Top 100 Warranty Providers of 2023:

About two-thirds of the top 100 U.S.-based warranty providers increased their warranty claims rate, accrual rate, and reserve balance in 2023. These unprecedented increases are mainly due to inflation, rather than huge rates of recalls or product failures. But a few companies did stand out as big winners and big losers in 2023, in the form of large increases and reductions in these three warranty metrics, compared to themselves in 2022.

Now that we've passed the mid-point of March, the deadline has passed for large companies to file their 2023 annual reports with the U.S. Securities and Exchange Commission (SEC). So it's time for us to kick off our twenty-first year of reviewing the annual warranty expense data with this survey of the top 100 U.S.-based, warranty-issuing manufacturers.

We can't compare the warranty metrics of two different companies, without knowing how they compose their numbers, what they count and don't count as warranty costs, how they count parts costs, the specifics of their call centers, the protocols of their staff, and so on. While we can't compare companies to each other, we can compare them to themselves in the past, and track the largest changes to their warranty expense metrics. The following six charts present the top increases and reductions in manufacturers' warranty claims rates, accrual rates, and reserve balances.

We had some surprising results this year, with the metrics decidedly lopsided towards increases in 2023, when it's usually the other way around. About two-thirds of the top 100 saw increases in their claims rates, accrual rates, and reserve balances from 2022 to 2023. Inflation is likely to blame, whether actual, in the case of claims, or expected, in the case of accruals and reserves.

Methodology

First, we gathered data from the annual financial reports of every product warranty-issuing manufacturer that reports warranty costs to the SEC. We extracted three key metrics: total warranty claims paid, total warranty accruals made, and the year-end balance of the warranty reserve fund.

We also gathered data on product sales revenue for each company, and used these data to calculate two additional warranty metrics: claims as a percentage of revenue (the claims rate), and accruals as a percentage of revenue (the accrual rate).

We standardized all of the different manufacturers' fiscal years to the calendar year, using data from subsequent quarterly financial statements for those companies whose fiscal 2023 ended in the middle of calendar 2023.

We sorted our list of hundreds of U.S.-based manufacturers by the total claims paid during 2023, and narrowed the list down to the top 100 companies. Among the top 100, the lowest amount of claims paid was about $27 million in 2023.

We eliminated four manufacturers from the list because we needed to craft too many estimates to fill in missing data. Those four companies are: Emerson Electric Co., Mohawk Industries Inc., Dentsply Siro Inc., and Coherent Corp. These four likely paid out more than $27 million in 2023, we cannot be sure how much.

There were a few dozen companies that were late to report. Based on past years where they did report, we know that a few had a chance of making the top 100, but they were too late to make it into this newsletter. The largest contenders for the top 100 that didn't report in time were: Microvast Holdings Inc., Infinera Corp., SunPower Corp., 3D Systems Corp., and Cutera Inc.

For each manufacturer on the list of the top 100, we calculated the percent change of the claims rate, accrual rate, and warranty reserve end-balance from 2022 to 2023. We ranked the companies by their rates of change, and Figures 1-6 show the largest increases and reductions in these warranty metrics. However, we won't present those rates of change in Figures 1-4, because percent changes of percentages are not particularly meaningful data points.

With six charts in this report, three showing reductions and three showing increases, each manufacturer in the top 100 had a maximum of three possible appearances. Eight companies did so this year: Acuity Brands Inc., American Woodmark Corp., Ingersoll Rand Inc., Insulet Corp., Lucid Group Inc., Nvidia Corp., Philip Morris International Inc., and Woodward Inc.

Nine companies made two appearances in the charts, and 18 made one appearance. 65 companies made no appearances, meaning that for most warranty-issuing manufacturers, warranty costs are stable and steady. Those whose warranty costs are volatile are an anomaly, and it's worth analyzing those companies that are experiencing more fluctuation in warranty metrics than is typical.

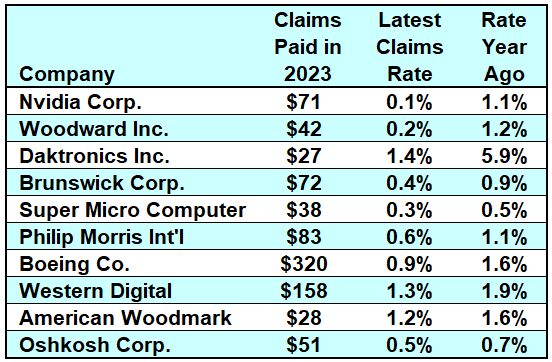

Claims Rate Reductions

Figure 1 shows the ten largest warranty claims rate reductions of 2023, which is great news for the following companies. Some of them are recovering from recalls or surges in product failures, but most refrained from discussing the details of this in their annual reports.

Figure 1

Top 100 U.S.-based Warranty Providers:

Top Ten Claims Rate Reductions,

Calendar Year 2022 vs. 2023

(claims as a % of product sales)

Our top warranty claims rate reduction of 2023 was GPU manufacturer Nvidia Corp., which saw its claims rate fall from 1.1% in 2022 to just 0.1% in 2023. As we noted in our October 2023 newsletter "GPU Warranty Expenses," Nvidia spent more in warranty claims payments during the fourth quarter of 2022 than it did during any quarter of the previous decade, by a landslide. This rise in claims costs was the result of defective "third-party component[s] embedded in certain Data Center products," as stated in Nvidia's 2022 annual report. So the reduction in the claims rate in 2023 is a return to normal.

The rising cost of each of Nvidia's discrete GPUs, along with the fact that the two most intensive usages of these GPUs, powering artificial intelligence and cryptocurrency mining, both count as commercial use that voids the product warranty, helps keep Nvidia's warranty claims costs quite low. However, as we'll see in Figure 4, Nvidia is perhaps expecting higher warranty costs in the future, as the company had the largest accrual rate increase among the top 100, despite having the largest claims rate reduction. The high level of volatility in opposite directions for the two warranty expense rates is certainly peculiar, if not a warning signal.

Woodward Inc., which makes control systems for aerospace and turbines, had the second-largest claims rate reduction, falling from 1.2% in 2022 to 0.2% in 2023. Woodward stated in its 2022 annual report that it expected to recover a large portion of that year's heightened warranty costs from insurance.

Woodward also appears in Figure 3, the largest accrual rate reductions, and Figure 5, the largest warranty reserve reductions, so the company managed to cut warranty costs across the board in 2023. American Woodmark and Philip Morris also appear in the same set of three charts, showing big savings on warranty expenses in 2023 compared to 2022.

LED screen manufacturer Daktronics, in the third slot in Figure 1, saw its claims rate fall from 5.9% in 2022 to 1.4% in 2023. In its annual report, the company simply stated that it had been having some trouble accurately predicting warranty costs in 2022 and 2023.

Boat manufacturer Brunswick Corp. also saw its claims rate more than halve, from 0.9% in 2022 to 0.4% in 2023. Super Micro Computer and Philip Morris both also saw their claims rate come just shy of halving.

The largest company in Figure 1 in terms of total warranty claims paid was Boeing Co., which saw its claims rate fall from 1.6% in 2022 to 0.9% in 2023. We most recently discussed Boeing's warranty woes in our recent newsletter "Warranty Adjustments," so this reduction looks like the calm before (yet another) storm. Boeing's product failures have been all over the news lately, and we wouldn't be surprised to find Boeing in the foil to this chart, the top ten claims rate increases, in next year's edition of this newsletter.

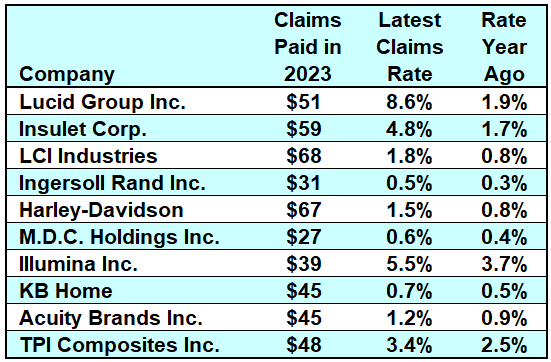

Claims Rate Increases

Figure 2 shows the ten largest warranty claims rate increases from 2022 to 2023.

Figure 2

Top 100 U.S.-based Warranty Providers:

Top Ten Claims Rate Increases,

Calendar Year 2022 vs. 2023

(accruals as a % of product sales)

Lucid Group saw its claims rate more than quadruple, from 1.9% in 2022 to 8.6% in 2023. Lucid issued three recalls in July 2023 for its Lucid Air sedans, affecting about 6,000 vehicles from the 2022 and 2023 model years. For a company like Lucid, 6,000 vehicles is likely a vast majority of its existing products, as the company announced in January that it sold just 6,001 cars in 2023. As of mid-2019, Lucid is majority owned by Saudi Arabia's Public Investment Fund, as we discussed in our August 2023 newsletter "U.S. EV-Only Warranty Expense Rates."

Insulet is in the second slot, with its claims rate almost tripling, from 1.7% in 2022 to 4.8% in 2023. Last year, we noticed Insulet ramp up accruals significantly as it announced a recall of the batteries of many of its insulin pumps. Insulet also features in Figure 3, the top ten accrual rate reductions, so the company clearly accrued for the recall in one lump sum in 2022, and paid out claims from that fund during 2023.

LCI industries saw its claims rate double, from 0.8% in 2022 to 1.8% in 2023. In its 2023 annual report, the company states, "Warranty costs decreased operating profit by $29.4 million due to increased warranty claim payments driven by retail dealers seeking service work to offset retail sales which declined in 2023 and higher claim activity associated with certain products." So warranty costs increased in part because retailers returned parts under warranty because they didn't sell, and in part because certain parts had high defective rates.

Ingersoll Rand acquired three companies in 2023: EcoPlant in June, and Fraserwoods and Oxywise in October. The company reported acquiring $2.2 million in warranty accruals. However, its warranty claims costs rose by much more than that, with total claims more than doubling, and the claims rate increasing by four-fifths.

Ingersoll Rand also appears in Figure 4, the top ten accrual rate increases, and Figure 6, the top ten warranty reserve increases. Lucid Group and Acuity Brands also appear in the same set of three charts, meaning 2023 was a costly year for these manufacturers' warranty expenses across the board.

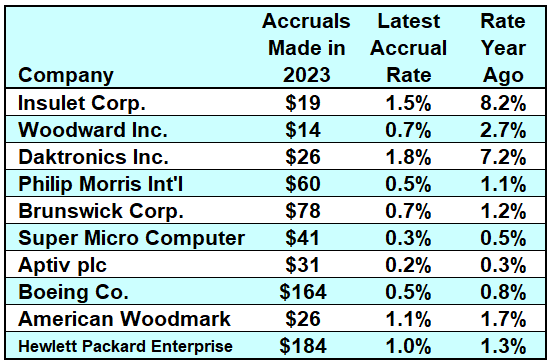

Accrual Rate Reductions

Figure 3 shows the top ten largest warranty accrual rate reductions in 2023.

Figure 3

Top 100 U.S.-based Warranty Providers:

Top Ten Accrual Rate Reductions,

Calendar Year 2022 vs. 2023

(accruals as a % of product sales)

Notice that the top company in Figure 3, Insulet Corp., was in the second slot of Figure 2. This is the rare company that saw claims costs increase, but still cut accruals significantly, with the accrual rate dropping from 8.2% in 2022 to 1.5% in 2023. We also see Insulet in Figure 5, the top ten warranty reserve reductions, because the company set aside all of the funds for the battery recall in 2022, and paid most of that money out in 2023.

Woodward, Daktronics, Philip Morris International, Brunswick, Super Micro Computer, Boeing, and American Woodmark all also appeared in Figure 1, meaning there were significant reductions in both the claims and accrual rates during 2023.

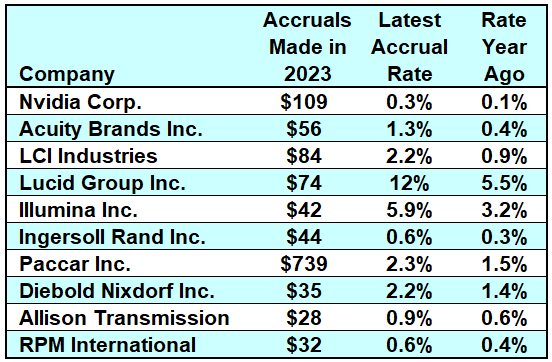

Accrual Rate Increases

Figure 4 shows the top ten accrual rate increases from 2022 to 2023. This chart shows some of the companies in the midst of warranty woes, many in the form of recalls. Manufacturers have direct control over how much money they accrue for future warranty expenses, so large increases in the accrual rate means big unexpected warranty costs arose.

Figure 4

Top 100 U.S.-based Warranty Providers:

Top Ten Accrual Rate Increases,

Calendar Year 2022 vs. 2023

(accruals as a % of product sales)

Nvidia is another anomaly in this newsletter, along with Insulet. Insulet saw the claims rate rise, but the accrual rate and reserve balance fall, while Nvidia saw the claims rate fall, but the accrual rate and reserve balance rise.

Nvidia's accrual rate rose from 0.1% to 0.3%, so it's not exactly tragic news. In proportion to where it was, the accrual rate technically quintupled. However, Nvidia's total accruals actually fell by about one-third. Product revenue decreased compared to 2022, leading to a smaller amount of total accruals being a higher proportion of sales revenue in 2023, driving up the accrual rate. A very interesting case.

Acuity Brands, which makes lighting systems and controls, also appeared in our recent newsletter "Smallest Warranty Reserve Capacities." Despite Acuity increasing its claims rate, accrual rate, and reserve balance in 2023, it still had one of the smallest warranty reserve capacities. Interestingly, although Acuity's accrual rate more than tripled from 0.4% to 1.3%, total accruals only increased by 8%. Similar to what happened with Nvidia, decreased product revenue led to a slightly larger number being a much larger proportion of total sales.

On the other hand, LCI and Lucid Group saw both total accruals and the accrual rate increase significantly. LCI increased total accruals by four-fifths, while the accrual rate more than doubled. Lucid more than doubled both total accruals and the accrual rate.

Paccar Inc. has by far the largest warranty costs among this group of ten companies. In its 2023 annual report, the company stated, "Average cost per truck increased cost of sales by $916.7 million, primarily reflecting higher raw material, labor and product support costs, mainly warranty expense." So Paccar blames increased operation costs on higher warranty expenses, but doesn't detail exactly what drove up warranty costs in 2023.

Paccar's accrual rate increased by about half, from 1.5% in 2022 to 2.3% in 2023. Paccar came close to doubling its warranty accruals from 2022 to 2023, but increased product revenue mitigated some of these increases as reflected in the accrual rate. We'll also note that Paccar made an additional $212 million in changes in estimates for pre-existing product warranties.

Warranty Reserve Reductions

Figure 5 shows the ten largest warranty reserve balance reductions. The balances shown in Figures 5 and 6 are the end-balances of the warranty reserve funds at the end of each calendar year. For companies with fiscal years that differ from the calendar year, we used data from the quarterly financial report that ended closest to, but not after, December 31, 2023.

Figure 5

Top 100 U.S.-based Warranty Providers:

Top Ten Warranty Reserve Reductions,

Calendar Year 2022 vs. 2023

(accruals as a % of product sales)

Insulet tops the chart yet again, followed again by Woodward. Both more than halved their warranty reserve fund balances in 2023.

Broadband and wireless network infrastructure manufacturer CommScope exactly halved its warranty reserve fund balance, from $55 million in 2022 to $27.4 million in 2023. Other companies that make their only appearance in this newsletter in Figure 5 are Peloton Interactive, Western Digital, Winnebago Industries, BorgWarner, and HP.

Warranty Reserve Increases

Figure 6 shows the top ten increases in warranty reserve balances from the end of 2022 to the end of 2023.

Figure 6

Top 100 U.S.-based Warranty Providers:

Top Ten Warranty Reserve Increases,

Calendar Year 2022 vs. 2023

(accruals as a % of product sales)

Lucid Group tops this chart as well, doubling its warranty reserve fund balance from 2022 to 2023. Fellow electric vehicle manufacturer Tesla also appears in Figure 6, with by far the largest warranty reserve fund among these ten companies. Tesla grew its warranty reserve fund by about half from 2022 to 2023.

Paccar grew its warranty reserve fund by about two-thirds. The next-largest warranty reserve fund in Figure 6 belongs to SolarEdge Technologies, which grew its reserves by about one-third.

Along with SolarEdge, other manufacturers making their only appearance in this newsletter in Figure 6 are Enphase Energy, TPI Composites, Tesla, and Skyline Champion.