Death" warranty debacle in 2007 and 2008, when the company's Xbox 360 video game console failed en masse, the company gradually stopped reporting its warranty expenses altogether. The Xbox was Microsoft's first foray into hardware, and the Xbox 360 failures were the company's first taste of the difference between software and hardware malfunctions. Fixing Xbox 360s took a lot more than simply installing a bug fix or software update. With a hardware failure at this scale, an estimated one in three products was being sent back broken.

In the end, Microsoft seemed to find it easier not to include data on its warranty expenses at all. Nobody at the SEC has seemed to notice, so Microsoft, along with many peers who also continue to trade publicly and issue product warranties, have seen no consequences for their abrupt cessation of reporting their warranty expense data.

We are also haunted by some other once-looming presences, such as Eastman Kodak Co., which stopped reporting in the wake of its bankruptcy woes in 2012 and subsequent restructuring. Harman International Industries Inc., which makes audio equipment including JBL speakers, stopped reporting in 2017 when it became a subsidiary of Samsung. Plantronics Inc. and Polycom Inc., which both started out in the telecom space but were moving into consumer electronics, merged in 2019, to form the Poly brand. And then in 2022, HP Inc. purchased Poly.

These days, it's not so easy to draw bold distinctions between computer companies and consumer electronics companies. Two of the largest companies in our recent U.S. Computer Industry Warranty Report were Apple Inc., maker of the iPhone and iPad, and HP Inc., which makes 3D and paper printers. But since they started as computer manufacturers, they stay in that category; unlike Microsoft, which was a software company that ventured into electronics first with the Xbox, though it later dabbled in computers with the Surface Pro laptop/tablet hybrids.

Garmin Ltd., meanwhile, has adapted aviation- and boating-oriented navigation equipment to use by consumers in passenger cars over the past two decades. It's primarily a consumer-focused company, while many of its GPS navigation system competitors are more focused on trucking, shipping, avionics, and other business-oriented applications. We're now categorizing it under consumer electronics, rather than aerospace.

Garmin is joined by GoPro Inc., the makers of those waterproof action cameras that you may have found attached to your head sometime in the past decade, and iRobot Corp., the makers of the Roomba automated vacuum cleaning robot, as the representatives of the consumer electronics industry among the top 12 warranty payers in this report.

Keep in mind that most popular consumer electronics are manufactured by companies not based in the United States. For example, in the television aisle of any Walmart in America, we would find Samsung, Sony, Panasonic, and LG, all of which are based in either Japan or South Korea. We can only report the data we have, but remain aware that the global consumer electronics industry is much larger than what the U.S. industry numbers show. With so many major players not reporting their warranty expenses, and inflation and unstable exchange rates of global currencies, it would be near-impossible for us to compile a smartphone warranty report right now.

Beyond the major departures from consumer electronics, we do have a number of interesting companies present in this report among the three categories we call materials handling, security, and sports equipment. Materials handling includes water management equipment such as pumps, valves, pipes, and fire hydrants; oil, gas, and coal equipment such as drills, drill pipes, and filters; agricultural items such as feed bags, grain storage, water troughs, and bulk milk tanks; and waste management equipment such as balers and conveyor belts. Among the top 12 manufacturers named in the charts in this report, Xylem Inc., Flowserve Corp., and Lindsay Corp. represent materials handling equipment.

Security equipment warranties include products such as locks, alarms, and traffic cameras, along with some unexpected items. Breathalyzers from Lifeloc Technologies Inc. are covered by product warranties, as are some handguns (and perhaps alarms) from Smith & Wesson Brands Inc. Among the top 12 in terms of warranty expenses, only Allegion plc represents this category.

The "sports equipment" category ended up serving as a catch-all in our 20th Annual Product Warranty Report. Sports equipment includes traditional non-vehicle recreational items, such as treadmills, stationary bikes, golf clubs, and camping equipment. Among our top 12, this is represented by Peloton Interactive Inc., which makes high-end exercise bikes, and Johnson Outdoors Inc., which makes camping gear including tents and portable stoves, scuba diving equipment, and canoes and kayaks.

But sports also includes a few companies that had significant warranty expenses in recent years, but don't quite fit under any neat category. The largest in this camp is Philip Morris International Inc. (PMI). Yes, the same Philip Morris that's been making Marlboro cigarettes for 175 years. PMI is a distinct company from Altria Group Inc., which is the parent company of Philip Morris USA. PMI spun off from the parent Altria in 2008; while it consists of all of Philip Morris' non-United States business, it is still a U.S.-based company.

So how did a cigarette company end up the top warranty reporter in this report? On its website, Philip Morris International proclaims that it is intent on "delivering a smoke-free future." The company is all-in on its transition to vaporizers (colloquially known as "vapes") and electronic cigarettes. Apparently, so are consumers, because the company has topped the list since it started reporting in 2015. We assume that many of the other major cigarette companies are also issuing warranties for their vapes, but so far, PMI is the only one to report these expenses in its annual reports.

Sports also includes several jewelry companies that offer product warranties. This includes Signet Jewelers Ltd., which owns the Jared and Kay brands for which there are so many TV commercials. Signet's diamonds, rubies, sapphires, and emeralds come with a lifetime product warranty against stone loss. Interestingly, the company also sells extended warranty service contracts that cover repairs and resizings. Fossil Group Inc., which makes accessories for a variety of brands, offers two-year warranties on its watches.

One other newcomer that we'd like to mention is Cricut Inc., which makes the coveted Cricut craft machines. The company only started reporting its warranty expenses in 2020, but was just shy of the top 12 in claims and accruals during 2022.

Warranty Claims Totals

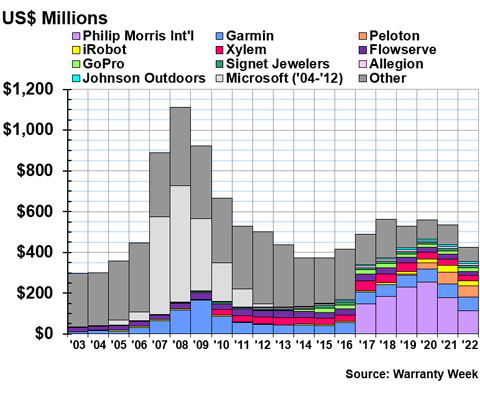

So clearly, the biggest story here is the upheaval and evolution in the companies represented amongst the top warranty claims payers in these industries. Figure 2 takes the same data visualized in Figure 1 and breaks it down by the top 10 manufacturers that paid the most claims in 2022. And to further illustrate the Microsoft Xbox 360 debacle, easily the biggest U.S. consumer electronics warranty story of the past 20 years, we have included Microsoft's past numbers in light grey, since the company no longer reports its warranty expenses (though it undoubtedly still issues product warranties).

Figure 2

Other Product Warranties

Claims Paid by Top U.S.-based Companies

(in US$ millions, 2003-2022)

The largest warranty claims payer among the list of 129 manufacturers was Philip Morris International. The company paid $114 million in claims in 2022, down $63 million, or about one-third, from the year prior. The company's claims payments peaked in 2020 at $254 million, and have been falling since then, but the company only started reporting in 2017. In PMI's own words, the company issues 1-year warranties for its "heat-not-burn devices and e-vapor products."

Garmin's claims payments have been very steady in the past few years. The company paid $67 million in claims in 2022, a mere 0.5% increase. In third is Peloton, which only started reporting in 2019. The company paid $53 million in claims in 2022, down a little bit from 2021.

iRobot, maker of the Roomba vacuum, saw claims double from 2020 to 2021, but they decreased by -20% from 2021 to 2022. In 2022, the company paid $27 million in claims. In mid-2022, Amazon announced plans to purchase iRobot for $1.7 billion, but this deal has been investigated and delayed by the U.S. Federal Trade Commission (FTC), the U.K.'s Competition and Markets Authority (CMA), and the European Union, on antitrust and privacy grounds. iRobot was still reporting separately in the fourth quarter of 2022, so the deal isn't done yet. On the privacy side, it seems that iRobot's Roombas essentially generate maps of your entire home as they roll around. Amazon is quickly foraying into smart home tech; they also bought Ring doorbells back in 2018. By the way, we're adding Amazon to our wish list of future warranty expense reporters.

Water management technology company Xylem ranked fifth in total claims in 2022. The company paid $25 million in claims, down -22%, or $7 million. Next is Flowserve, maker of pumps, valves, actuators, and seals, which paid $19 million in warranty claims in 2022. GoPro, maker of the eponymous action cameras, also paid $19 million in claims.

Signet Jewelers, owner of Kay Jewelers, Jared, Zales, the Piercing Pagoda (where I got my ears pierced at the mall), Blue Nile, and many other jewelry brands, paid $11 million in claims in 2022. The company isn't the only jewelry brand to guarantee its wares with product warranties. Fossil Group, which, ranked 11th, just missed the cutoff for inclusion in Figure 2, paid $9 million in claims in 2022. Fossil makes watches for a number of higher-end mall brands including Armani Exchange, DKNY, Tory Burch, Michael Kors, and Diesel. Incidentally, while researching this newsletter, we came across an article from 2003 reporting that Fossil was teaming up with Palm (maker of the PalmPilot) and Microsoft to make two new, cutting-edge "telephone wristwatches," like Dick Tracy wore. Nevertheless, Fossil didn't start reporting its warranty expenses until 2015.

Speaking of Microsoft, we'll quickly remark upon the phantom of the data from the few years that the company reported its warranty expenses. Microsoft released the Xbox 360 in late 2015, just in time for the holiday season. But immediately, Christmases across the land were haunted by the "Red Ring of Death," so-called because the normally green lights surrounding the power button turned red to signal a hardware failure. The company didn't publicly acknowledge the issue until July 2007, when it extended the Xbox 360's product warranty from 90 days to three years. The company reported paying $480 million in claims in 2007, then $568 million in 2008, and $353 million in 2009. While the exact failure rate is unknown, estimates range from 25% to 55% of all Xbox 360s sold.

Warranty Accrual Totals

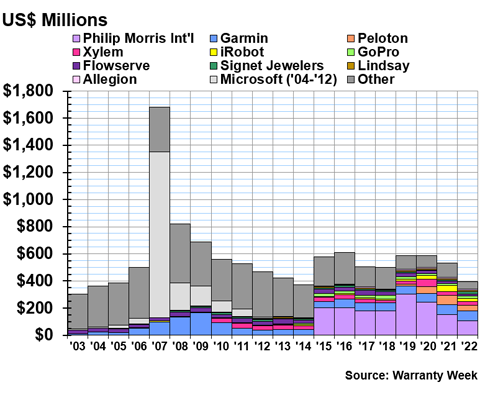

Figure 3 shows warranty accruals totals for the top companies in these industries.

Figure 3

Other Product Warranties

Accruals Made by Top U.S.-based Companies

(in US$ millions, 2003-2022)

Microsoft accrued a total of $1.2 billion during calendar 2007, after the company publicly acknowledged the Xbox 360 hardware failures. The company accrued an additional $202 million in calendar 2008 in relation to this. Accruals dropped off in the following years, then Microsoft simply stopped reporting its warranty expenses in its financial statements in 2012. This was the same year the company released the first of its Surface tablet/ laptop hybrids, an electronic that came with a one-year warranty. So claims and accruals probably didn't disappear, although the data did.

In 2022, Philip Morris International accrued $107 million. This was down -30%, or $47 million, from 2021's total, and is merely one-third of the accruals the company made in 2019. In second is Garmin, which accrued $73 million. Next is Peloton, which accrued $44 million in 2022, down -40% from the year prior.

Xylem accrued $24 million in 2022. iRobot notably halved its accruals, to just $22 million. This could be reflective of the anticipated acquisition by Amazon, but it's also possible this is just a return to normal after higher-than-usual accruals in 2021. GoPro accrued $19 million, and Flowserve accrued $17 million.

Ranked eighth is Signet Jewelers, which doubled its accruals in 2022 to a total of $16 million. Next is Lindsay Corp., which accrued $10 million, up about 25%. The company, which didn't make the cut for Figure 2 since it ranked twelfth in claims payments, manufactures irrigation equipment, water pumps, tubing, railroad signals, and moveable traffic barriers. Allegion, maker of security systems and locks, accrued $9 million, down about -25%. Cricut accrued $8 million, a steep incline from $3 two years prior, and $0 reported every year before that. Mueller Water Products Inc., which makes fire hydrants and other water infrastructure products, accrued $7 million, up $2 million, or 40%. In-ground swimming pool manufacturer Latham Group Inc. accrued $7 million. Johnson Outdoors halved its accruals, putting aside $6 million in 2022.

Warranty Expense Rates

Industry-wide average warranty expense rates don't make much sense for this set of data. We decided to hone in on the expense rates of Philip Morris International, which had the largest total claims, accruals, and reserves in 2022 among the companies in this report.

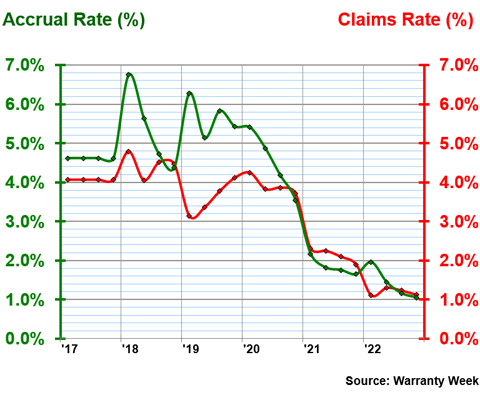

Figure 4

Phillip Morris International Inc.

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2017-2022)

Philip Morris International started reporting its warranty data in its 2017 annual report, but released claims data back to 2015, which are included in Figure 3. For 2017, we only had annual data available, but from 2018 to the present, we have quarterly data. In that first year of reporting, the company's claims rate was 4.07%, and its accrual rate was 4.62%. In the first quarter of 2018, the accrual rate spiked to 6.74%, the highest we have seen from the company.

Clearly, in those first years of reporting, PMI struggled to master the art of predicting warranty expenses. From 2018 to 2020, the company was overestimating its warranty costs, which is why the accrual rate was over a percentage higher than the claims rate. Ideally, those lines would be right on top of each other, with accruals being enough to fulfill claims, but not so much that excess funds are being deposited in the warranty reserve rather than reported as revenue. PMI's claims rate peaked around 4.5% in mid-2018.

The claims and accrual rates came closer together at the end of 2020. Then in the first quarter of 2021, vape sales took off for the company, and the proportions of accruals and claims to product revenue decreased dramatically. The claims rate fell from 3.7% at the end of 2020 to 2.3% at the beginning of 2021, and the accrual rate fell from 3.5% to 2.2%.

PMI's warranty expense rates have trended even lower since then. In the fourth quarter of 2022, its claims rate was 1.1%, and its accrual rate was 1.05%.

Figure 5 shows 20 years of warranty expense rates for Garmin Ltd., the second-largest warranty provider in this report in 2022.

Warranty Reserve Totals

Figure 5 shows warranty reserve totals for the 129 manufacturers in this report.

Figure 5

Other Product Warranties

Reserves Held by Top U.S.-based Companies

(in US$ millions, 2003-2022)

Reserves are the lowest they've been for these companies since Microsoft's Xbox 360 issues back in 2007. This drop is mainly due to Baker Hughes Co. ceasing its warranty expense reporting back in 2021. The company reported that it carried over its warranty reserve balance of $216 from 2020 to 2021, but didn't report any claims or accruals in 2021. Then the company didn't even report on its warranty reserves in 2022, so the $216 in the "Other" section of Figure 5 disappeared from 2021 to 2022.

Philip Morris International reported an ending reserve balance of $104 million. Xylem had the second-largest reserves, with $54 million. Next is Garmin with $51 million, then Signet Jewelers with $40 million, Peloton with $36 million, and iRobot with $27 million.

That's a wrap on our 20-year product warranty industry reports! Here are links to the online editions of all the previous parts of this series:

- Twentieth Annual Product Warranty Report

- U.S. Auto Warranty Expenses

- Truck & Heavy Equipment Warranties

- Auto Parts & Powertrain Warranties

- Automotive OEM & Supplier Warranty Expenses

- Aerospace Warranty Report

- New Home & Building Materials Warranty Report

- HVAC & Appliance Warranty Report

- Computer Industry Warranty Report

- Semiconductor Warranty Report

- Medical & Scientific Equipment Warranty Report

- Power Equipment Warranty Report