U.S. New Home & Building Materials Warranty Expenses:

Total warranty expenses in the industries that contribute to building new homes are rivaling those we saw right before the housing bubble burst in 2008. While the record highs for total claims and accruals are still 2007 and 2006, respectively, the new record high for warranty reserve balances was 2024.

We're moving on to the 22-year warranty expenses of the U.S.-based building trades sector. The building trades accounted for approximately one-sixth of all total warranty expenses of U.S.-based manufacturers in 2024.

This week's newsletter is a snapshot of the industries that contribute to building new homes, including the building itself, the construction materials, the fixtures, HVAC systems, appliances, and so on.

Readers may recall from our "Twenty-Second Annual Product Warranty Report" that we split the building trades sector into seven industries: appliances & HVAC, new home builders, building materials, power generation equipment, materials handling, security, and sports. This week, we're focusing on the first three industry groups in that list, because they focus on buildings, rather than infrastructure or equipment.

To create this report, we found all the U.S.-based companies in these three industry groups that report their warranty expenses. We found 58 manufacturers in the appliances & HVAC industry, 59 manufacturers in the new home builder industry, and 120 manufacturers in the building materials industry.

Of the 237 total manufacturers across the three industries, 85 reported warranty expenses in 2024: 17 in the appliance & HVAC industry, 21 new home builders, and 47 building materials manufacturers.

The largest new home builders were: Lennar Corp., D.R. Horton Inc., PulteGroup Inc., NVR Inc., Taylor Morrison Home Corp., Toll Brothers Inc., KB Home, and Hovnanian Enterprises Inc.

The largest building materials manufacturers were: Stanley Black & Decker Inc., Pentair plc, Mohawk Industries Inc., Masco Corp., Acuity Brands Inc., La-Z-Boy Inc., RPM International Inc., and Griffon Corp.

The largest manufacturers in the appliance & HVAC industry by warranty expenses were: Carrier Global Corp., Whirlpool Corp., Trane Technologies plc, Johnson Controls International plc, Middleby Corp., Emerson Electric Co., A.O. Smith Corp., and Lennox International Inc.

Carrier Global was spun-off from United Technologies in 2020, as part of the merger of United Technologies and Raytheon to form RTX Corp. Similarly, Trane Technologies was renamed from Ingersoll-Rand plc in 2020, when the company's tools and non-refrigeration businesses were sold to Gardner Denver via a Reverse Morris Trust. In the wake of that transaction, Gardner Denver acquired Ingersoll-Rand's industrial segment, and was renamed Ingersoll Rand Inc. (no hyphen), and the former Ingersoll-Rand businesses that were left over, which were HVAC and refrigerated transport, were rebranded as Trane Technologies. Trane also owns the Thermo King brand of refrigerated trucks, containers, and rail cars.

For each of the 237 manufacturers, we perused their annual reports and quarterly financial statements, and gathered three key warranty metrics: the amount of claims paid, the amount of accruals made, and the end-balance of the warranty reserve fund. We also gathered data on each manufacturer's total product sales revenue, and used these to calculate our two warranty expense rates: claims as a percentage of sales (the claims rate), and accruals as a percentage of sales (the accrual rate).

We'll zoom in and take a closer look at the warranty expenses of the appliance & HVAC industry in an upcoming newsletter. Take a look at our April 17, 2025 newsletter "New Home Builder Warranty Report" for an in-depth look at the warranty expenses of the U.S.-based new home builders.

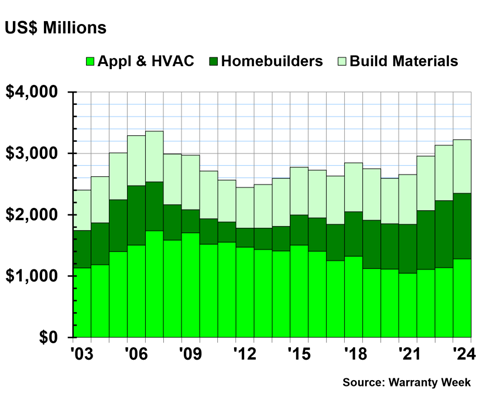

Warranty Claims Totals

Figure 1 shows the total warranty claims paid across the three building trade industry groups, from 2003 to 2024.

Figure 1

Homebuilding & Materials Warranties

Claims Paid by U.S.-based Manufacturers

(in US$ millions, 2003-2024)

In 2024, the appliance & HVAC industry paid $1.279 billion in warranty claims, a 13% increase from 2023. The new home builders paid $1.071 billion in claims, a -2% decrease. And the building materials manufacturers paid $874 million in warranty claims, a -3% decrease.

In the appliance & HVAC industry, Carrier Global, an HVAC manufacturer, paid $346 million in claims, a 78% increase from 2023. Whirlpool, an appliance manufacturer, paid $245 million in claims, a -19% decrease. HVAC manufacturer Trane Technologies paid $182 million in warranty claims in 2024, a 24% increase from 2023.

Johnson Controls paid $114 million in warranty claims in 2024, a 3% increase. Middleby paid $91 million in claims, a 10% increase. Emerson Electric paid $82 million in claims, a -14% decrease. A.O. Smith paid $79 million, a 6% increase. Lennox International paid $41 million, a 3% increase. Manitowoc Co. Inc. paid $36 million, a 15% increase. And Ametek Inc. paid $23 million, a 61% increase.

In the new home builder industry, Lennar paid $286 million in warranty claims in 2024, a -1% decrease from 2023. D.R. Horton paid $119 million, a -6% decrease. PulteGroup paid $107 million, a 7% increase. NVR paid $98 million, a 6% increase. Taylor Morrison paid $85 million, a 6% increase.

Champion Homes Inc. paid $66 million in claims in 2024, a 18% increase from 2023. Cavco Industries paid $62 million, a -24% decrease. These two manufacturers make mobile homes.

Toll Brothers paid $50 million, a -33% decrease. KB Home paid $43 million, a -6% decrease. Hovnanian Enterprises Inc. paid $32 million, a 45% increase. M.D.C. Holdings Inc. paid $27 million, a 2% increase. Meritage Homes Corp. paid $25 million, a 22% increase. M/I Homes Inc. paid $25 million, a 1% increase.

In the building materials industry, Stanley Black & Decker paid $177 million in warranty claims in 2024, a 10% increase from 2023. Pentair paid $84 million, a -5% decrease. Mohawk Industries paid $58 million, the same as the year prior. Masco paid $43 million, a 2% increase. Acuity Brands paid $42 million, a -9% decrease.

La-Z-Boy paid $38 million in claims in 2024, a 29% increase from 2023. RPM International paid $32 million, a 3% increase. Griffon Corp. paid $30 million, a 51% increase. Sherwin Williams Co. paid $28 million, a -14% decrease. MillerKnoll Inc. paid $25 million, a -5% decrease.

MKS Instruments Inc. paid $24 million in claims in 2024, a 50% increase from 2023. Steelcase Inc. paid $24 million in claims, a 2% increase. Owens Corning paid $23 million, a 35% increase. And American Woodmark Corp. paid $21 million, a -23% decrease.

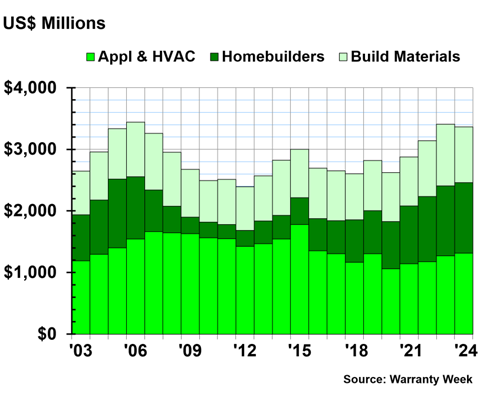

Warranty Accrual Totals

Figure 2 shows the total warranty accruals made by the manufacturers in the three building trade industry groups, from 2003 to 2024.

Figure 2

Homebuilding & Materials Warranties

Accruals Made by U.S.-based Manufacturers

(in US$ millions, 2003-2024)

In 2024, the appliance & HVAC industry set aside $1.313 billion in warranty accruals, a 3% increase from 2023. The homebuilders accrued $1.144 billion, a 0.4% increase. And the building materials manufacturers accrued $909 million, a -9% decrease from 2023.

In the appliance & HVAC industry, Carrier Global set aside $327 million in warranty accruals in 2024, a 38% increase from 2023. Whirlpool accrued $235 million, a -24% decrease. And Trane Technologies accrued $230 million, a 23% increase.

Johnson Controls accrued $114 million in 2024, a -15% decrease. Middleby accrued $100 million, a 12% increase. Emerson Electric accrued $88 million, a 10% increase. A.O. Smith accrued $81 million, a 2% increase. And Lennox International accrued $59 million, a 9% increase.

Among the homebuilders, Lennar accrued $289 million in 2024, a 1% increase. D.R. Horton accrued $210 million, a 7% increase. PulteGroup accrued $110 million, a 3% increase.

NVR accrued $85 million in 2024, a -11% decrease from the year prior. Taylor Morrison accrued $82 million, a -1% decrease. Champion Homes accrued $72 million, a 22% increase. Cavco Industries accrued $64 million, a -27% decrease.

KB Home accrued $41 million in 2024, a 9% increase. Toll Brothers accrued $36 million, a -19% decrease. And M.D.C. Holdings accrued $28 million, a 16% increase.

In the building materials industry, Stanley Black & Decker set aside $180 million in warranty accruals in 2024, a 5% increase from 2023. Pentair accrued $87 million, a -3% decrease. Mohawk Industries accrued $51 million, a -11% decrease. Acuity Brands accrued $43 million, a -22% decrease.

Masco accrued $38 million, a -41% decrease. La-Z-Boy accrued $37 million, a 13% increase. Sherwin Williams accrued $34 million, a -8% decrease. And RPM International Inc. accrued $31 million, a -4% decrease.

Warranty Expense Rates

To calculate our warranty expense rates, we put the amount of warranty claims or accruals made, and the product sales revenue over the same period. We calculate these rates for whole industries and segments thereof, along with individual manufacturers. In either case, the purpose is to see what percentage of the revenue coming in from product sales is going back out to warranty expenses.

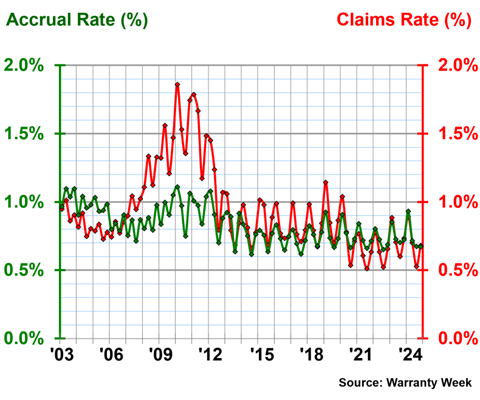

In Figure 3, we show the quarterly warranty claims and accruals rates for the homebuilders, from 2003 to 2024.

Figure 3

New Home Warranties

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2024)

Over 22 years, the new home builders had an average warranty claims rate of 0.94%, with a standard deviation of 0.30%, and an average accrual rate of 0.83%, with a standard deviation of 0.13%.

In 2024, the homebuilders had an average claims rate of 0.70%, and an average accrual rate of 0.75%. The quarterly industry average claims rates of 2024 ranged from 0.53% in the third quarter, to 0.89% in the first quarter. The accrual rates ranged from 0.67% in the fourth quarter, to 0.93% in the first quarter.

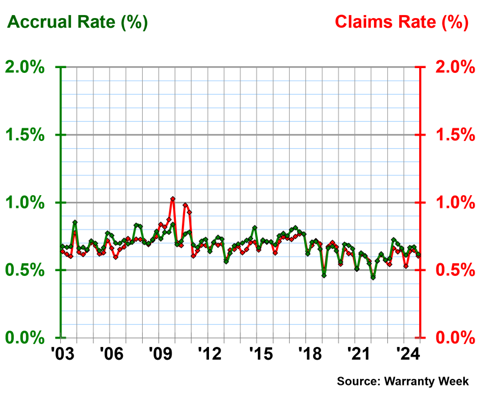

Figure 4 shows the average warranty expense rates of the building materials manufacturers over 22 years.

Figure 4

Building Material Warranties

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2024)

Over 22 years, the building materials manufacturers had an average warranty claims rate of 0.68%, with a standard deviation of 0.09%, and an average warranty accrual rate of 0.69%, with a standard deviation of 0.08%.

In 2024, the industry average claims rate was 0.61%. The quarterly averages ranged from 0.53% in the first quarter, to 0.65% in the third quarter.

The industry average accrual rate was 0.64% in 2024. The quarterly averages ranged from 0.61% in the first quarter, to 0.67% in the third quarter.

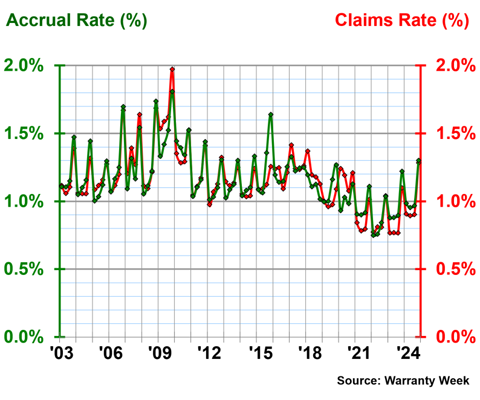

Figure 5 shows the industry average quarterly warranty expense rates of the appliance & HVAC industry, from 2003 to 2024.

Figure 5

Appliance & HVAC Warranties

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2024)

Over 22 years, the industry average claims rate for the appliance & HVAC industry was 1.16%, with a standard deviation of 0.22%. The average accrual rate was 1.17%, with a standard deviation of 0.21%.

In 2024, the industry average claims rate was 1.00%. The quarterly averages ranged from 0.89% in the second quarter, to 1.28% in the fourth quarter.In 2024, the industry average accrual rate was 1.05%. The quarterly averages ranged from 0.95% in the second quarter, to 1.30% in the fourth quarter.

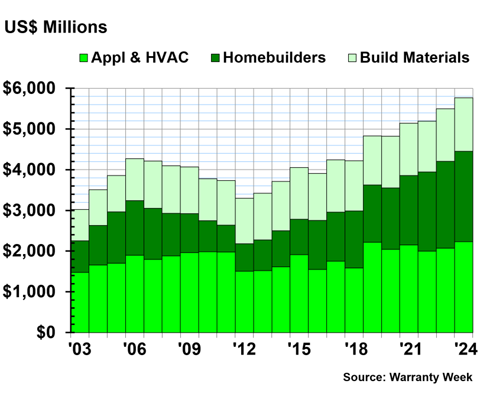

Warranty Reserve Balances

Our final warranty metric is the year-end-balance of the warranty reserve funds across the three building trades industries, from 2003 to 2024.

Figure 6

Homebuilding & Materials Warranties

Reserves Held by U.S.-based Manufacturers

(in US$ millions, 2003-2024)

At the end of 2024, the appliance & HVAC industry had a warranty reserve balance of $2.232 billion, an 8% increase from the end of 2023. The homebuilders had a reserve end-balance of $2.219 billion, a 4% increase. And the building materials manufacturers had an end-balance of $1.316 billion, a 2% increase.

At the end of 2024, Carrier Global had a warranty reserve balance of $786 million, a 38% increase from the end of the year prior. Trane had a warranty reserve balance of $415 million, an 11% increase from the end of 2023.

Whirlpool had a reserve end-balance of $196 million, a -5% decrease from the end of 2023. A.O. Smith had an end-balance of $190 million, a 1% increase. Lennox International had a reserve balance of $158 million, an 11% increase. Johnson Controls had a reserve balance of $115 million, a -45% decrease from the end of 2023.

Middleby had a reserve balance of $98 million at the end of 2024, a 10% increase from the end of 2023. Emerson Electric had a balance of $79 million, an 8% increase. And Newell Brands had a balance of $68 million, a -26% decrease.

Among the homebuilders, D.R. Horton had a reserve balance of $570 million at the end of 2024, a 7% increase from the end of 2023. Lennar had an end-balance of $446 million, an 8% increase from the end of the year prior. Taylor Morrison had an end-balance of $214 million, a 16% increase.

Toll Brothers had an end-balance of $189 million, an -8% decrease. NVR had an end-balance of $133 million, a -9% decrease. And PulteGroup had a reserve end-balance of $131 million, an 8% increase.

In the building materials industry, Cornerstone Building Brands Inc. had a warranty reserve balance of $188 million at the end of 2024, a -3% decrease from the end of the year prior. Stanley Black & Decker had an end-balance of $140 million, a 2% increase. Owens Corning had an end-balance of $99 million, a 2% increase.

Masco had a reserve balance of $81 million at the end of 2024, a -2% decrease. MillerKnoll Inc. had an end-balance of $70 million, a -2% decrease. VF Corp. had an end-balance of $68 million, a 15% increase. And Pentair had a reserve end-balance of $67 million, a 3% increase from 2023.

Catch the rest of our series of 22-year charts:

- "Twenty-Second Annual Product Warranty Report"

- "New Home Builder Warranty Report"

- "U.S. Small Vehicle Warranty Expenses"

- "U.S. Truck, Bus, & Heavy Equipment Warranty Expenses"

- "U.S. Auto Parts & Powertrain Warranty Expenses"

- "U.S. Aerospace Warranty Expenses"