U.S. Aerospace Warranty Expenses:

Total warranty claims exceeded total warranty accruals in the U.S. aerospace industry, and for the three largest manufacturers by warranty costs, Boeing, RTX, and GE Aerospace. The industry average claims rate also exceeded the average accrual rate in 2024.

We're back with our series of 22-year charts, after a short hiatus. This week, we're rounding out our analysis of the 2024 warranty expenses of the U.S.-based vehicle industry with the aerospace industry.

In 2024, the aerospace industry comprised 5% of all warranty claims paid by U.S.-based companies, 3% of all warranty accruals made by U.S.-based companies, and 8% of all warranty reserves held by U.S.-based companies.

Aerospace is a rare industry where claims actually exceeded accruals in 2024. In 2024, the U.S.-based aerospace industry paid $1.398 billion in warranty claims, a 19% increase from 2023, yet only set aside $1.075 billion in warranty accruals, a -6% decrease from 2023. While this trend is not the case for every manufacturer in the aerospace industry, claims exceeded accruals for Boeing, RTX, and GE Aerospace, the three largest manufacturersin the industry by warranty expenses, in 2024.

GE Aerospace is new to this report, since it officially spun-off its power generation business as GE Vernova in April 2024. The parent General Electric then renamed itself GE Aerospace, which retains the GE stock ticker symbol. In our March 2025 newsletter "GE's Warranty Expenses by Industry," we found that about 55% to 65% of the former parent GE's product warranty costs were from the power generation industry (Vernova), while 15% to 25% were from aerospace, and about 20% were from healthcare. We formerly categorized General Electric in the power generation industry, but since each spin-off has filed its own separate annual report with historical data, we have updated the 2022 and 2023 numbers with the industry split.

While 2024 was the company's first year reporting as GE Aerospace, now a pure-play in the aerospace industry, it provided numbers for 2022 and 2023 in its 2024 annual report; GE Vernova and GE HealthCare similarly released historical data as well. Check out our charts breaking down these data based on industry in our March 6, 2025 newsletter.

To create this newsletter, we first compiled a list of all of the U.S.-based aerospace manufacturers that have reported warranty expenses for some period between 2003 and 2024. We found 68 manufacturers, 20 of which reported warranty expenses in 2024.

We separated this list of 68 companies into two key industry groups: OEMs and suppliers. We have found that the warranty expense rates of OEMs and suppliers vary, based on the amount of contact with the end-user.

We generally see a very slow and inefficient supplier recovery process in this industry. Last year, we noted that supplier Spirit AeroSystems was part of the Boeing 737 MAX groundings of 2019 and 2020, and it looked like a case where Boeing would attempt to do supplier recovery. Spirit AeroSystems was spun off from Boeing as a separate entity supplier in 2005. However, Boeing announced in July 2024 that it planned to re-acquire Spirit AeroSystems in the third quarter of 2025. Part of this deal will involve transferring specific assets to Airbus, mainly related to A350, A321, and A220 production, announced in April 2025. So, no supplier recovery paperwork needed; Boeing decided it was just easier to re-acquire the supplier.

Among the 68 manufacturers, the three U.S.-based aerospace OEMs we identified were: Boeing Co., General Dynamics Corp., and Textron Inc. General Dynamics owns the Gulfstream brand, and Textron owns the Cessna and Beechcraft brands.

The other 65 manufacturers were aerospace suppliers. The suppliers that reported warranty expenses in 2024 were: RTX Corp., GE Aerospace (still officially named General Electric Co., but doing business as "GE Aerospace"), Honeywell International Inc., Teledyne Technologies Inc., Woodward Inc., Moog Inc., Leonardo DRS Inc., OSI Systems Inc., Astronics Corp., Hexcel Corp., Spirit AeroSystems Holdings Inc., Heico Corp., Park-Ohio Holdings Corp., Gogo Inc., Innovative Solutions & Support Inc., Tel-Instrument Electronics Corp., and Curtiss-Wright Corp.

For each of the 68 manufacturers, we perused their annual reports and quarterly financial statements, and extracted three key warranty metrics: the amount of claims paid, the amount of accruals made, and the end-balance of the warranty reserve fund.

We also gathered data on each manufacturer's total product sales revenue, and used these to calculate two additional warranty expense rates: claims as a percentage of product sales (the claims rate), and accruals as a percentage of product sales (the accrual rate).

Note that many of the manufacturers in this industry are also military contractors. Defense contractors do not report warranty costs associated with military contracts, so these data only represent warranty costs of civilian aircraft.

Of course, there are other aerospace OEMs based in the United States, such as Lockheed Martin and Northrop Grumman. However, since they are primarily military contractors, they don't report their warranty expenses.

There's a few other manufacturers that could possibly fall into the aerospace OEM category, but that we ultimately classified elsewhere, because their primary product line was in another industry. For instance, AeroVironment Inc. and Workhorse Group Inc. both make drones, but we ultimately classified them in the automotive sector, because that's where the bulk of their revenue, and the bulk of their warranty expenses, come from.

And of course, this newsletter also does not include internationally-based aerospace OEMs such as Airbus, Embraer, Bombardier, or Dassault, nor jet engine manufacturers such as Rolls-Royce, Safran, or MTU Aero Engines.

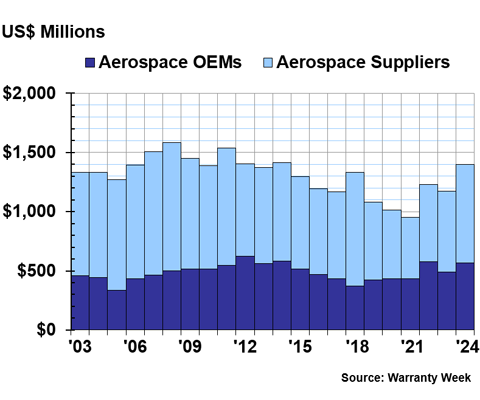

Warranty Claims Totals

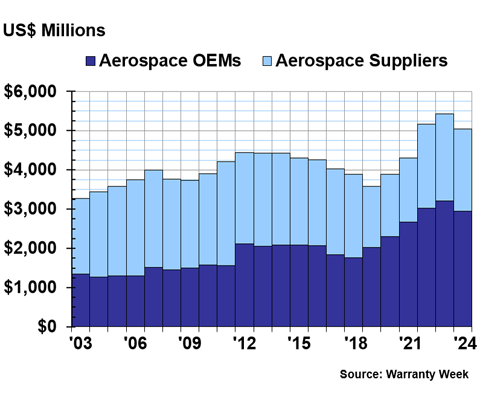

Figure 1 shows the total amount paid in warranty claims by the U.S.-based aerospace OEMs and suppliers, from 2003 to 2024.

Figure 1

Aerospace Warranties

Claims Paid by U.S.-based Companies

(in US$ millions, 2003-2024)

In 2024, the aerospace OEMs paid $569 million in warranty claims, a 16% increase from 2023.

Boeing paid $392 million in claims, a 23% increase from the year prior. General Dynamics paid $105 million in claims, a 4% increase. And Textron paid $72 million in claims, a 4% increase.

The aerospace suppliers paid $829 million in claims in 2024, a 21% increase from 2023.

GE Aerospace paid $321 million in claims in 2024, a 92% increase from 2023. It's not out of the ordinary for the company's claims costs to rise so much in the first year after a spin-off. The company reported two years of historical data along with its 2024 data. GE Aerospace paid $167 million in claims in 2023, and $162 million in claims in 2022.

RTX paid $247 million in claims in 2024, a -20% decrease from 2023. Honeywell paid $171 million, a 61% increase from 2023's total of $106 million.

Teledyne paid $25 million in claims, a 68% increase from 2023's total of $15 million. Leonardo DRS paid $17 million, a 44% increase from 2032's total of $12 million. Woodward paid $15 million, a -65% decrease from 2023's total of $42 million.

Moog paid $9 million in 2024, a -18% decrease from the year prior. OSI Systems paid $6 million, a 46% increase. Astronics paid $4 million, a -9% decrease.

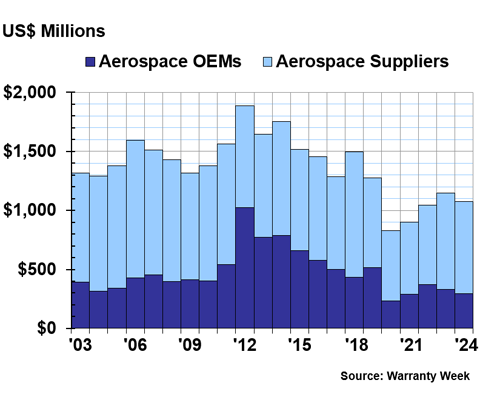

Warranty Accrual Totals

Figure 2 shows the total warranty accruals set aside by the aerospace OEMs and suppliers, from 2003 to 2024.

Figure 2

Aerospace Warranties

Accruals Made by U.S.-based Companies

(in US$ millions, 2003-2024)

In 2024, the three U.S.-based aerospace OEMs set aside $297 million in warranty accruals, a -10% decrease from the year prior.

We'd be remiss not to point out that there are missing puzzle pieces in Figure 2, which are Boeing's changes of estimate to previous accruals. In 2023, Boeing set aside $164 million in regular accruals, and an additional $329 million in changes of estimate to previous accruals. In 2022, Boeing set aside $202 million in regular accruals, and an additional $576 million in changes of estimate.

However, Boeing did not dabble in these large changes of estimate in 2024, perhaps indicating that the extra warranty expenses associated with the 737 MAX 8 groundings are over. In 2024, Boeing set aside just $81 million in warranty accruals, a -51% decrease from 2023's regular accruals. It's an even more dramatic decrease when one takes the additional changes of estimate into account. It seems that Boeing's warranty department is having a respite, after a decade of warranty woes, between the 787 Dreamliner groundings in 2013 and 2014, and the 737 MAX 8 groundings in 2019 and 2020.

On the other hand, General Dynamics' warranty accruals increased sharply from 2023 to 2024. In 2024, General Dynamics set aside $137 million in warranty accruals, an increase of 52% from 2023.

Textron set aside $79 million in warranty accruals in 2024, a 4% increase from the year prior.

The U.S.-based aerospace suppliers set aside $778 million in warranty accruals in 2024, a -5% decrease from the year prior.

GE Aerospace accrued $275 million in 2024, a -1% decrease from the year prior. RTX accrued $216 million in 2024, a -29% decrease from the year prior. Honeywell accrued $186 million, a 34% increase.

Teledyne set aside $26 million in accruals in 2024, almost double 2023's total of $14 million.

Leonardo DRS accrued $16 million in 2024, a -20% decrease from the year prior. Astronics accrued $12 million, a 93% increase from the year prior. Woodward accrued $12 million, a -16% decrease. Moog accrued $8 million, a -24% decrease. Spirit AeroSystems accrued $7 million, a -33% decrease. And OSI Systems accrued $7 million, an 80% increase.

Warranty Expense Rates

In 2024, the U.S. aerospace industry had an average warranty claims rate of 0.83%, and an average warranty accrual rate of 0.61%.

Over 22 years, the U.S. aerospace industry had an average claims rate of 0.82%, with a standard deviation of 0.18%, and an average accrual rate of 0.81%, with a standard deviation of 0.18%.

As we see in many industries, the warranty expense rates of the aerospace OEMs tend to be higher than those of the suppliers, since OEMs have more contact with the end-user. Suppliers paying warranty claims has the extra layer of supplier recovery, and expenses passing through middlemen, which tends to keep their warranty expense rates lower.

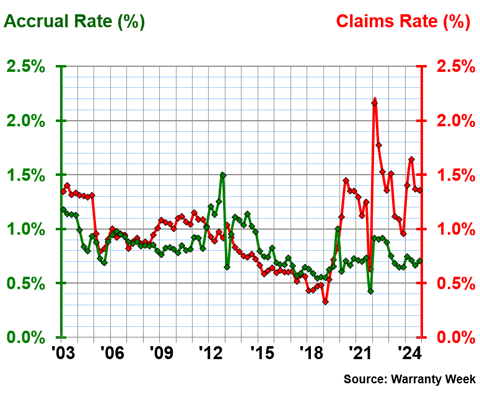

As such, we're presenting the average warranty expense rates of the two industry sub-groups. Figures 3 shows the quarterly claims and accrual rates of the three aerospace OEMs, from 2003 to 2024.

Figure 3

Aerospace OEM Warranties

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2024)

In 2024, the aerospace OEMs had an average warranty claims rate of 1.44%, and an average warranty accrual rate of 0.71%. The claims rate ranged from 1.35% in the fourth quarter, to 1.64% in the second quarter.

Over 22 years, the aerospace OEMs had an average claims rate of 0.98%, with a standard deviation of 0.33%, and an average accrual rate of 0.83%, with a standard deviation of 0.19%.

This is a unique industry where the average claims rate exceeds the average accrual rate. This is unsustainable in the long-run; you can't pay claims with money you don't have set aside in warranty accruals. That's where the changes of estimate come in, to add in extra funds with which to pay excessive claims costs associated with groundings and recalls.

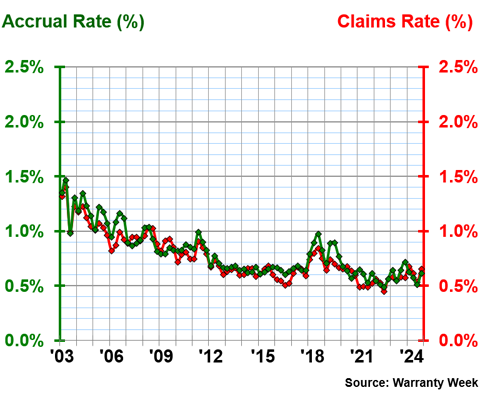

Figure 4 shows the quarterly claims and accrual rates of the three aerospace suppliers, from 2003 to 2024.

Figure 4

Aerospace Supplier Warranties

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2024)

In 2024, the U.S.-based aerospace suppliers had an average warranty claims rate of 0.62%, and an average warranty accrual rate of 0.58%. The claims rates ranged from 0.53% in the third quarter, to 0.68% in the first quarter. The accrual rates ranged from 0.51% in the third quarter, to 0.63% in the first quarter.

Over 22 years, the aerospace suppliers had an average claims rate of 0.76%, with a standard deviation of 0.21%, and an average accrual rate of 0.80%, with a standard deviation of 0.22%.

Warranty Reserve Balances

Our final warranty metric is the year-end balance of each manufacturer's warranty reserve fund. Figure 5 shows the warranty reserve end-balances over 22 years, from 2003 to 2024.

Figure 5

Aerospace Warranties

Reserves Held by U.S.-based Companies

(in US$ millions, 2003-2024)

At the end of 2024, the aerospace OEMs held a total of $2.948 billion in warranty reserves, a -8% decrease from the end of 2023.

Boeing held $2.133 billion in reserves at the end of 2024, a -13% decrease from the end of 2023. General Dynamics held $642 million in reserves, an 8% increase. And Textron held $173 million, a 1% increase from the end of the year prior.

At the end of 2024, the aerospace suppliers held $2.089 billion in warranty reserves, a -6% decrease from the end of 2023.

RTX held $993 million in warranty reserves at the end of 2024, a -9% decrease from the end of 2023. GE Aerospace held $592 million at the end of 2024, a -7% decrease from the end of the year prior. Honeywell held $237 million at the end of 2024, an 8% increase from the end of 2023.

Spirit AeroSystems held $87 million at the end of 2024, a 5% increase from the end of 2023. Teledyne held $50 million in reserves at the end of 2024, a 2% increase. Leonardo DRS held $29 million, a 12% increase. Moog held $23 million, a -7% decrease. Woodward held $19 million, a -13% decrease. And Astronics held $18 million, an 85% increase from the end of 2023.

Catch the rest of our series of 22-year charts:

- "Twenty-Second Annual Product Warranty Report"

- "New Home Builder Warranty Report"

- "U.S. Small Vehicle Warranty Expenses"

- "U.S. Truck, Bus, & Heavy Equipment Warranty Expenses"

- "U.S. Auto Parts & Powertrain Warranty Expenses"