Largest Nine-Month Warranty Expense Rate Changes:

The majority of U.S.-based manufacturers keep their claims and accrual rates consistent from quarter to quarter, or see incremental variations. But a smaller minority see wild fluctuations in their warranty expense rates. This week, we're honing in on the biggest increases and reductions of the first three quarters of 2023, the most volatile on both sides of the spectrum.

New year, new Warranty Week newsletters for you! We're eagerly awaiting the annual reports of the U.S.-based manufacturers, which will start trickling in during early February, and keep coming until mid-March.

In anticipation of our 21st edition of the "Annual Product Warranty Report," we're taking a similar nationwide survey approach to the nine-month data from 2023. We're focusing specifically on the warranty expense rates, which are Warranty Week's exclusive calculations made from data manufacturers provide in their quarterly financial reports.

Methodology

First, we made a list of all of the U.S.-based product warranty providers in 2022. Then we removed all of the companies that did not make a report in the third quarter of 2023, including those that only report annually, were acquired, ceased reporting, missed filing one or more reports, or their third quarter report for 2023 is delayed.

We went into each manufacturer's four quarterly reports from 2022, and three from 2023, and recorded four metrics: warranty claims paid, warranty accruals held, warranty reserves held, and total product revenue. Product revenue refers to revenue generated from selling products that come with warranties, excluding other revenue from things like extended warranties, service plans, software subscriptions, apparel sales, and so on.

Next, we sorted these companies by the total amount of warranty claims they paid during the first three quarters of 2023, and narrowed down the list to the top 100, each of which paid out $13 million or more in claims during that period.

We calculated the warranty expense rates by dividing total warranty claims and accruals by total product revenue, to produce the claims (claims / revenue) and accrual rates (accruals / revenue), respectively. These rates were calculated for the periods ending September 30, 2022, and September 30, 2023, to provide the expense rates for the first nine months of each year. For those companies on fiscal year schedules that differ from the calendar year, we considered the "third quarter" the one ending on the closest date before September 30, but not before June 30.

While we cannot contrast the expense rates of two different companies, especially across industries, and without knowing what each one does and does not count as warranty expenses, without quickly devolving into the land of baseless comparisons, we can compare each company to its own past self. So we compared each company's 2022 nine-month warranty expense rates to its 2023 expense rates from the same period. We ranked them, revealing the biggest increases and decreases. In the four tables that follow, we are listing the ten biggest percentage gainers and decliners for the claims rate, in Figures 1 and 2, respectively, and for the accrual rate, in Figures 3 and 4, respectively.

Of the top 100 manufacturers, a total of 27 made an appearance in any of the 40 possible slots in the four tables below. 14 companies made a single appearance, and 13 made the maximum of two appearances. This means that 73 made no appearance at all. But some of the 27 that did have the largest expense rate changes did so in a spectacular fashion, doubling or halving their expense rates in just a year.

Manufacturers should want normal, boring, consistent warranty expense rates, but the following companies have seen a high degree of volatility. As we will see, appearances, and especially multiple appearances, in the following tables can be good or bad, depending on whether the metrics are rising or falling.

The Companies

As we mentioned, of the top 100 manufacturers, only 27 appear at least once in Figures 1-4.

The 13 companies that made the maximum of two appearances in the four tables are: American Woodmark Corp., Bloom Energy Corp., Boeing Co., Daktronics Inc., Ingersoll Rand Inc., Insulet Corp., LCI Industries, Nvidia Corp., Peloton Interactive Inc., Philip Morris International Inc., Regal Rexnord Corp., SolarEdge Technologies Inc., and Taylor Morrison Home Corp.

And the 14 companies that made only one appearance are: Aptiv plc, Cummins Inc., Dana Inc., Hovnanian Enterprises Inc., Illumina Inc., Lucid Group Inc., M.D.C. Holdings Inc., Oshkosh Corp., Power Solutions International Inc., Skyline Champion Corp., SunPower Corp., Teradyne Inc., Toll Brothers Inc., and Woodward Inc.

These are the companies showing the most warranty pain or gain. Figures 1 and 3 contain the most improved, while Figures 2 and 4 contain the top warranty cost increases. But keep in mind that these are not all caused by surges in defects, or huge recalls. Some relate to mergers and acquisitions, which in and of themselves can raise warranty costs.

However, among the top 100 warranty providers, especially among the very largest, warranty expense rates tend not to change much from one year to the next. In fact, among the top 20 U.S.-based manufacturers (that report their warranty expenses), only Cummins and Boeing made appearances, and both for warranty expense rate reductions.

But there's also a subset for which the numbers increase by astronomical factors: tripling, quadrupling, and even as much as thirteen-fold. This reflects real pain, volatility, and big unanticipated expenses. Remember that these rates keep total claims and accruals proportional to product sales, so costs increasing simply because more units were sold doesn't show up in these data. Warranty expenses should stay incremental and proportional to sales, but some of the following companies are struggling with this.

We'll begin with the warranty claims rates, and, on a more optimistic note, with the top ten claims rate reductions for the first nine months of 2023.

Warranty Claims Rates

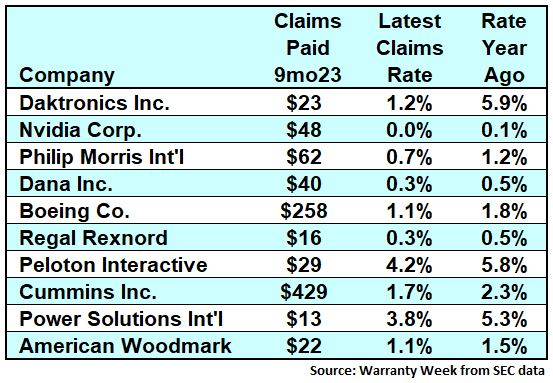

Figure 1 shows the top ten claims rate reductions for the first nine months of 2023, compared to the same three quarters of 2022.

Figure 1

Top 100 U.S.-based Warranty Providers:

Top Ten Claims Rate Reductions,

First 9 Mo. 2023 vs. First 9 Mo. 2022

(claims as a % of product sales)

Remarkably, only three of the ten companies in Figure 1 don't show up again in this newsletter. Six of the ten are also featured in Figure 3, the top ten largest accrual rate reductions, and strangely, one is also in Figure 4, with a claims rate reduction but accrual rate increase. The three companies featured only in Table 1 are, coincidentally, the three powertrain manufacturers: Dana, Cummins, and Power Solutions International.

For many of these companies, these reductions are corrections of dramatic increases during the year prior, rather than the result of huge cost-saving measures. Although, we can consider recovery back to normal from a recall or costly product failure in just a year a victory of its own.

Take scoreboard and outdoor LED screen maker Daktronics, for instance, in the top slot of Figure 1, with the biggest reduction in the claims rate. The company went from a 1.0% claims rate in the first three quarters of 2021, to the 5.9% claims rate shown in Figure 1 from 2022, back down to 1.2% in 2023. Daktronics actually took the top slot in the foil to this table, the top ten largest claims rate increases, in last year's tables comparing the first three quarters of 2021 and 2022. So kudos to Daktronics for managing to make this recall short, rather than have a lasting impact on its warranty costs.

It's a similar story for Nvidia, the GPU manufacturer in the second spot in Figure 1. Last year, Nvidia was in the second place slot in the top 10 claims rate increases, from 0.0% to 0.1%. Well, Nvidia's claims rate went back down, and it's back to 0.0% for the first nine months of 2023. For more context on Nvidia's history and warranty expenses, take a look at our recent newsletter "GPU Warranty Expenses," from October 2023.

Philip Morris is in third place in Table 1, with a reduction of the nine-month claims rate from 1.2% in 2022 to 0.7% in 2023. You may be asking yourself, what Philip Morris products come with warranties? Well, cigarettes are out, and vapes are in, and they're consumer electronic devices that can break and malfunction, and thus come with product warranties. Philip Morris is just the only vape manufacturer currently reporting, and the SEC and FASB don't seem to have gotten wind (or vapor) of this yet. And apparently, Philip Morris' vapes are breaking less, or at least, the company is paying a lower proportion of vape sales on warranty claims.

Dana and Boeing, in the fourth and fifth slots in Figure 1, respectively, were also among last year's top ten claims rate increases. Dana's claims rate nearly halved, from 0.5% in 2022 to 0.3% in 2023. Boeing's claims rate fell from 1.8% in 2022 to 1.1% in 2023. Of course, Boeing's already back in the news for more 737 Max groundings, so we expect their claims rate will continue to zigzag in the coming year.

Electric motor and powertrain manufacturer Regal Rexnord, in sixth on the list, saw its claims rate reduce by about a third, from 0.5% to 0.3%, in the wake of the big merger between Regal Beloit Corp. and Rexnord Corp. in late 2021, which likely drove up the expense rates during 2022. The company initiated another big acquisition of Altra Industrial Motion in March 2023, but managed to reduce its warranty expense rates anyway, so kudos are due.

Peloton, with the seventh-largest claims rate reduction, from 5.8% during the first three quarters of 2022 to 4.2% in the same period in 2023, only began reporting its warranty expenses in 2020. It's the maker of the eponymous luxury home exercise equipment, and infamous for the monthly virtual class subscription that users must pay in addition to the thousands of dollars for the apparatus, either an exercise bike or a treadmill. Even after the claims rate reduction, its claims rate of 4.2% is still much higher than the average for all U.S.-based manufacturers.

Next, we'll take a look at the largest nine-month claims rate increases, shown in Figure 2.

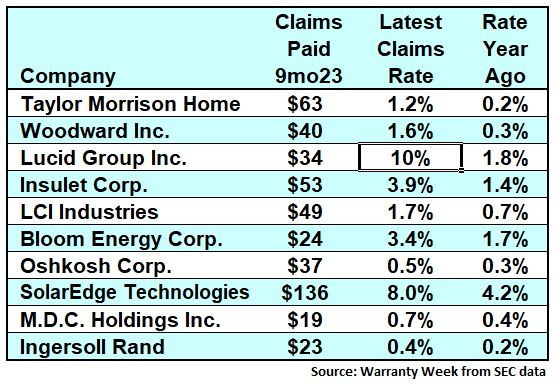

Figure 2

Top 100 U.S.-based Warranty Providers:

Top Ten Claims Rate Increases,

First 9 Mo. 2023 vs. First 9 Mo. 2022

(claims as a % of product sales)

Of these ten companies, five also make an appearance in Figure 4, and one makes an appearance in Figure 3. The four that make their only appearance in Figure 2 are Woodward, Lucid Group, Oshkosh, and M.D.C. Holdings.

We have Taylor Morrison in the top slot of Figure 2, with a claims rate that more than sextupled, from 0.2% during the first three quarters of 2022, to 1.2% during the same period of 2023. Interestingly, this is the negative foil to Dana and Boeing's good fortune of moving from the list of biggest increases in 2022 to the list of biggest reductions in 2023. Taylor Morrison had the largest claims rate reduction of the top 100 manufacturers during 2022, and a year later, it's the top increaser.

In second is Woodward Inc., manufacturer of parts for aircraft engines, turbines, and power generation. This is the company's only appearance in the four tables, with a claims rate that quintupled from 0.2% in 2022 to 1.2% in 2023.

In third is Lucid Group, with a claims rate that also quintupled, though on a much more dramatic scale, from 1.8% in the first three quarters of 2022, to a shocking 10% in 2023. Lucid is an electric vehicle manufacturer. For comparison, global automotive manufacturers have an average claims rate of about 2.5%, and Lucid's largest U.S.-based, EV-only rival, Tesla, had a claims rate of 1.8% in the third quarter of 2023. Paying 10% of sales back to consumers in the form of warranty claims is an unsustainable and untenable situation for any global manufacturer, and this figure reflects real pain for Lucid. However, we're not too worried about the company going out of business, since it's majority owned (61%) by the Kingdom of Saudi Arabia's sovereign wealth fund, the Public Investment Fund. Lucid only manufactured a little more than 6,000 EV units during the first three quarters of 2023.

Insulet Corp., maker of insulin pumps, is in fourth, with a claims rate that tripled, from 1.4% in the first three quarters of 2022 to 3.9% in 2023. Last year, Insulet was in "the pain chart," Figure 4, for a huge increase in its accrual rate during the first nine months of 2023. Clearly, this claims rate increase in 2023 is the result of the insulin pump battery recall for which the company accrued extra funds during 2022.

LCI Industries saw its claims rate more than double, from 0.7% in the first nine months of 2022 to 1.7% in the same period of 2023. Bloom Energy saw its claims rate double from 1.7% to 3.4%. Oshkosh was just shy of doubling, from 0.3% to 0.5%. SolarEdge was also just shy of doubling, from 4.2% to a whopping 8.0%.

Warranty Accrual Rates

In Figure 3, we celebrate the companies that cut their accrual rates the most. These numbers are particularly important because each company chooses how much money to accrue, based on what they anticipate spending on warranty claims in the future. A lower accrual rate means more profits and savings for these companies.

Figure 3

Top 100 U.S.-based Warranty Providers:

Top Ten Accrual Rate Reductions,

First 9 Mo. 2023 vs. First 9 Mo. 2022

(accruals as a % of product sales)

As we mentioned in our discussion of Figure 1, six of the ten companies in Figure 3 overlap with Figure 1. Those companies are: Nvidia, Daktronics, Philip Morris, Regal Rexnord, Boeing, and American Woodmark.

Interestingly, we have one more repeat appearance in Figure 3, this time Insulet from Figure 2. This means that Insulet managed to see its claims rate increase but its accrual rate decrease over the same nine-month period of 2023. Insulet had an accrual rate of 14% during the first three quarters of 2022, so the company likely made a huge lump sum accrual for the anticipated costs of the insulin pump battery recall, and is currently paying out from this total, explaining the high accruals last year and high claims this year.

The three companies that make their only appearance in any of the four tables here are Hovnanian, Aptiv, and Toll Brothers. Hovnanian and Toll Brothers are both new home builders, and Aptiv makes electronic screens and software for vehicles. All of them reduced their accrual rates by a little less than half from 2022 to 2023.

The Pain Chart

Finally, we have the bad news. Figure 4, which we've dubbed "the pain chart," is a table that no manufacturer wants to be a part of. While claims are something that happen to a company, accruals are something a company decides to do. And accrual increases have a direct impact on net income. So when a company decides to raise its accrual rate, it does so because the accountants believe it will be necessary in order to pay claims.

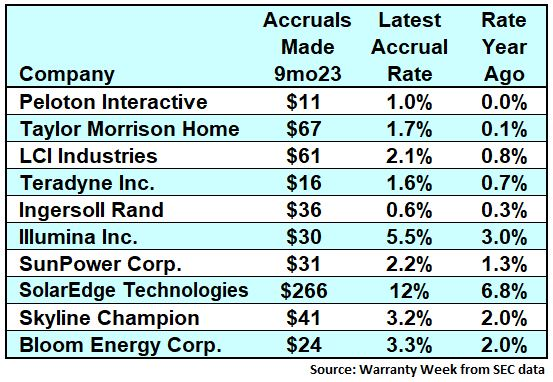

Figure 4

Top 100 U.S.-based Warranty Providers:

Top Ten Accrual Rate Increases,

First 9 Mo. 2023 vs. First 9 Mo. 2022

(accruals as a % of product sales)

Five of the ten companies in Figure 4 overlap with Figure 2. Those companies are: Taylor Morrison Home, LCI Industries, Ingersoll Rand, SolarEdge, and Bloom Energy.

Peloton leads the pack, with an increase from 0.0% to 1.0%. We have several questions. We're willing to accept that Peloton, like Insulet, is an exception to the rule, and that the claims and accrual rates can make big moves in opposite directions during the same period. But how is Peloton paying its claims with such a low accrual rate, even after the increase? In the same nine months of 2023 that the company paid 4.2% of sales in warranty claims, only 1.0% of sales were accrued to pay for claims. The first three quarters of 2022 are even more preposterous: the company paid 5.8% of sales in claims, but reported accruing 0% of revenue for warranty expenses.

Taylor Morrison leads the vanguard once again. Recall that the new home builder's claims rate sextupled. Not to be outdone, the company's accrual rate increased thirteen-fold during the same nine-month period, from 0.1% to 1.7%. In our recent newsletter "Nine-Month New Home Warranty Update," we detail Taylor Morrison's accruals per home sold since 2012.

LCI Industries more than doubled its accrual rate, from 0.8% to 2.1%. Ingersoll Rand's accrual rate also doubled, from 0.3% to 0.6%. SolarEdge's accrual rate increased by about three-fourth, from 6.8% to a shockingly high 12%, the highest accrual rate we see in this report. And Bloom Energy increased its accrual rate by about two-thirds, from 2.0% to 3.3%.

Teradyne, Illumina, SunPower, and Skyline Champion all make their only appearance in this newsletter in Figure 4. It's not great news for the companies, but it's not as bad as it is for those that appear in Figure 2 along with Figure 4.

Teradyne, maker of electronic test equipment, more than doubled its accrual rate, from 0.7% to 1.6%. Illumina, a biotechnology manufacturer that makes gene and DNA sequencers, came just short of doubling its accruals, from 3.0% to 5.5%. Solar manufacturer SunPower increased its accruals by three-quarters, from 1.3% to 2.2%. And finally, mobile home builder Skyline Champion increased its accruals by two-thirds, from 2.0% to 3.2%.