U.S. HVAC & Appliance Warranty Expenses:

The warranty expenses of the HVAC industry exceeds those of the appliance industry, but the appliance industry had much higher average warranty expense rates than the HVAC manufacturers do. So the HVAC manufacturers are spending more on warranty overall, but the appliance manufacturers are spending a larger proportion of their product sales revenue on warranty.

What better time to discuss the warranty expenses of U.S.-based HVAC and appliance manufacturers than amidst another round of heat waves across the country? HVAC systems from California, to Texas, to Montana, to New York, are being put into overdrive across the country. Not to mention Western Europe, which is recovering from a massive heat wave as well (although they do not use air conditioning to the same extreme that we do in the United States). And when new HVAC systems break, warranty work fixes them. And when warranty work fixes them, we record those costs, and present the following 22-year HVAC & appliance product warranty expense charts to you.

These data also include makers of household and industrial appliances, though we're not quite sure that there's a correlation between the summertime and oven use. Perhaps air fryers, blenders, and other countertop appliances are getting more use. And certainly, this would be a very unfortunate time of year for a new refrigerator or freezer to break.

Last week, we presented the warranty expenses of all manufacturers that contribute to the building of a new home, including not just the HVAC & appliance industry, but also the building materials manufacturers, and the new home builders themselves. This week, we're zooming in just on the HVAC & appliance industry subset, and further dividing it into the two industry sub-groups.

To create this newsletter, we identified a total of 58 U.S.-based manufacturers, 32 on the HVAC side, and 26 on the appliance side.

The largest HVAC manufacturers by warranty expenses were: Carrier Global Corp., Trane Technologies plc, Johnson Controls International plc, Emerson Electric Co., A.O. Smith Corp., and Lennox International Inc.

Carrier Global was spun-off from United Technologies in 2020, as part of the merger of United Technologies and Raytheon to form RTX Corp. In its first annual report, Carrier Global provided data starting in 2019. For this newsletter, we have removed the United Technologies data from before the spin-off of Carrier Global, since the company was heavily involved in other industries aside from HVAC, including aerospace with Pratt & Whitney, and building materials under the Otis Worldwide elevator brand. Thus, the earlier portions of these charts, before the past five years, may look different than previous versions of this newsletter.

Similarly, Trane Technologies was renamed from Ingersoll-Rand plc in 2020, when the company's tools and non-refrigeration businesses were sold to Gardner Denver via a Reverse Morris Trust. In the wake of that transaction, Gardner Denver acquired Ingersoll-Rand's industrial segment, and was renamed Ingersoll Rand Inc. (no hyphen), and the former Ingersoll-Rand businesses that were left over, which were HVAC and refrigerated transport, were rebranded as Trane Technologies. Trane owns the Thermo King brand of refrigerated trucks, containers, and rail cars, along with the Trane branded HVAC systems.

The largest appliance manufacturers were: Whirlpool Corp., Middleby Corp., Manitowoc Co. Inc., Ametek Inc., Newell Brands Inc., and JBT Marel Corp.

Whirlpool has been the parent company of fellow U.S.-based appliance manufacturer Maytag since 2006. We do include Maytag's data from 2003 to 2005 in this newsletter, and after that, Maytag's warranty expenses are wrapped up in the Whirlpool numbers.

JBT Marel changed its name in January 2025, after the company, formerly known as JBT Corp., or John Bean Technologies Corp., completed its acquisition of the Icelandic food processing equipment manufacturer Marel hf.

Note that GE Appliances is not included in this report. Since 2016, the GE Appliances brand has been owned by the China-based Haier Group, which does not report its warranty expenses at all.

Electrolux, based in Sweden, and Sony, Panasonic, Hitachi, Canon, and Nidec, all based in Japan, actually do report their warranty expenses, but these are outside of the scope of this newsletter, as we're focusing on U.S.-based manufacturers. There are many more global appliance & HVAC manufacturers (many also make consumer electronics) that do not report their warranty expenses at all, including Samsung, LG, Miele, Bosch, Midea, Gree Electric, and Daikin.

In short, it's important to note that the majority of appliances sold at retailers like Lowe's and Best Buy are not manufactured by U.S.-based companies. With the exception of Whirlpool, most of the appliance manufacturers in this newsletter make industrial appliances for commercial kitchens, industrial cooling, or outdoor cooking.

For each of the 58 U.S.-based HVAC & appliance manufacturers, we perused their annual reports and quarterly financial statements, and gathered three key warranty metrics: the amount of claims paid, the amount of accruals made, and the end-balance of the warranty reserve fund.

We also gathered data on each manufacturer's product sales revenue, and used these to calculate our two warranty expense rates: claims as a percentage of product sales (the claims rate), and accruals as a percentage of sales (the accrual rate).

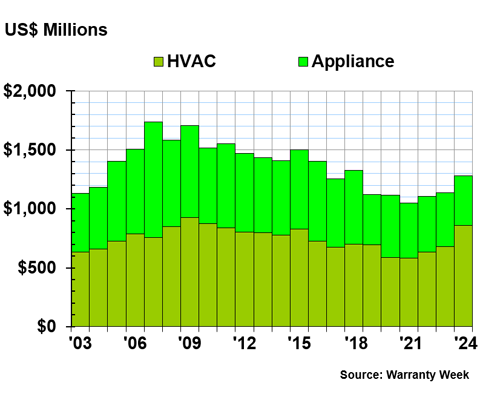

Warranty Claims Totals

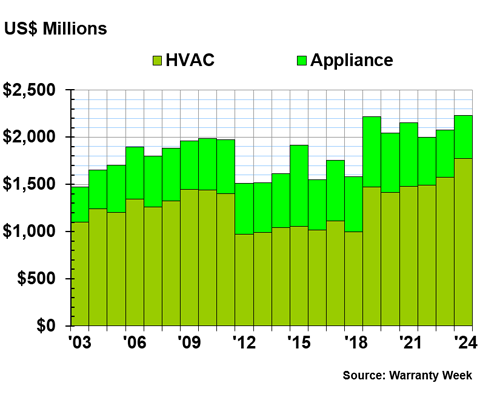

Figure 1 shows the total warranty claims paid by the U.S.-based appliance & HVAC manufacturers, from 2003 to 2024.

Figure 1

HVAC & Appliance Warranties

Claims Paid by U.S.-based Manufacturers

(in US$ millions, 2003-2024)

In 2024, the HVAC & appliance manufacturers paid a total of $1.279 billion in warranty claims, a 13% increase from 2023.

The HVAC manufacturers paid $862 million in warranty claims in 2024, a 27% increase from 2023. The appliance manufacturers paid $418 million in claims in 2024, a -9% decrease from 2023.

On the HVAC side, Carrier Global paid $346 million in claims in 2024, a shocking 78% increase from 2023's total of $194 million. There was no reason for this jump provided in Carrier Global's 2024 10-K annual report.

Trane paid $182 million in claims in 2024, a 24% increase from the year prior. Johnson Controls paid $114 million in claims, a 3% increase.

Emerson Electric paid $82 million in claims in 2024, a -14% decrease from 2023. A.O. Smith paid $79 million in claims, a 6% increase. Lennox International paid $41 million, a 3% increase.

Rockwell Automation Inc. paid $16 million in warranty claims in 2024, a -7% decrease from the year before. Standex International Corp. paid $2 million in claims, a -16% decrease. And Tecogen Inc. paid $277,000 in claims in 2024, a -2% decrease.

On the appliance side, Whirlpool paid $245 million in claims in 2024, a -19% decrease from 2023. Middleby paid $91 million, a 10% increase. Manitowoc paid $36 million, a 15% increase.

Ametek paid $23 million in warranty claims in 2024, a 61% increase from 2023. Newell Brands paid $11 million, a 57% increase.

JBT Marel Corp. paid $7 million in claims in 2024, a -38% decrease from 2023. Traeger Inc. paid $4 million, a decrease of -38%. And National Presto Industries Inc. paid $1 million, a -24% decrease.

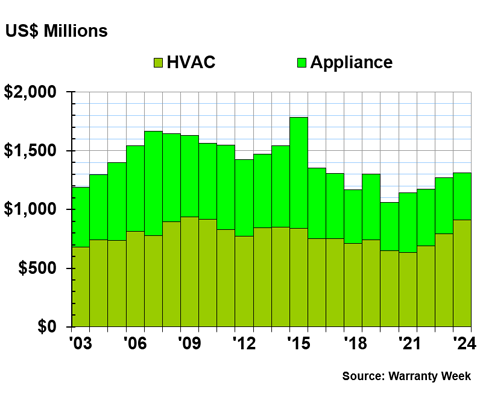

Warranty Accrual Totals

Figure 2 shows the total warranty accruals of the U.S.-based HVAC & appliance manufacturers, from 2003 to 2024.

Figure 2

HVAC & Appliance Warranties

Accruals Made by U.S.-based Manufacturers

(in US$ millions, 2003-2024)

In 2024, the HVAC & appliance industry set aside a total of $1.313 billion in warranty accruals, a 3% increase from 2023.

The HVAC manufacturers set aside $913 million in accruals in 2024, a 15% increase from 2023. The appliance manufacturers set aside $400 million, a -16% decrease from 2023.

In the HVAC industry, Carrier Global set aside $327 million in warranty accruals in 2024, a 38% increase from 2023. Trane Technologies set aside $230 million, a 23% increase.

Johnson Controls accrued $114 million in 2024, a -15% decrease from 2023. Emerson Electric accrued $88 million, a 10% increase. A.O. Smith accrued $81 million, a 2% increase. Lennox International accrued $59 million, a 9% increase.

Rockwell Automation accrued $12 million in 2024, a -30% decrease. Standex International accrued $2 million, a 1% increase. And Tecogen accrued $258,000, a decrease of -10%.

In the appliance industry, Whirlpool set aside $235 million in warranty accruals in 2024, a -24% decrease from 2023. Middleby accrued $100 million in 2024, a 12% increase.

Manitowoc accrued $26 million, a -12% decrease. Ametek accrued $25 million, a 6% increase. JBT Marel accrued $10 million, a 3% increase. Traeger accrued $3 million, a -51% decrease. National Presto Industries accrued $1 million, a -34% decrease. And Newell Brands reported $0 in accruals in 2024, although it did pay claims in 2024.

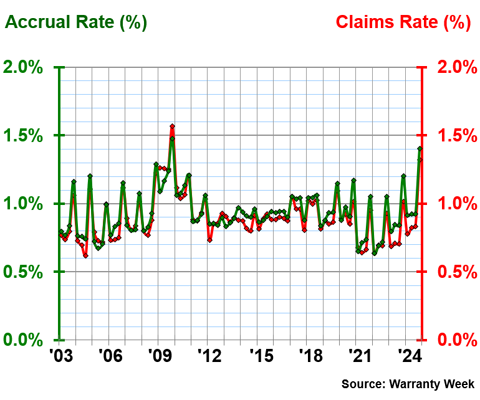

Warranty Expense Rates

Our warranty expense rates express the total warranty claims and accruals as a percentage of the total product revenue sales made by a manufacturer or industry. This shows us what proportion of sales revenue is going back out to warranty costs, rather than contributing to net income.

Figure 3 shows the average quarterly warranty expense rates for the U.S.-based HVAC industry, from 2003 to 2024.

Figure 3

HVAC Warranties

Average Claims & Accrual Rates

(as a % of product sales, 2003-2024)

Over 22 years, the HVAC manufacturers had an average warranty claims rate of 0.90%, with a standard deviation of 0.17%. The HVAC manufacturers had an average warranty accrual rate of 0.93%, with a standard deviation of 0.16%.

In 2024, the HVAC manufacturers had an average warranty claims rate of 0.94%. The quarterly values ranged from 0.78% in the first quarter, to 1.32% in the fourth quarter.

In 2024, the HVAC manufacturers had an average accrual rate of 1.04%. The values ranged from 0.92% in the first quarter, to 1.41% in the fourth quarter.

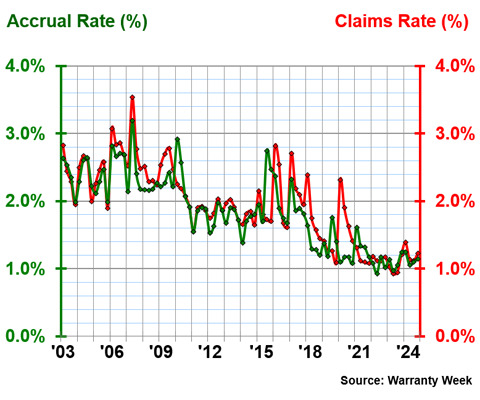

Figure 4 shows the quarterly average claims and accrual rates for the U.S.-based appliance industry, from 2003 to 2024.

Figure 4

Appliance Warranties

Average Claims & Accrual Rates

(as a % of product sales, 2003-2024)

Over 22 years the appliance manufacturers had an average claims rate of 1.95%, with a standard deviation of 0.58%, and an average accrual rate of 1.85%, with a standard deviation of 0.55%. These are some of the highest standard deviations we saw in any industry in 2024, meaning that the appliance industry has had more volatile warranty expense rates of 22 years than most other industries in the U.S. market.

In 2024, the appliance manufacturers had an average warranty claims rate of 1.22%. The quarterly percentages ranged from 1.11% in the third quarter, to 1.39% in the first quarter.

In 2024, the appliance manufacturers had an average warranty accrual rate of 1.14%. The rates ranged from 1.05% in the second quarter, to 1.25% in the first quarter.

Warranty Reserve Balances

Figure 5 shows the year-end-balances of the warranty reserve funds of the manufacturers in these two industry sub-groups, from 2003 to 2024.

Figure 5

HVAC & Appliance Warranties

Reserves Held by U.S.-based Manufacturers

(in US$ millions, 2003-2024)

At the end of 2024, the HVAC & appliance industry as a whole held a warranty reserve balance of $2.232 billion, an 8% increase from the end of 2023.

The HVAC manufacturers held $1.771 billion in warranty reserves at the end of 2024, a 12% increase from the end of 2023. The appliance manufacturers held $461 million in reserves at the end of 2024, a -7% decrease.

Carrier Global held $786 million in its warranty reserve fund in 2024, a 38% increase from the end of 2023. Trane held $415 million, an 11% increase. A.O. Smith held $190 million, a 1% increase. Lennox International held $158 million, an 11% increase. Johnson Controls held $115 million, a -45% decrease from the year prior.

Emerson Electric held $79 million, an 8% increase. Rockwell Automation held $25 million in reserves, a 32% increase. And Standex held $3 million, a 3% increase.

On the appliance side, Whirlpool held $196 million in warranty reserves at the end of 2024, a -5% decrease from the end of 2023. Middleby held $98 million in reserves, a 10% increase. Newell Brands held $68 million, a -26% decrease.

Manitowoc held $45 million in reserves at the end of 2024, a -20% decrease. Ametek held $39 million, a 4% increase. JBT Marel held $12 million, a 23% increase. Traeger held $3 million, a -58% decrease. And National Presto held $88,000, a -76% decrease.

Catch the rest of our series of 22-year charts:

- "Twenty-Second Annual Product Warranty Report"

- "New Home Builder Warranty Report"

- "U.S. Small Vehicle Warranty Expenses"

- "U.S. Truck, Bus, & Heavy Equipment Warranty Expenses"

- "U.S. Auto Parts & Powertrain Warranty Expenses"

- "U.S. Aerospace Warranty Expenses"

- "U.S. New Home & Building Materials Warranty Expenses"