U.S. Electronics Warranty Report:

The list of U.S.-based electronics manufacturers that report their warranty expenses does not include several heavy hitters in the industry. Since Apple ceased publishing its warranty data in 2022, we've seen reported warranty costs in the computer industry drop in half, but expenses in the semiconductor industry have been on the rise.

Apple ceased publishing its warranty expenses in the middle of 2022. Before then, Apple accounted for half of all the warranty expenses of U.S.-based computer manufacturers. Total product warranty accruals of the U.S. computer industry decreased by one-third from 2022 to 2023, and were cut by another one-third from 2023 to 2024. Apple also stopped publishing the expenses associated with its AppleCare extended warranty program.

As a result of this change in accounting practices within one of the largest U.S.-based manufacturers, and huge provider of both limited and extended warranties, the publicly available data for the warranty expenses of U.S.-based computer and consumer electronics industries are a bit lacking. Our data set is limited to the publicly available data published in financial statements filed with the SEC.

In the consumer electronics industry, Microsoft ceased publishing its warranty expenses in the middle of 2012, a few years after its "Red Ring of Death" Xbox 360 warranty crisis, which began in the 2005 holiday season. Google has never published its warranty expenses, despite manufacturing the Pixel line of smartphones.

Of course, Apple also makes smartphones, but we categorized the company in the computer industry since that was its original primary product line. And by the time Microsoft manufactured its first PCs, the Surface line, in 2012, it had already ceased reporting.

Without Apple, Microsoft, or Google, the U.S.-based consumer electronics manufacturers that do report their warranty expenses represent just a small portion of the global industry. The U.S. industry has very little representation of mobile phone, video game console, camera, TV, or tablet manufacturers. Eastman Kodak ceased reporting in the wake of bankruptcy and restructuring in 2012. Samsung, Sony, LG, Canon, Nikon, Panasonic, and Nintendo are not based in the U.S., and don't report their warranty expenses either.

It's not so bad on the computer side. Although Apple doesn't report, major players Dell, HP, and IBM do. Dell Inc. went private back in 2013, and ceased filing financial reports with the SEC. However, when it acquired EMC Corp. in 2016, the size of the merger meant that the newly-formed Dell Technologies Inc. needed to start publishing quarterly financial statements once again. And then Dell went public again in 2018, just five years after the controversial buyout.

In 2015, Hewlett-Packard Company split into two separate companies, HP Inc. and Hewlett Packard Enterprise Co. We class both of these manufacturers in the computer industry.

Of course, other computer manufacturers such as Lenovo, Asus, Toshiba, and Asus are not based in the U.S., nor do they report their warranty expenses in their financial statements. GPU manufacturers such as Nvidia and AMD are included in the semiconductor industry, but Intel does not report.

In the computer industry, we identified 27 U.S.-based manufacturers that reported warranty expenses between 2003 and 2024. Eight of those manufacturers reported warranty expenses in 2024: HP Inc., Dell Technologies Inc., Hewlett Packard Enterprise Co., IBM Corp., Super Micro Computer Inc., Corsair Gaming Inc., Unisys Corp., and One Stop Systems Inc.

In the consumer electronics industry, we identified 37 U.S.-based manufacturers that reported warranty expenses between 2003 and 2024. Seven of them reported warranty expenses in 2024: Garmin Ltd., GoPro Inc., VOXX International Corp., Moving iMage Technologies Inc., Knowles Corp., Universal Electronics Inc., and Genasys Inc.

We found 163 U.S.-based semiconductor manufacturers that reported warranty expenses between 2003 and 2024. 36 of them reported warranty expenses in 2024. The largest were: Lam Research Corp., Applied Materials Inc., Advanced Micro Devices Inc. (AMD), Nvidia Corp., Coherent Corp., Marvell Technology Inc., Teradyne Inc., IPG Photonics Corp., Kulicke and Soffa Industries Inc., Axcelis Technologies Inc., and Onto Innovation Inc.

We'll detail the warranty expenses of the individual semiconductor manufacturers in next week's newsletter, so we won't detail these data in this article.

There were 44 U.S.-based data storage manufacturers that reported warranty expenses between 2003 and 2024. Five of them reported warranty expenses in 2024: Western Digital Corp., Seagate Technology Holdings plc, Quantum Corp., Intevac Inc., and NetApp Inc.

63 U.S.-based peripherals manufacturers reported warranty expenses between 2003 and 2024. 16 of them reported in 2024. The largest were: Dover Corp., Diebold Nixdorf Inc., Zebra Technologies Corp., Daktronics Inc., NCR Atleos Corp., 3D Systems Corp., and Hurco Companies Inc.

For each electronics manufacturer, we perused their annual reports and quarterly financial statements, and gathered three key warranty metrics: the amount of claims paid, the amount of accruals made, and the end-balance of the warranty reserve fund.

In addition, we gathered data on each manufacturer's product sales revenue, and used these to calculate two additional warranty metrics: claims as a percentage of sales revenue (the claims rate), and accruals as a percentage of sales revenue (the accrual rate).

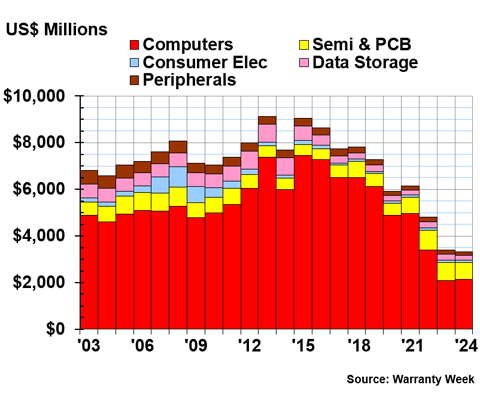

Warranty Claims Totals

Figure 1 shows the total warranty claims paid by these five industries in the electronics sector, from 2003 to 2024.

Figure 1

Electronics Warranties

Claims Paid by U.S.-based Manufacturers

(in US$ millions, 2003-2024)

In 2024, the U.S.-based computer industry paid $2.129 billion in warranty claims, a 2% increase from 2023. The semiconductor industry paid $724 million, a -7% decrease. The data storage industry paid $218 million in claims, a -12% decrease. The peripherals manufacturers paid $152 million in claims, a -19% decrease from the year prior. And the consumer electronics manufacturers paid $102 million in warranty claims in 2024, a 2% increase.

In the computer industry, HP Inc. paid $907 million in warranty claims in 2024, a 4% increase from 2023. Dell Technologies Inc. paid $891 million in claims, a 2% increase.

Hewlett Packard Enterprise Co. paid $185 million in claims in 2024, a -11% decrease from the year prior. IBM paid $81 million, a -2% decrease. Super Micro Computer paid $55 million, a 43% increase from 2023's total of $38 million. And Corsair paid $6 million, a -1% decrease.

In the consumer electronics industry, Garmin paid $83 million in warranty claims in 2024, a 11% increase from the year prior. GoPro paid $13 million, a -31% decrease. And audio equipment manufacturer VOXX International paid $4 million in warranty claims in 2024, a -6% decrease.

In the data storage industry, Western Digital paid $130 million in warranty claims in 2024, a -18% decrease from the year prior. Seagate Technology Holdings paid $85 million, a 1% increase. And Quantum Corp. paid $3 million, a -2% decrease.

And in the peripherals industry, Dover Corp. paid $53 million in warranty claims in 2024, a -16% decrease from the year prior. Diebold Nixdorf paid $44 million, a 20% increase. Zebra Technologies paid $29 million in claims in 2024, a 4% increase. Daktronics paid $14 million, a -49% decrease from the year prior.

NCR Atleos paid $4 million in claims in 2024, quadruple 2023's total of $1 million. 3D Systems paid $3 million, a -26% decrease. And Hurco Companies paid $3 million, a -9% decrease from the year prior.

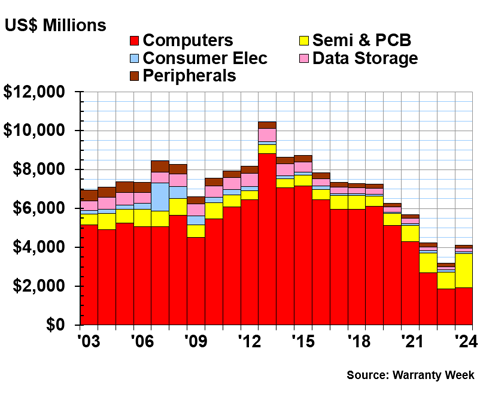

Warranty Accrual Totals

Figure 2 shows the total warranty accruals set aside by these five industries in the U.S.-based electronics sector, from 2003 to 2024.

Figure 2

Electronics Warranties

Accruals Made by U.S.-based Manufacturers

(in US$ millions, 2003-2024)

In 2024, the U.S.-based computer industry set aside $1.915 billion in warranty accruals in 2024, a 3% increase from the year prior. The semiconductor & PCB industry set aside $1.752 billion in accruals, double the accruals of 2023; we will delve deeper into this sharp increase in next week's newsletter.

The U.S.-based, publicly reporting consumer electronics industry set aside $106 million in warranty accruals in 2024, a 1% increase from the year prior. The data storage industry accrued $178 million, a 13% increase. And the peripherals manufacturers accrued $148 million in 2024, a -19% decrease.

In 2024, HP set aside $721 million in warranty accruals, a 5% increase from the year prior. Dell set aside $875 in accruals, a 3% increase.

Hewlett Packard Enterprise accrued $173 million in 2024, a -6% decrease from the year prior. IBM accrued $82 million, a -2% decrease. Super Micro Computer accrued $58 million, a 42% increase. And Corsair accrued $6 million, a -35% decrease from the year prior.

In the consumer electronics industry, Garmin set aside $90 million in warranty accruals in 2024, a 13% increase from 2023. GoPro set aside $11 million in accruals, a -45% decrease. And VOXX International accrued $4 million, a -23% decrease.

In the data storage industry, Western Digital set aside $117 million in warranty accruals, a 21% increase from 2023. Seagate accrued $58 million, a 5% increase. Quantum Corp. accrued $3 million, a -8% decrease. And NetApp Inc. accrued $1 million, a -78% decrease.

In the peripherals industry, Dover Corp. set aside $55 million in warranty accruals in 2024, a -15% decrease. Diebold Nixdorf accrued $40 million, a 14% increase. Zebra Technologies accrued $28 million, a -3% decrease. Daktronics accrued $14 million, a -45% decrease. 3D Systems accrued $4 million, a 35% increase. And Hurco Companies Inc. accrued $2 million, a -13% decrease.

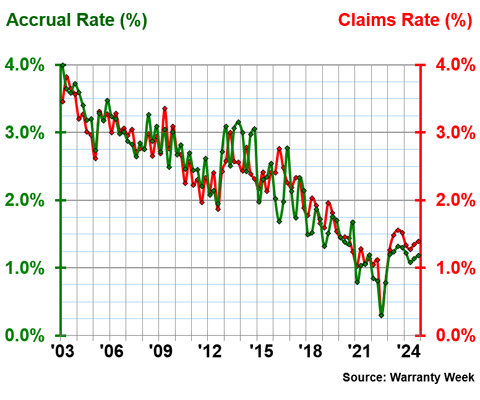

Warranty Expense Rates

Figures 3 through 7 show the average quarterly warranty claims and accrual rates for each U.S.-based industry, from 2003 to 2024.

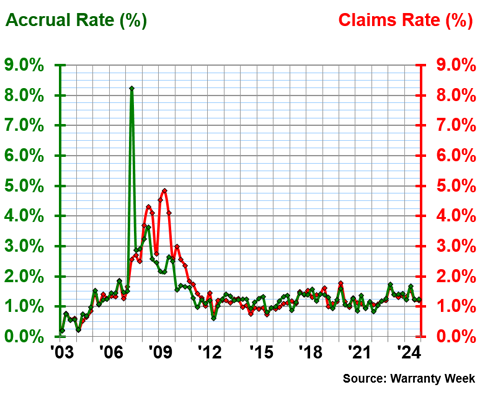

Figure 3 shows the average warranty expense rates of the computer manufacturers.

Figure 3

U.S.-based Computer OEMs

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2024)

Over 22 years, the U.S.-based computer manufacturers had an average warranty claims rate of 2.29%, with a standard deviation of 0.75%, and an average warranty accrual rate of 2.29%, with a standard deviation of 0.85%.

In 2024, the computer industry had an average claims rate of 1.34%. The values ranged from 1.27% in the second quarter, to 1.39% in the fourth quarter.

The computer industry had an average accrual rate of 1.16% in 2024. The values ranged from 1.08% in the second quarter, to 1.22% in the first quarter.

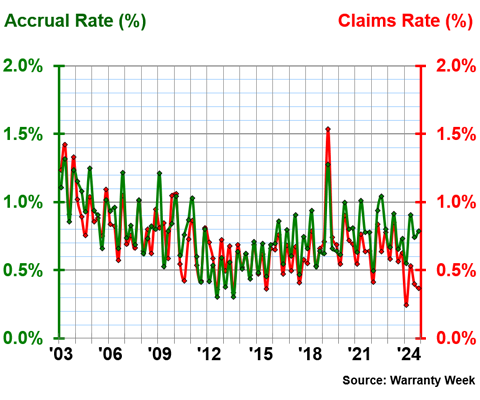

Figure 4 shows the average warranty expense rates of the semiconductor industry.

Figure 4

U.S.-based Semiconductor Manufacturers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2024)

Over 22 years, the semiconductor industry had an average warranty claims rate of 0.71%, with a standard deviation of 0.24%, and an average accrual rate of 0.77%, with a standard deviation of 0.23%.

In 2024, the semiconductor industry had an average warranty claims rate of 0.39%, and an average warranty accrual rate of 0.75%.

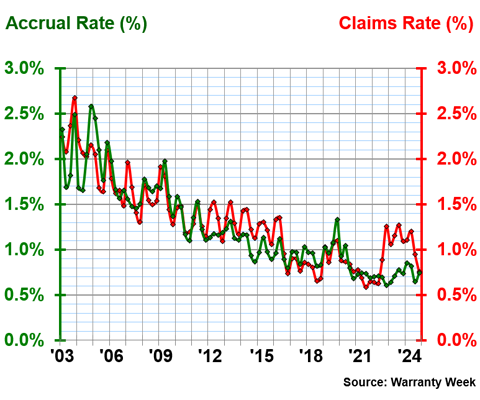

Figure 5 shows the warranty expense rates of the U.S.-based consumer electronics manufacturers.

Figure 5

U.S.-based Consumer Electronics Manufacturers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2024)

Over 22 years, the U.S.-based consumer electronics manufacturers had an average warranty claims rate of 1.50%, with a standard deviation of 0.92%, and an average warranty accrual rate of 1.45%, with a standard deviation of 0.94%.

In 2024, the consumer electronics industry had an average warranty claims rate of 1.32%, and an average warranty accrual rate of 1.34%.

Figure 6 shows the average expense rates of the data storage manufacturers.

Figure 6

U.S.-based Data Storage Manufacturers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2024)

Over 22 years, the data storage industry had an average warranty claims rate of 1.31%, with a standard deviation of 0.46%, and an average warranty accrual rate of 1.25%, with a standard deviation of 0.48%.

In 2024, the data storage manufacturers had an average claims rate of 1.00%, and an average accrual rate of 0.76%.

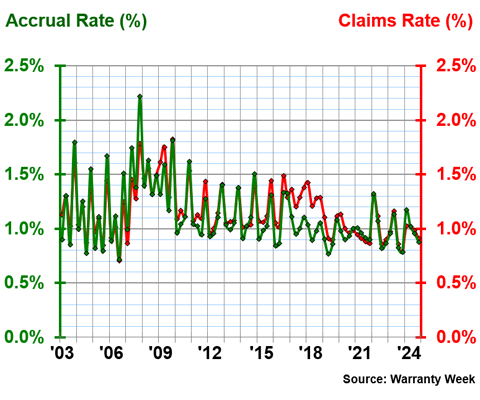

Figure 7 shows the average warranty expense rates of the peripherals manufacturers.

Figure 7

U.S.-based Peripherals Manufacturers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2024)

Over 22 years, the peripherals manufacturers had an average warranty claims rate of 1.16%, with a standard deviation of 0.24%, and an average accrual rate of 1.12%, with a standard deviation of 0.28%.

In 2024, the U.S.-based peripherals industry had an average warranty claims rate of 0.99%, and an average warranty accrual rate of 1.01%.

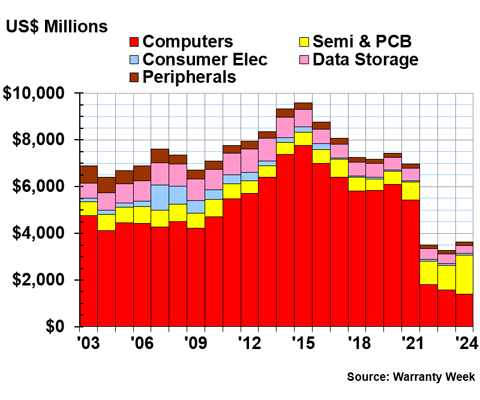

Warranty Reserve Balances

Figure 8 shows the year-end warranty reserve balances of the five U.S.-based industries in the electronics sector, from 2003 to 2024.

Figure 8

Electronics Warranties

Reserves Held by U.S.-based Manufacturers

(in US$ millions, 2003-2024)

At the end of 2024, the U.S.-based computer manufacturers held $1.385 billion in warranty reserves, a -11% decrease from the end of the year prior. The semiconductor & PCB manufacturers held $1.691 billion in warranty reserves at the end of 2024, a 58% increase from 2023.

The consumer electronics held $76 million in reserves at the end of 2024, a 4% increase. The data storage manufacturers held $329 million in reserves, a -17% decrease. And the peripherals manufacturers held $142 million, a -13% decrease.

In the computer industry, HP held $550 million in reserves at the end of 2024, a -22% decrease from the end of 2023. Dell held $428 million, a -4% decrease. Hewlett Packard Enterprise held $301 million, a -5% decrease. IBM held $76 million, a -17% increase. Super Micro Computer held $18 million, a 10% increase. And Corsair held $9 million, a -22% increase.

In the consumer electronics industry, Garmin held $62 million, a 12% increase. GoPro held $6 million, a -29% decrease. And VOXX International held $6 million, a -3% decrease.

In the data storage industry, Western Digital held $165 million, a -18% decrease. Seagate Technology held $136 million, a -19% decrease. And NetApp held $27 million, a 4% increase.

In the peripherals industry, Dover held $42 million, a -17% decrease. Daktronics held $38 million, a 10% increase. Zebra Technologies held $26 million, a -4% decrease. And Diebold Nixdorf held $23 million, a -20% decrease.

Catch the rest of our series of 22-year charts:

- "Twenty-Second Annual Product Warranty Report"

- "New Home Builder Warranty Report"

- "U.S. Small Vehicle Warranty Expenses"

- "U.S. Truck, Bus, & Heavy Equipment Warranty Expenses"

- "U.S. Auto Parts & Powertrain Warranty Expenses"

- "U.S. Aerospace Warranty Expenses"

- "U.S. New Home & Building Materials Warranty Expenses"

- "U.S. HVAC & Appliance Warranty Expenses"

- "U.S. Power Generation Equipment Warranty Expenses"