U.S. Electric Vehicle Warranties:

Tesla's claims and accrual rates have been on the rise since 2023. The startups Lucid and Rivian are not quite as consistent with their quarterly warranty accounting yet, even after some high-profile foreign investments.

Electric vehicles accounted for 10% of U.S. passenger car sales in August 2025, a new record high, according to S&P Global Mobility. However, industry experts say that this bump in EV sales over the summer reflected a rush to buy before the $7,500 EV tax credit ended on September 30, as part of Trump's megabill that was passed over the summer.

In contrast to that 10% figure in the United States, about 50% of new cars sold in China are EVs, and about 20% in the EU.

As reported by Nora Eckert in her Reuters article "Trump’s crackdown on EVs hits home in the Battery Belt," "roughly two dozen battery projects worth tens of billions in investment have been announced this decade." However, in the last year, "Americans’ waning enthusiasm for electric cars led automakers to delay or scrap some factory projects. Now, the additional fallout from U.S. President Donald Trump’s recent policy changes is descending on the Battery Belt," a region that spans across the U.S. Midwest and Southeast.

Eckert reported, "by 2030, the planned battery plants would provide the capacity to produce 13 million to 15 million EVs annually." However, "S&P Global Mobility predicts only around 3 million EVs will be produced that year, and some would likely use batteries imported from other countries." It's worth noting that the 3 million figure refers to predicted U.S. BEV sales in 2030. It's likely that PHEVs, and perhaps EREVs, both of which use petrol engines in combination with an electric battery, would utilize these batteries as well.

Even so, it seems that many manufacturers are still de-emphasizing these planned battery factories, now that qualifying for the $7,500 EV tax credit is no longer an incentive to have battery producing facilities and EV assembly plants located in the United States.

Ford has been delaying opening its new electric truck and battery factory in Stanton, Tennessee, according to Eckert. While construction on the assembly plant continues, a local report in 2024 stated, "production of Ford Motor Company’s electric next-generation pickup truck at its new West Tennessee plant will be delayed until 2027." The facility will also have a battery plant, in partnership with the Korean battery manufacturer SK On.

Additionally, Ford has two more battery factories in partnership with SK On, one in Kentucky that began production in August 2025, and another in Marshall, Michigan, which is currently under contruction and on track to start battery production in 2026. As reported by Ford Authority in May, Ford and SK On will be supplying many of the batteries they're producing at these facilities to Nissan— "roughly 100 GWh of EV batteries between 2028-2033." It seems this move was due to anticipated lower demand for Ford's own line of EVs in the near future.

As reported by Suvrat Kothari for Inside EVs, "Toyota this year inaugurated its $14 billion battery plant in North Carolina. Panasonic opened a $4 billion facility in Kansas. General Motors and LG Energy Solution have two giant joint-venture factories in the works— one in Tennessee and another in Michigan— each valued at more than $2 billion."

In addition, there's the Hyundai Motor Group Megaplant, the $12.6 billion assembly plant and battery factory near Savannah, Georgia. The assembly plant started producing EVs in October 2024. However, the opening of the adjoining battery plant, in partnership with fellow South Korean manufacturer LG Energy Solution, has been delayed, due to the largest ICE raid in history occurring at the Hyundai Megaplant in September 2025, in which 475 factory workers were detained, 300 of them South Korean nationals.

Overall, several battery manufacturing facilities and dedicated EV assembly plants in the U.S., which were proposed during the Biden administration as a result of the Inflation Reduction Act of 2022, have begun producing EVs and batteries, and many more are in the final stages of construction. However, since the $7,500 tax credit just ended a few weeks ago, and EV sales in the U.S. are predicted to decrease as a result, it's unclear what the future of EV assembly and EV battery manufacturing in the United States will be.

American EVs

For this newsletter, we decided to highlight the warranty expenses of three U.S.-based, dedicated EV pure play OEMs, Tesla Inc., Rivian Automotive Inc., and Lucid Group Inc.

There were a few very small EV manufacturers that do report their warranty expenses, which we decided to exclude from the charts in this newsletter. The main reason we excluded these companies was that the warranty expense rates were so high in certain quarters, due to low vehicle sales revenue, that the figures were not meaningful.

There's Faraday Future Intelligent Electric Inc., which the Nevada State Treasurer called a "Ponzi scheme" back in 2016. The company had produced just 16 cars by the end of 2024, according to an interview with the company's CEO at CES in January 2025. In January 2024, Faraday Future had a claims rate over 3,000%, and an accrual rate over 1,900%.

There's also Hyliion Holdings Corp., which developed electric and hybrid powertrain systems for class 8 trucks. However, since its acquisition of the hydrogen and fuel agnostic generator brand KARNO from GE Aerospace, the company seems to be de-emphasizing its electric powertrain business, the Hypertruck ERX. Recently, Hyliion announced plans for KARNO generator production in its investor reports, with no mention of electric powertrain. It seems that the past few years have been a transition period without much manufacturing occurring. The company has also barely reported any warranty expenses since the beginning of 2024, with the warranty expense rates varying between 0%, and incalculable, due to a denominator of zero (no reported product sales revenue).

And finally, there is Workhorse Group Inc., which makes electric vans and drones focused on last mile delivery. In its 2025 second quarter financial report, Workhorse stated that it has "more than 60 vehicles operating in customer and partner fleets." It shipped 32 W56 step vans in the second quarter of 2025.

Of course, traditional ICE OEMs are also selling EVs in the U.S., and in much higher volumes, including Ford, GM, Stellantis, Volkswagen, BMW, Mercedes-Benz, Hyundai, Kia, Nissan, Subaru, and Volvo Cars. However, since EVs are not these manufacturers' primary product lines, they are not included in this newsletter.

For each of the three U.S.-based BEV OEMs, Tesla, Rivian, and Lucid, we perused their annual reports and quarterly financial statements, and gathered three key warranty metrics: the amount of claims paid, the amount of accruals made, and the end-balance of the warranty reserve fund.

In addition, we gathered data on each manufacturer's total vehicle sales revenue, and use these to calculate our two additional warranty expense rates: claims as a percentage of vehicle sales (the claims rate), and accruals as a percentage of vehicle sales (the accrual rate).

Tesla

Tesla is one of the largest worldwide EV manufacturers, in competition with China's BYD for top global EV sales. The OEM and its celebrity oligarch CEO are frequently in the news, though it hasn't been for warranty issues since early 2024.

Take a look at our February 8, 2024 newsletter "U.S. Auto Warranty Annual Reports" for an in-depth discussion of Tesla's massive global recalls issued at the end of 2023 and beginning of 2024, due to issues with automatic assisted steering, and other safety issues related to its Autopilot software. There was also an issue with the ABS warning light display panel in Tesla's vehicles. Almost every vehicle produced by Tesla, from 2012 up to the 2023 model year, was recalled, either in December 2023, or January or February 2024, with recalls issued in China, the U.S., and Europe. The remedy for these issues were all OTA software updates.

Tesla has experienced smaller recalls since then, but nothing of the same magnitude as those recalls of approximately 2 million vehicles in the U.S., and about 1.6 million vehicles in China.

To see bar graphs depicting Tesla's total warranty costs, up to the second quarter of 2025, take a look at our September 11, 2025 newsletter "Mid-Year U.S. Auto Warranty Expenses."

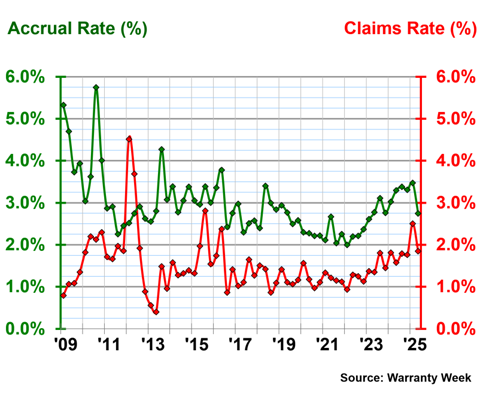

Figure 1 shows Tesla's quarterly warranty expense rates, from 2009 to the second quarter of 2025. Furthermore, Figure 1a zooms in on Tesla's quarterly warranty expense rates from the last ten years, from 2016 to mid-2025.

Figure 1

Electric Vehicle Manufacturer Warranties:

Tesla, Claims and Accrual Rates,

(as % of product revenue, 2009-2025)

We can see that Tesla's warranty expense rates have become much more consistent in the last ten years. 2016 was the model year that Tesla introduced the Model S, and the Model 3 was introduced in model year 2017.

Warranty expense rates tend to be more highly variable for newer OEMs, in early years with fewer units produced compared to industry leaders. Tesla has grown to prominence as a leading global OEM, especially in the past decade. It's not a coincidence that the company's warranty expenses became more predictable from quarter to quarter around the same time. It's a lesson to which all of the other newer American EV OEMs should pay attention.

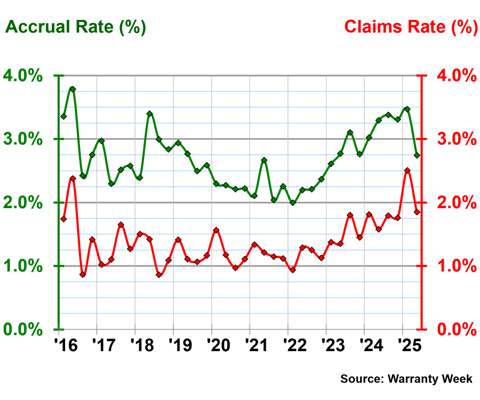

Figure 1a

Electric Vehicle Manufacturer Warranties:

Tesla, Claims and Accrual Rates,

(as % of product revenue, 2016-2025)

In Figure 1a, we can better see that Tesla increased its proportion of warranty accruals during 2022 and 2023, before the recalls were issued. The accrual rate dipped from the third to the fourth quarter of 2023, but continued to climb from the fourth quarter of 2024 to the first quarter of 2025.

The claims rate is a little less predictable, and the upward trend is not as prominent. The claims rate jumped in the first quarter of 2025, but dropped again in the second quarter.

In the second quarter of 2025, Tesla had a warranty claims rate of 1.85%, a relatively large drop from the first quarter. Tesla paid a total of $398 million in warranty claims in the second quarter of 2025, an increase of 2% from the previous quarter.

Tesla had a warranty accrual rate of 2.74% in the second quarter of 2025, another big drop down from the first quarter. Tesla set aside $591 million in warranty accruals in the second quarter, an increase if 9%.

Rivian

Rivian is a newer BEV OEM. Rivian acquired a former Mitsubishi Motors manufacturing plant in 2017, and delivered its first vehicles in 2021. Rivian is perhaps best known for supplying Amazon's electric delivery van (EDV) fleet; Amazon has at least 30,000 Rivian EDVs on the road in the U.S. In addition, Amazon owns 18% of Rivian.

Rivian and Volkswagen launched a joint venture in 2025. According to the press release, "the companies plan to bring next-generation electrical architecture and best-in-class software technology for both companies’ future electric vehicles, covering all relevant vehicle segments, including subcompact cars." Volkswagen invested $5.8 billion in Rivian, and now owns 16% of Rivian as well.

In addition, the Saudi Arabian investment firm Abdul Latif Jameel owns 13% of Rivian.

Rivian produced 6,000 vehicles in the second quarter of 2025, and delivered over 10,000 vehicles.

Rivian reported a warranty reserve balance, but no warranty claims, in 2022. Starting in 2023, Rivian reported warranty claims paid, accruals made, and reserves held on a quarterly basis.

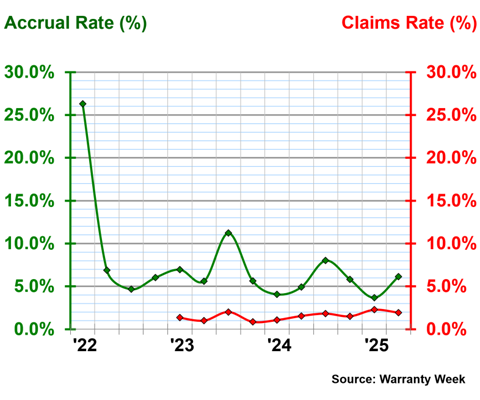

Figure 2 shows Rivian's warranty expense rates, including the 2022 warranty accruals made (as reflected in the warranty reserve end-balance). Figure 2a shows these data starting in 2023, when Rivian began reporting all three warranty metrics.

Figure 2

Electric Vehicle Manufacturer Warranties:

Rivian, Claims and Accrual Rates,

(as % of product revenue, 2022-2025)

Rivian reported a warranty reserve balance of $100 million at the end of 2022. Thus, we estimated $25 million set aside in warranty accruals per quarter in 2022. This resulted in a warranty accrual rate of 26% in the first quarter of 2022. Thus, we created Figure 2a, which shows these data starting in 2023.

Figure 2a

Electric Vehicle Manufacturer Warranties:

Rivian, Claims and Accrual Rates,

(as % of product revenue, 2023-2025)

Rivian's warranty accrual rate varies a lot from quarter to quarter. In the second quarter of 2025, Rivian had an accrual rate of 6.15%, which rose by two-thirds from the first quarter, where the accrual rate was 3.69%.

In the second quarter of 2025, Rivian set aside $57 million in warranty accruals, an increase of two-thirds from $34 million set aside in the first quarter. However, these figures are both lower than the $85 million set aside in warranty accruals in the fourth quarter of 2024.

Rivian paid $18 million in warranty claims in the second quarter of 2025, and had a warranty claims rate of 1.94%.

At the end of the second quarter, Rivian held $389 million in its warranty reserve fund, a decrease of -15% from the first quarter.

Lucid

Lucid Motors was founded in 2016, and delivered its first vehicle in 2021. In 2019, Lucid received $1.3 billion in funding from the Saudi Arabia Public Investment Fund (PIF). In 2021 as part of the process of going public, Lucid merged with a special-purpose acquisition company (SPAC), which resulted in the Saudi PIF owning 60% of Lucid, after a total investment of $2.9 billion.

Lucid produced 3,800 vehicles in the second quarter of 2025, and delivered 3,300 vehicles.

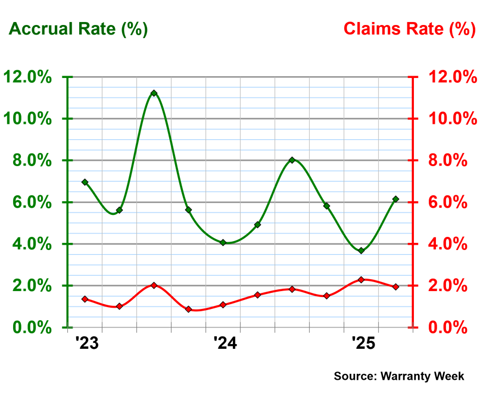

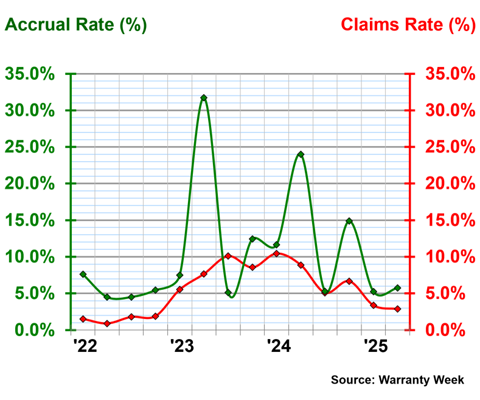

Figure 3 shows the warranty expense rates of Lucid, from 2022 to the second quarter of 2025.

Figure 3

Electric Vehicle Manufacturer Warranties:

Lucid, Claims and Accrual Rates,

(as % of product revenue, 2022-2025)

In the second quarter of 2025, Lucid had a warranty claims rate of 2.87%, and paid $7 million in warranty claims. Lucid's claims rates, and total claims costs, have dropped every quarter from the beginning of 2024.

Lucid's warranty accrual rates peaked dramatically in two of four quarters in 2024. In the second quarter of 2024, Lucid had an accrual rate of 24%, and in the fourth quarter, the accrual rate was 15%. In the first quarter of 2025, the accrual rate was 5.24%, and in the second quarter, the accrual rate was 5.77%.

Lucid set aside $15 million in warranty accruals in the second quarter of 2025, up 22% from the first quarter. At the end of the second quarter of 2025, Lucid held $124 million in warranty reserves, a 6% increase from the end of the first quarter.

Check out these newsletters on 2024 international auto warranty expenses, and 2025 Q1 & Q2 American auto warranty expenses:

- "U.S. Auto Warranty Annual Reports"

- "European Automaker Warranty Expenses"

- "Japanese Automaker Warranty Expenses"

- "Mid-Year U.S. Auto Warranty Expenses"

- "Korean & Indian Automaker Warranty Expenses"

- "Chinese Electric Vehicle Warranties"