U.S. Semiconductor Warranty Expenses:

In 2024, GPU manufacturer and generative AI leader Nvidia increased its warranty accruals eightfold, doubled its warranty accrual rate, and increased the size of its warranty reserve fund sevenfold. It will be interesting to see where these warranty claims costs arise for Nvidia, since commercial use of its GPUs in data centers voids the product warranty.

As we saw in last week's newsletter, total warranty accruals set aside by the U.S.-based semiconductor industry doubled from 2023 to 2024. This week, we'll delve deeper into the warranty expenses of this industry, and explore this sharp increase in warranty costs for the semiconductor & printed circuit board manufacturers in 2024.

The four largest U.S.-based manufacturers that report their warranty expenses are Lam Research Corp., Applied Materials Inc., Advanced Micro Devices Inc. (AMD), and Nvidia Corp.

Nvidia and AMD are two of the largest global manufacturers of discrete graphics processing units, or GPUs. Discrete GPUs are separate from the central processing unit (CPU) chip, hence their distinction as discrete units, and have their own cooling equipment and mechanisms.

Discrete GPUs are popular with video gamers and those who build their own personal computers, but the most high-powered and advanced GPUs are coveted for their ability to conduct the complex calculations needed to mine cryptocurrency and power artificial intelligence. Data centers, including those of Data Center Alley in northern Virginia, are increasingly using GPUs, rather than CPUs, to conduct parallel computations, and other complex and intensive calculations, needed for AI and machine learning.

We split the semiconductor industry into two industry sub-groups, semiconductor & PCB manufacturers, and makers of semiconductor manufacturing equipment. Nvidia and AMD are semiconductor OEMs, while Lam Research and Applied Materials are both makers of semiconductor manufacturing equipment.

Lam Research is a manufacturer of wafer fabrication equipment. Applied Materials manufactures equipment used to make chips, flat-panel displays, and solar panels.

Note that chip manufacturer Intel does not publish its warranty expenses in its annual reports, despite being a publicly traded, U.S.-based company.

To create this newsletter, we identified 163 U.S.-based manufacturers of semiconductors and semiconductor manufacturing equipment that reported product warranty expenses between 2003 and 2024. 36 of those manufacturers reported warranty costs in 2024.

We perused the annual reports and quarterly financial statements of each manufacturer, and gathered three key warranty metrics: the amount of claims paid, the amount of accruals made, and the year-end balance of the warranty reserve fund.

In addition, we gathered data on each manufacturer's total product sales revenue, and used these to calculate two warranty expense rates: claims as a percentage of sales revenue (the claims rate), and accruals as a percentage of product sales revenue (the accrual rate).

Warranty Claims Totals

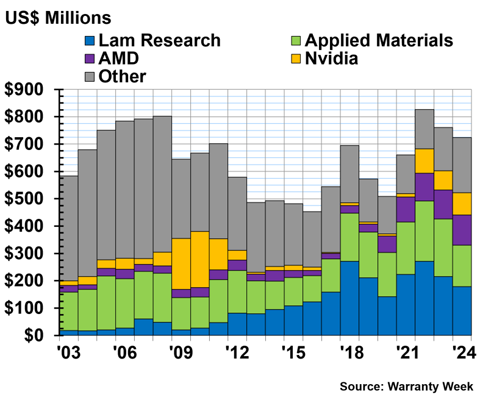

Figure 1 shows the total warranty claims paid by the U.S.-based semiconductor & PCB manufacturers, from 2003 to 2024.

Figure 1

Semiconductor Warranties

Claims Paid by U.S.-based Manufacturers

(in US$ millions, 2003-2024)

In 2024, the semiconductor & PCB industry paid $724 million in warranty claims, a -7% decrease from 2023.

Lam Research paid $179 million in warranty claims in 2024, a -17% decrease from the year prior. Applied Materials paid $152 million, a -28% decrease.

AMD paid $110 million in claims in 2024, a 4% increase from the year prior. Nvidia paid $81 million, a 14% increase.

Coherent Corp. paid $38 million in warranty claims, a -3% decrease. Marvell Technology Inc. paid $25 million, in its first year of reporting. Teradyne Inc. paid $23 million, a 25% increase.

IPG Photonics Corp. paid $16 million in claims in 2024, a -21% decrease from the year prior. Kulicke and Soffa Industries Inc. paid $13 million, a -12% decrease. Axcelis Technologies Inc. paid $12 million, a 19% increase. And Onto Innovation Inc. paid $11 million, a -9% decrease.

Warranty Accrual Totals

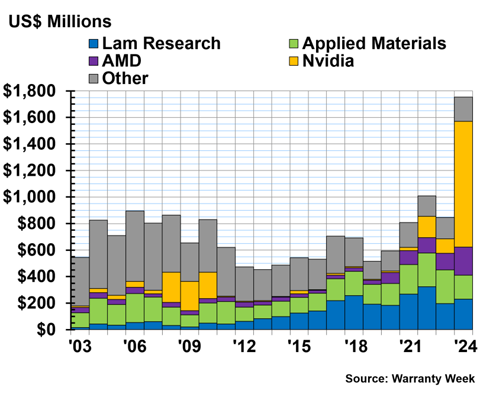

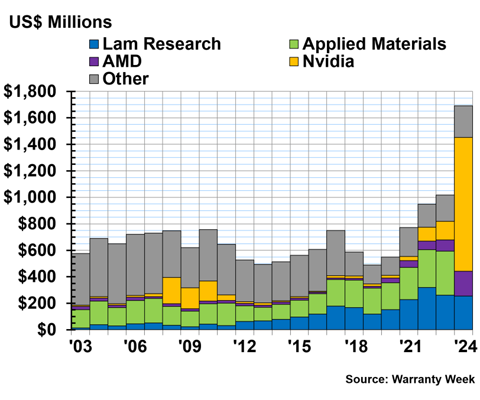

Figure 2 shows the total warranty accruals set aside by the U.S.-based semiconductor manufacturers, from 2003 to 2024.

Figure 2

Semiconductor Warranties

Accruals Made by U.S.-based Manufacturers

(in US$ millions, 2003-2024)

In 2024, the semiconductor & PCB industry set aside a total of $1.752 billion in warranty accruals, double 2023's total of $878 million.

Nvidia set aside $948 million in warranty accruals in 2024, a 770% increase from 2023's total of $839 million. Nvidia's annual report for the fiscal year ending January 26, 2025, which the company calls fiscal 2025, but we label as 2024 in our data, mentions, "In fiscal years 2025, 2024, and 2023 the additions in product warranty liabilities primarily related to Compute & Networking segment."

Nvidia's Compute & Networking segment includes the artificial intelligence department, and is also the company's largest revenue generator. Beyond that line in the 10-K report, the GPU manufacturer did not offer an explanation for increasing its warranty accruals eightfold from 2023 to 2024.

However, amazingly, Nvidia's product sales also increased by a large degree from 2023 to 2024, and the company had a warranty accrual rate of just 0.75% in 2024. This means that while Nvidia increased its total accruals eightfold, that total was still less than 1% of the total revenue generated from the sale of products that come with warranties. That is about double Nvidia's accrual rate from 2023, but still rather low in the grand scheme of things.

Lam Research set aside $229 million in warranty accruals in 2024, a 17% increase from the year prior. AMD set aside $213 million in accruals in 2024, a 69% increase from 2023. Applied Materials set aside $181 million in warranty accruals, a -29% decrease.

Coherent set aside $34 million in accruals in 2024, a -8% decrease. Teradyne accrued $30 million, a 39% increase. Kulicke and Soffa Industries accrued $12 million, a -9% decrease. Onto Innovation Inc. accrued $12 million, a 30% increase. Axcelis Technologies accrued $11 million, a -13% decrease. And ACM research accrued $11 million, a 44% increase from the year prior.

Warranty Expense Rates

In this newsletter, we're presenting the warranty expense rates of the two industry segments, the semiconductor OEMs, and the makers of semiconductor manufacturing equipment. Take a look at Figure 4 of last week's newsletter, "U.S. Electronics Warranty Report," for a chart showing the average warranty expense rates of the semiconductor industry as a whole.

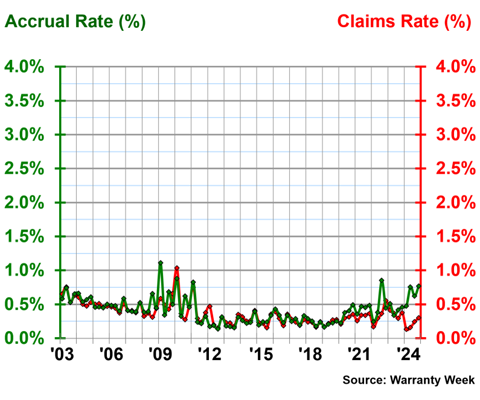

Figure 3 shows the quarterly average warranty expense rates of the semiconductor & PCB OEMs, from 2003 to 2024.

Figure 3

Semiconductor Devices & Printed Circuit Board Manufacturers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2024)

Over 22 years, the semiconductor device manufacturers had an average warranty claims rate of 0.36%, with a standard deviation of 0.16%, and an average warranty accrual rate of 0.41%, with a standard deviation of 0.19%.

In 2024, the semiconductor manufacturers had an average warranty claims rate of 0.21%. The quarterly values ranged from 0.13% in the first quarter, to 0.30% in the fourth quarter.

In 2024, the semiconductor manufacturers had an average warranty accrual rate of 0.66%. The quarterly values ranged from 0.48% in the first quarter, to 0.77% in the fourth quarter.

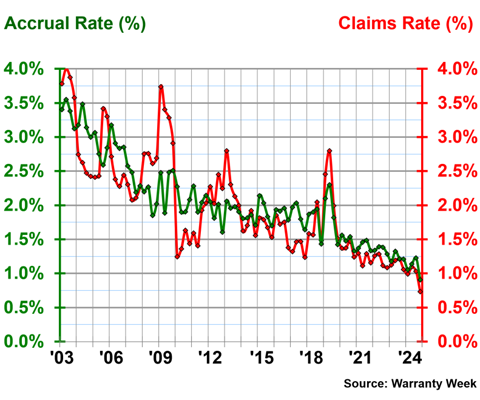

Figure 4 shows the average quarterly warranty expense rates for the makers of semiconductor manufacturing equipment, from 2003 to 2024.

Figure 4

Semiconductor Manufacturing Equipment

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2024)

Over 22 years, the semiconductor manufacturing equipment industry had an average warranty claims rate of 1.99%, with a standard deviation of 0.77%, and an average warranty accrual rate of 2.04%, with a standard deviation of 0.62%.

In 2024, the makers of semiconductor manufacturing equipment had an average warranty claims rate of 0.96%. The values ranged from 0.73% in the fourth quarter, to 1.10% in the second quarter.

In 2024, the makers of semiconductor manufacturing equipment had an average warranty accrual rate of 1.08%. The quarterly values ranged from 0.91% in the fourth quarter, to 1.23% in the third quarter.

Warranty Reserve Balances

Figure 5 shows the year-end warranty reserve balances of the semiconductor industry, from 2003 to 2024.

Figure 5

Semiconductor Warranties

Reserves Held by U.S.-based Manufacturers

(in US$ millions, 2003-2024)

At the end of 2024, the U.S.-based semiconductor & PCB manufacturers held $1.691 billion in warranty reserves, a 58% increase from the end of 2023.

Nvidia held $1.009 billion at the end of its fiscal year, a sevenfold increase from the $142 million in reserves held at the end of 2023.

AMD doubled the size of its warranty reserve fund from 2023 to 2024; at the end of 2024, AMD held $188 million in warranty reserves, a 121% increase from the $85 million held at the end of 2023.

Lam Research held $255 million in warranty reserves at the end of 2024, a -2% decrease from the end of the year prior.

Coherent held $43 million in reserves at the end of 2024, a -7% decrease. Teradyne held $42 million in warranty reserves at the end of 2024, more than double the $16 million in reserves the company held at the end of 2023.

IPG Photonics held $34 million in reserves, a -24% decrease. Marvell Technology held $17 million in reserves, a -14% decrease. Axcelis Technologies held $15 million in reserves, a -9% decrease. ACM Research Inc. held $13 million, a 29% increase. Onto Innovation held $11 million, a 16% increase. And Veeco Instruments Inc. held $10 million in reserves at the end of 2024, a 10% increase.

Catch the rest of our series of 22-year charts:

- "Twenty-Second Annual Product Warranty Report"

- "New Home Builder Warranty Report"

- "U.S. Small Vehicle Warranty Expenses"

- "U.S. Truck, Bus, & Heavy Equipment Warranty Expenses"

- "U.S. Auto Parts & Powertrain Warranty Expenses"

- "U.S. Aerospace Warranty Expenses"

- "U.S. New Home & Building Materials Warranty Expenses"

- "U.S. HVAC & Appliance Warranty Expenses"

- "U.S. Power Generation Equipment Warranty Expenses"

- "U.S. Electronics Warranty Report"