U.S. Power Generation Equipment Warranty Expenses:

2024 was the first year that GE Vernova, formed through the merger of GE Power and GE Renewable Energy, filed a separate annual report from the GE Aerospace and HealthCare divisions. The company reported three years of data, back to 2022. The industry average accrual rates have fluctuated rather dramatically since then, as the new spin-off gets its footing, especially with the warranty costs of its wind turbines.

In April 2024, General Electric completed its split into three separate corporate entities, GE Aerospace, GE Vernova, and GE HealthCare. 2024 was the first year for which GE Vernova and GE Aerospace filed separate annual reports, and each provided product warranty data for three years, 2022, 2023, and 2024. We found that about 55% to 65% of the former parent General Electric's product warranty expenses came from the power generation sector.

GE Vernova was formed by the merger of the GE Power, GE Renewable Energy, GE Digital, and GE Energy Financial Services divisions, and subsequent spin-off into a separate company. The parent GE was renamed GE Aerospace.

Leading up to the spin-offs, GE sold its nuclear turbine business, a large part of the GE Steam Power sub-division of the GE Power division, in 2022, to EDF, the French state-owned electric utility company. Post-spin-off, GE Vernova was organized into four divisions: Power, Wind, Electrification Systems, and Electrification Software.

Aside from GE Vernova, the largest U.S.-based power generation equipment manufacturers include: Generac Holdings Inc., SolarEdge Technologies Inc., Enphase Energy Inc., Valmont Industries Inc., Bloom Energy Corp., Fluence Energy Inc., ChargePoint Holdings Inc., TPI Composites Inc., Microvast Holdings Inc., First Solar Inc., and FTC Solar Inc.

Some, such as Generac, make portable generators. Others, such as Valmont, make power infrastructure, such as traffic and utility poles. Many, including SolarEdge, Enphase, First Solar, and FTC Solar, make solar panels, solar cells, or solar inverters. Some make infrastructure for electric vehicle charging, including ChargePoint. Along with GE Vernova, TPI Composites makes wind turbine blades. Many more in the industry produce batteries, fuel cells, or energy storage products, primarily in the renewable energy space.

Many companies that install solar systems on the roofs of homes and buildings offer longer-than-typical product warranties, presumably to help soothe consumers' possible concerns about the reliability of the relatively new technology. We've seen manufacturers of solar panels, cells, or inverters offer product warranties that are valid for 10, 15, 20, 25, or even 50 years. Enphase Energy, for example, provides a product warranty term of up to 25 years for its microinverter units.

To compose this newsletter, we found 66 U.S.-based manufacturers of power generation equipment, which reported product warranty expenses between 2003 and 2024. 24 of those manufacturers reported warranty costs in 2024.

For each manufacturer, we perused their annual reports and quarterly financial statements, and gathered three key warranty metrics: the amount of claims paid, the amount of accruals made, and the end-balance of the warranty reserve fund. We also gathered data on each manufacturer's product sales revenue, and used these to calculate two additional warranty metrics: claims as a percentage of sales (the claims rate), and accruals as a percentage of sales (the accrual rates).

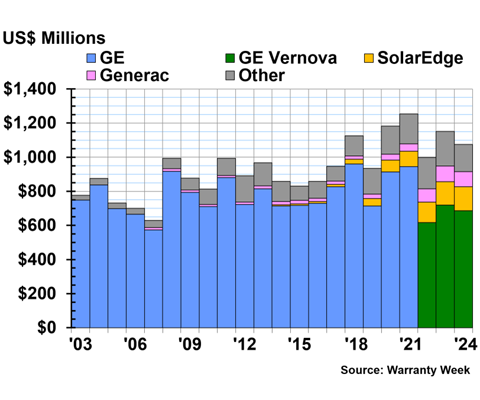

Warranty Claims Totals

Figure 1 shows the total warranty claims paid by the U.S.-based power generation equipment manufacturers, from 2003 to 2024.

Figure 1

Power Generation Equipment Warranties

Claims Paid by U.S.-based Manufacturers

(in US$ millions, 2003-2024)

In 2024, the U.S.-based power generation manufacturers paid a total of $1.076 billion in warranty claims, a -7% decrease from 2023.

In 2024, GE Vernova paid $686 million in claims, a -5% decrease from 2023's total of $719 million.

SolarEdge paid $141 million in claims in 2024, a 3% increase from 2023.

Generac paid $89 million, a -3% decrease from the year prior. In July 2023, a class action lawsuit was filed against Generac, alleging that Generac violated the Magnuson-Moss Warranty Act by refusing the fulfill warranty claims made for its SnapRS technology for solar storage systems. The lawsuit alleges that Generac avoided fulfilling the warranty claims by blaming the product failures on user error or incorrect installation, rather than faulty components. Generac claimed that the solar installers should be responsible for paying the claims, while the installers said that Generac should be responsible. Meanwhile, some of those installers, such as Pink Energy, have already gone out of business.

TPI Composites paid $34 million, a -30% decrease. Enphase Energy paid $22 million, a -20% decrease. Bloom Energy paid $21 million, a -18% decrease. Valmont Industries paid $21 million, a 22% increase. Microvast Holdings paid $14 million, a -24% decrease.

First Solar's warranty claims costs more than doubled, from $6 million in 2023, to $13 million in 2024.

Power Solutions International Inc. paid $13 million, a -24% decrease. Fluence Energy paid $7 million, a 13% increase. FTC Solar paid $3 million, a -20% decrease. And American Superconductor Corp. paid $3 million, a 37% increase.

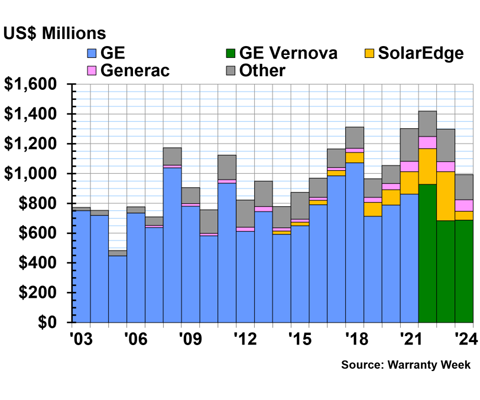

Warranty Accrual Totals

Figure 2 shows the total warranty accruals made by the U.S.-based power generation manufacturers, from 2003 to 2024.

Figure 2

Power Generation Equipment Warranties

Accruals Made by U.S.-based Manufacturers

(in US$ millions, 2003-2024)

In 2024, the U.S.-based power generation manufacturers set aside a total of $992 million in warranty accruals, a -24% decrease from 2023.

GE Vernova set aside $687 million in warranty accruals in 2024, a 0.44% increase from 2023's total of $684 million.

Generac set aside $78 million in accruals, a 16% increase from the year prior.

SolarEdge more than halved its accruals from 2023 to 2024. SolarEdge accrued $60 million in 2024, a -82% decrease from 2023's total of $329 million. Enphase Energy also halved its accruals, from $52 million in 2023, to $28 million in 2024, a -47% decrease.

Valmont Industries accrued $23 million in 2024, a -5% decrease from 2023. Bloom Energy accrued $18 million, a -34% decrease. Fluence Energy accrued $18 million, a 32% increase.

ChargePoint Holdings more than tripled its warranty accruals, from $5 million in 2023, to $17 million in 2024.

TPI Composites accrued $13 million in 2024, a 9% increase from the year prior. Microvast Holdings accrued $13 million, a 1% increase. First Solar accrued $7 million, a 37% increase. FTC Solar accrued $7 million, a 67% increase. Power Solutions International accrued $6 million, a -9% decrease.

Array Technologies accrued $4 million, a -33% decrease. Babcock & Wilcox Enterprises Inc. accrued $3 million, a -48% decrease. And American Superconductor Corp. accrued $3 million in 2024, a 25% increase.

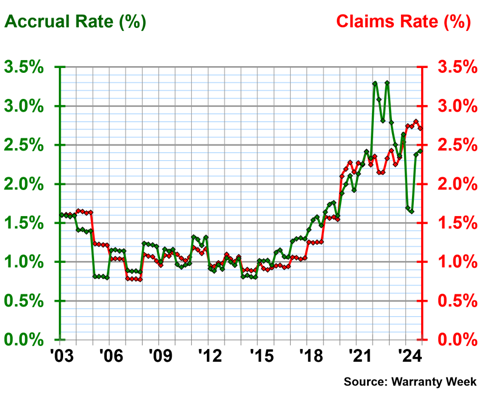

Warranty Expense Rates

Figure 3 shows the average quarterly warranty claims and accrual rates for the power generation equipment manufacturers, from 2003 to 2024.

Figure 3

Power Generation Equipment Warranties

Average Claims & Accrual Rates

(as a % of product sales, 2003-2024)

Over 22 years, the power generation equipment industry had an average warranty claims rate of 1.41%, with a standard deviation of 0.57%, and an average warranty accrual rate of 1.44%, with a standard deviation of 0.61%.

In 2024, the power generation equipment manufacturers had an average claims rate of 2.75%. The quarterly values ranged from 2.71% in the fourth quarter, to 2.80% in the third quarter.

In 2024, the power generation industry had an average accrual rate of 2.03%. The quarterly values ranged from 1.65% in the second quarter, to 2.42% in the fourth quarter.

As we can see in Figure 3, that's quite a wide range, and a high degree of volatility is especially apparent in the accrual rates since 2022. This is mostly due to the calibration of the new GE Vernova's warranty expenses leading up to, and directly after, the spin-off.

As is also rather apparent in Figure 3, prior to the split, General Electric only reported its warranty expenses on an annual basis, rather than quarterly, and as the largest manufacturer in the U.S.-based industry, that shaped the data from 2003 to 2021.

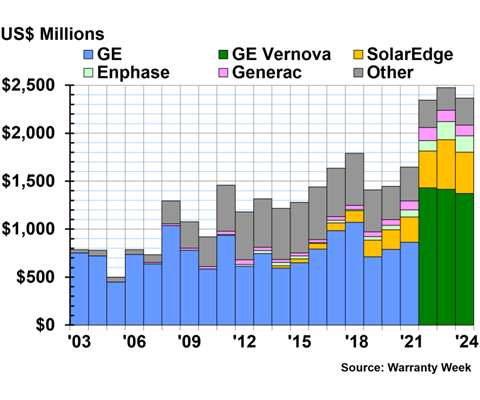

Warranty Reserve Balances

Figure 4 shows the warranty reserve fund end-balances of the U.S.-based power generation equipment manufacturers, from 2003 to 2024.

Figure 4

Power Generation Equipment Warranties

Reserves Held by U.S.-based Manufacturers

(in US$ millions, 2003-2024)

At the end of 2024, the power generation manufacturers held $2.367 billion in warranty reserves, a -4% decrease from the end of 2023.

At the end of 2024, GE Vernova held $1.370 billion in warranty reserves, a -3% decrease from the end of 2023.

SolarEdge held $432 million in reserves at the end of 2024, a -17% decrease from the end of the year prior. Enphase Energy held $171 million, a -10% decrease from the year prior. Generac held $111 million, a -5% decrease.

First Solar held $76 million in reserves at the end of 2024, triple its 2023 end-balance of $25 million.

TPI Composites held $39 million in reserves at the end of 2024, a 3% increase from the end of 2023. Fluence Energy held $38 million, a 34% increase. Microvast Holdings held $33 million, a -6% decrease.

Valmont Industries held $24 million at the end of 2024, a 6% increase from the end of 2023. Bloom Energy held $17 million, a -14% decrease. Power Solutions International held $14 million, a -27% decrease. FTC Solar held $12 million, a 8% increase.

Array Technologies held $7 million, a 12% increase. BWX Technologies Inc. held $7 million, a 6% increase. Eos Energy Enterprises Inc. held $5 million, a -18% decrease. Babcock & Wilcox held $3 million in reserves at the end of 2024, a -55% decrease form the end of 2023. And American Superconductor held $3 million, a 50% increase.

Catch the rest of our series of 22-year charts:

- "Twenty-Second Annual Product Warranty Report"

- "New Home Builder Warranty Report"

- "U.S. Small Vehicle Warranty Expenses"

- "U.S. Truck, Bus, & Heavy Equipment Warranty Expenses"

- "U.S. Auto Parts & Powertrain Warranty Expenses"

- "U.S. Aerospace Warranty Expenses"

- "U.S. New Home & Building Materials Warranty Expenses"

- "U.S. HVAC & Appliance Warranty Expenses"