Chinese Electric Vehicle Warranties:

BYD, Nio, Li Auto, and XPeng are increasing their global EV sales. BYD outsold Tesla in the EU in August and September 2025, and is opening factories across four continents. The Chinese EV OEMs' warranty accrual rates are comparable to those of their Western competitors, but their claims rates remain much lower than the global industry average.

The U.S. government is scaling back its emphasis on electric vehicles, by revoking the EV tax credits, and stalling funding for electric vehicle charging infrastructure. However, the market for EVs continues to grow worldwide, especially in Europe and Asia.

While EVs are more of a luxury market in the United States, they have become cheap and abundant in China. Many Chinese automakers have also moved into the European market, undercutting the prices of European EVs.

In 2024, the European Union proposed imposing tariffs on Chinese-built EVs, and negotiations continued into 2025. In April 2025, the EU and China announced an agreement to set minimum prices for Chinese EVs, rather than imposing tariffs.

According to the Fraunhofer Institute for Systems and Innovation Research (ISI), global sales for battery electric vehicles (BEVs) increased by 10% to almost eleven million units sold, and sales for plug-in hybrid EVs (PHEVs) increased by 58% to 6.4 million vehicles sold. The Fraunhofer ISI study stated, "The PHEV market is growing in particular due to the 'Extended Range Electric Vehicles' (EREV) that are popular in China."

In particular, the Fraunhofer ISI found that Chinese manufacturers increased their EV sales by about 45% from 2023 to 2024, and that over 50% of the vehicles produced by Chinese OEMs in 2024 were electric. According to this study,

"The most important sales market is the domestic market. In contrast, the manufacturers' targeted expansion, particularly into Europe, is progressing much more slowly than expected. In North America, where only a few thousand vehicles are launched on the market, the number of Chinese exports has increased. In absolute terms, however, this is of little significance. In Europe, sales of Chinese sales figures even slumped by around ten percent. Despite this, Chinese manufacturers sold almost 5.8 million BEV and almost five million PHEV."

Note that in the Chinese market, BEVs and PHEVs are collectively known as "new energy vehicles," or NEVs. However, this acronym is not typically used in the EV sphere outside of China.

Chinese EV OEMs

Not every Chinese auto OEM publishes an annual report, and not all of those that do include their warranty expenses in their financial disclosures. Since there are so many non-reporters, it's not possible to make charts that credibly represent the warranty expenses of the whole Chinese auto industry. Thus, in this newsletter, we're presenting charts of each individual EV OEM's warranty claims and accrual rates, rather than our typical bar graphs.

Many Chinese auto OEMs are making electric vehicles at this point, whether BEVs or HEVs. However, most of them are still making traditional internal combustion engine (ICE) vehicles as well.

Chinese ICE manufacturers with significant EV divisions include: Geely, SAIC, GAC, Chery, Changan, Dongfeng, and Great Wall. However, ICE vehicles are still the majority of vehicles sold by each of these manufacturers, with EVs varying from 20% to 40% of these OEMs' units sold. As such, one could not consider these OEMs "EV companies," per se, but they do have a meaningful presence in the Chinese EV sphere.

Many of these companies are also exporting EVs to Europe, some under subsidiary brands. SAIC owns the MG Motor and Maxus brands. Dongfeng owns the Voyah brand. FAW Group owns the Hongqi brand.

Geely owns the Zeekr and Lotus EV brands. In addition, Geely Group, the parent company of Geely Auto, also owns the Polestar and Volvo Cars brands. While Polestar and Volvo Cars have their own headquarters in Sweden, they technically are Chinese-owned EV companies.

In addition, the Chinese market has several major auto OEMs that only make EVs, including BYD, Li Auto, Nio, and XPeng. There is also Leapmotor, of which Stellantis owns a 20% share, but it does not report its warranty expenses.

Most of these Chinese auto OEMs do not sell vehicles in the United States, for a variety of reasons, including high tariffs, market regulations, and the lack of dealer networks. The caveat here is that Volvo Cars and Polestar, both owned by Geely, do sell vehicles in the United States, and already have an established dealership network.

Chinese EV brands you could find in the European market include BYD, Zeekr, Polestar, Volvo Cars, Nio, XPeng, MG, Maxus, Great Wall Motor (GWM), Maxus, Voyah, and Hongqi. The European countries buying and registering the most new EVs include Norway, Sweden, Denmark, Finland, the Netherlands, and Iceland. In addition, plug-in hybrids (PHEVs) are increasing in popularity in Germany, France, Spain, and Belgium.

To create this newsletter, we decided to hone in just on the Chinese EV companies where EVs are their primary product line: BYD, XPeng, Nio, Li Auto, and Polestar.

We perused the annual reports of these five EV OEMs, and gathered three key warranty metrics: the amount of claims paid, the amount of accruals made, and the end-balance of the warranty reserve fund.

BYD does not report its warranty claims costs, but does report its warranty accruals and reserve balance. We used these two figures to estimate the claims paid by BYD.

We also gathered data on each manufacturer's total vehicle sales revenue, and used these to calculate our two warranty expense rates: claims as a percentage of sales (the claims rate), and accruals as a percentage of sales (the accrual rate). The following charts depict these data.

All exchange rates used in this newsletter are from the IRS Yearly average currency exchange rates table.

BYD

First, we're taking a look at the claims and accrual rates of BYD, which is by far China's largest EV-only OEM.

BYD was founded in 2003, and the acronym stands for "Build Your Dreams." BYD made its first EV, a PHEV, in 2008, and ceased manufacturing ICE vehicles in 2022. Since then, the OEM has been a pure play in the EV space. Around 60% of BYD's models sold are PHEVs, and about 40% are BEVs.

In addition to its dominance in the Chinese market, and growth in the European market, BYD does significant sales in Brazil and Mexico, with a smaller presence in countries including Thailand and Australia.

BYD outsold Tesla in the EU in August and September 2025, the first time the Chinese OEM surpassed the American one.

BYD has been expanding its global manufacturing facilities in recent years. Of course, BYD has several huge factories in China, and is currently constructing a "mega factory" in Zhengzhou, Henan Province, which will span about 50 square miles, larger than San Francisco. BYD has several other factories across China, including in Changsha, Shenzhen, Xi'an, and Hefei.

BYD has had a factory in Chennai, India since 2008, and an electric bus factory in Lancaster, California, United States since 2023. BYD does not make cars at its U.S. facility, just electric city and school buses, which are sold under the RIDE brand.

In addition, BYD opened two factories in July 2024, one in Rayong, Thailand, and one in Jizzakh, Uzbekistan. BYD also took over a former Ford factory in Camaçari, Brazil, which opened as a BYD facility in July 2025. BYD has announced plans to open factories in West Java, Indonesia, Karachi, Pakistan, and Szeged, Hungary, likely in 2026.

BYD has also announced plans to open production plants in Türkiye and Mexico, for which sites have not yet been chosen. Furthermore, BYD has announced that it's searching for a site for a third European factory, and that Spain is a frontrunner.

In short, BYD is rapidly expanding not just its international sales, but also its global manufacturing facilities. BYD has opened three new factories on two continents in the past year and a half, with another three new factories currently under construction, and plans for three more factories announced and looking for sites.

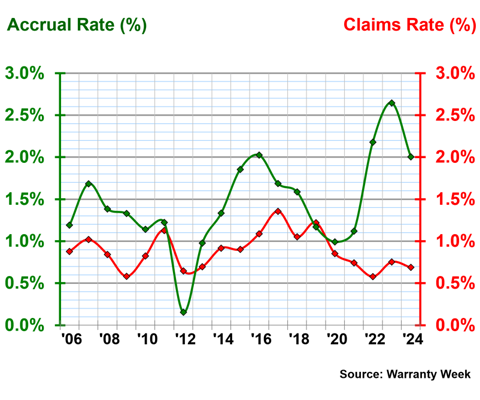

Figure 1 shows BYD's warranty claims and accrual rates, from 2006 to 2024. Keep in mind that BYD's warranty claims figures are estimates, calculated based on the total accruals and reserves, which are reported.

Figure 1

Electric Vehicle Manufacturer Warranties:

BYD, Claims and Accrual Rates,

(as % of product revenue, 2006-2024)

BYD had a warranty accrual rate of 2.00% in 2024, a decrease of about one-quarter from the year prior. BYD set aside ¥12.4 billion Chinese yuan in warranty accruals in 2024. Using the exchange rate from the IRS Yearly average currency exchange rates table, BYD set aside $1.84 billion USD in warranty accruals in 2024.

In 2024, BYD had a warranty claims rate of 0.69%, a bit of a decrease from 2023.

At the end of fiscal 2024, BYD held ¥22.7 billion in warranty reserves, or $3.38 billion.

NIO

Nio, stylized as NIO, is a unique EV manufacturer, at the forefront of battery swapping technology in passenger cars. In early October 2025, during China's National Day Golden Week holidays, Nio set a record of over 145,000 battery swaps conducted across China in a single day. Nio averaged 95,000 daily battery swaps in China in September 2025.

While battery swap technology is being discussed for heavy trucks in Europe, battery swap is not nearly as popular for passenger cars outside of China. The battery swap process only takes about five minutes, and the stations do not require a 24/7 human attendant.

Nio operates over 3,500 battery swap stations across China, and 61 across Europe. The European countries in which Nio operates power swap stations are: Germany (21), Norway (20), the Netherlands (10), Sweden (8), Denmark (1), and Belgium (1).

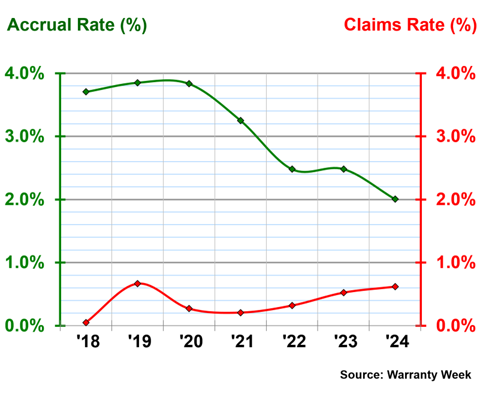

Figure 2 shows the annual warranty claims and accrual rates for Nio, from 2018 to 2024.

Figure 2

Electric Vehicle Manufacturer Warranties:

Nio, Claims and Accrual Rates,

(as % of product revenue, 2018-2024)

Nio's claims rate increased by about one-quarter, from 0.50% in 2023 to 0.62% in 2024. In 2024, Nio paid ¥360 million in warranty claims, or $53 million.

Nio's accrual rate decreased by about one-fifth, from 2.50% in 2023, to 2.01% in 2024. Nio set aside ¥1.17 billion in warranty accruals in 2024, or $174 million.

At the end of 2024, Nio held ¥4.72 billion in warranty reserves, or $701 million.

Li Auto

Li Auto makes extended range EVs, or EREVs, which use a built-in petrol engine to charge the battery, extending the range of the battery between charges. It's similar to how the old Chevy Volt worked, though GM ceased production of that model back in 2019. EREVs are different from PHEVs; although both use an electric motor and secondary gas engine, the function of that ICE component is different.

In addition to China, Li Auto sells vehicles in Uzbekistan, where it recently opened its first overseas dealership, along with exports to Kazakhstan, Saudi Arabia, the UAE, Russia, and Belarus.

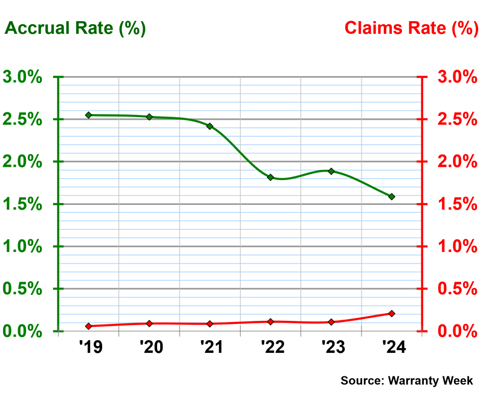

Figure 3 shows the warranty claims and accrual rates of Li Auto, from 2019 to 2024.

Figure 3

Electric Vehicle Manufacturer Warranties:

Li Auto, Claims and Accrual Rates,

(as % of product revenue, 2019-2024)

Li Auto saw its warranty claims rate double, from 0.10% in 2023, to 0.21% in 2024. Li Auto paid ¥290 million in warranty claims in 2024, or $43 million.

Li Auto had a warranty accrual rate of 1.59% in 2024, down a bit from the year prior. Li Auto set aside ¥2.20 billion in warranty accruals in 2024, or $327 million.

Li Auto held ¥5.16 billion in warranty reserves at the end of fiscal 2024, or $767 million.

XPeng

Volkswagen Group owns a 5% stake in XPeng, and the two OEMs are partners in several ventures. One of those collaborations is an extensive charging network across China. The two OEMs have also announced plans to co-develop EVs.

XPeng and Volkswagen both contribute about 10,000 EV chargers across China to their collective network. In addition, BP Pulse, British Petroleum's EV charger brand, also shares its charging network with XPeng, contributing another 23,000 chargers to the network. XPeng is using these collaborations to offer the largest fast charger network in China, exceeding the charging network of Tesla in the country.

In addition to selling in China, XPeng sells vehicles in Norway, Germany, Italy, Singapore, Malaysia, and Indonesia.

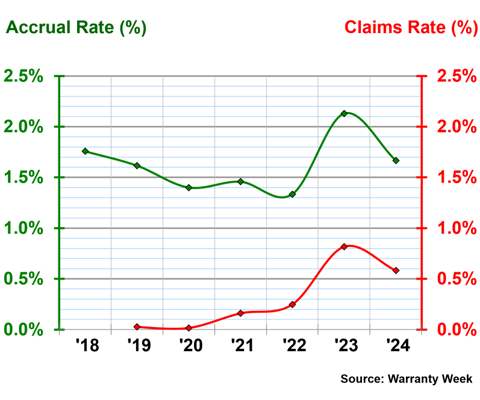

Figure 4 shows the warranty claims and accrual rates of XPeng, from 2018 to 2024.

Figure 4

Electric Vehicle Manufacturer Warranties:

XPeng, Claims and Accrual Rates,

(as % of product revenue, 2018-2024)

In 2024, XPeng had a warranty claims rate of 0.58%, a decrease of about one-quarter from the year prior. In 2024, XPeng paid ¥209 million in warranty claims, or $31 million.

XPeng had a warranty accrual rate of 1.67% in 2024, a decrease of about one-quarter from 2023. In 2024, XPeng set aside ¥597 million in warranty accruals, or $89 million.

XPeng held ¥1.20 billion in warranty reserves at the end of fiscal 2024, or about $178 million.

Polestar

Figure 5 shows the warranty claims and accrual rates of Polestar. For an more in-depth look at Polestar's warranty expenses in 2024, take a look at our newsletter "European Automaker Warranty Expenses."

Figure 5

Electric Vehicle Manufacturer Warranties:

Polestar, Claims and Accrual Rates,

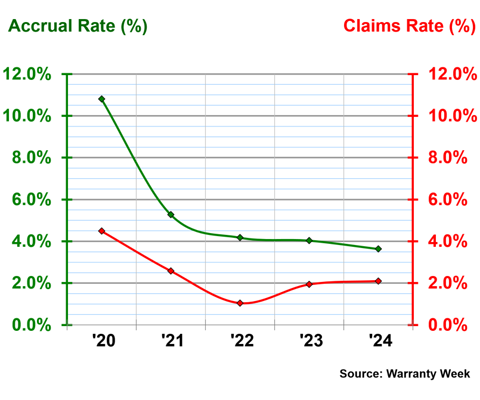

(as % of product revenue, 2020-2024)

In 2024, Polestar had a warranty claims rate of 2.10%, and a warranty accrual rate of 3.63%.

Check out these newsletters on 2024 international auto warranty expenses:

- "U.S. Auto Warranty Annual Reports"

- "European Automaker Warranty Expenses"

- "Japanese Automaker Warranty Expenses"

- "Korean & Indian Automaker Warranty Expenses"