U.S. Telecom Equipment Warranty Expenses:

The warranty expenses of the U.S.-based telecommunications equipment industry have decreased significantly over the last two decades, especially in the landline and mobile phone industry sub-group. In addition, the average warranty claims and accrual rates for the industry have decreased by about one-third since 2018.

The warranty expenses of the U.S.-based telecom equipment manufacturers have decreased by two-thirds over the last two decades, from 2004 to 2024.

From 2003 to 2024, 200 U.S.-based telecom equipment manufacturers published their warranty expenses in their 10-Q and 10-K filings with the SEC. In 2024, only 15% of those manufacturers reported product warranty costs.

We've especially seen warranty costs decrease in the landline and mobile phone industry subgroup over the last two decades, as landlines have been phased out as obsolete (even Warranty Week removed its landline last year), and mobile phones have transitioned into consumer electronics. 90% of the U.S.-based landline and mobile phone telecom manufacturers had ceased reporting their warranty expenses by 2024.

To create this newsletter, we divided the U.S. telecom equipment industry into four industry sub-groups: internet and data communications, landline and mobile phone, broadcast and cable television, and satellite and microwave.

We identified 200 U.S.-based telecom equipment manufacturers that have reported product warranty expenses from 2003 to 2024. 29 of those manufacturers reported warranty expenses in 2024.

For each manufacturer, we perused their annual reports and quarterly financial statements, and gathered three key warranty metrics: the amount of claims paid, the amount of accruals made, and the end-balance of the warranty reserve fund.

In addition, we gathered data on each manufacturer's product sales revenue, meaning the revenue generated just from the sale of products sold with limited warranties attached. We used these data to calculate our two warranty expense rates: claims as a percentage of product sales (the claims rate), and accruals as a percentage of product sales (the accrual rate).

Telecom Equipment Manufacturers

The telecom equipment manufacturers in the internet and data communications subgroup that reported warranty expenses in 2024 were: Cisco Systems Inc., Juniper Networks Inc., EnerSys, Vertiv Holdings Co., Extreme Networks Inc., Lumentum Holdings Inc., Itron Inc., Netgear Inc., Calix Inc., Amtech Systems Inc., Applied Optoelectronics Inc., CSP Inc.. Socket Mobile Inc., and Cambium Networks Corp.

The manufacturers in the landline and mobile phone subgroup that reported warranty expenses in 2024 were: Ciena Corp., Adtran Holdings Inc., DZS Inc., PowerFleet Inc., Preformed Line Products Co., and Motorola Solutions Inc.

The manufacturers in the broadcast and cable television subgroup that reported warranty expenses in 2024 were: CommScope Holding Co. Inc., Infinera Corp., SPX Technologies Inc., Viavi Solutions Inc., and Optical Cable Corp.

The manufacturers in the satellite and microwave subgroup that reported warranty costs in 2024 were: Aviat Networks Inc., Comtech Telecommunications Corp., KVH Industries Inc., Frequency Electronics Inc., and Pineapple Energy Inc.

L3Harris, the IT services provider and defense contractor formed in 2019 by the merger of L3 Technologies Inc. and Harris Corp., ceased reporting its warranty expenses in 2022.

Once-familiar names in the telecom manufacturing industry that we won't see in this report include Nortel, Lucent, Avaya, 3Com, and Motorola. Nortel went bankrupt back in 2009. 3Com was acquired by Hewlett-Packard in 2010, and is now part of Hewlett Packard Enterprise, which we put in the computer industry in our data.

Back in 2011, Motorola split into two companies, Motorola Solutions and Motorola Mobility. Mobility was acquired by Google in 2012, then by Lenovo in 2014. Solutions, the telecom business, remains independent, publicly-traded, and based in the United States, but is inconsistent in reporting its warranty expenses. In 2024, the company published it warranty accruals, and a warranty reserve account end-balance, but reported $0 in warranty claims paid.

Lucent, which spun off from AT&T in 1996 and included the Western Electric and Bell Labs businesses, was acquired by the French company Alcatel in 2006; Alcatel-Lucent was subsequently acquired by Nokia in 2016. Avaya, which spun off from Lucent in 2000, went private in 2007, and has filed for Chapter 11 bankruptcy twice since, once in 2017, and again in 2023.

In the broadcast and cable TV category, the biggest players were once Scientific Atlanta and JDS Uniphase. Scientific Atlanta was acquired by Cisco Systems in 2015, so it's still represented in this report, though in a different category. JDS Uniphase split into two companies, Lumentum Holdings and Viavi Solutions, back in 2015. Lumentum is now in the internet and data communications category, while Viavi remains in broadcast and cable TV.

In 2022, Plantronics Inc. was acquired by HP Inc, and ceased reporting in the middle of that year.

In June 2024, Nokia announced its acquisiton of Infinera Corp. This acquisition was completed in February 2025, and Infinera continued to report its warranty expenses through the end of calendar 2024.

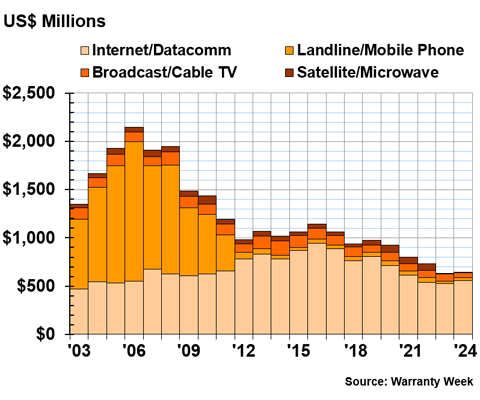

Warranty Claims Totals

Figure 1 shows the total warranty claims paid by the U.S.-based telecom equipment industry, from 2003 to 2024, divided by industry sub-group.

Figure 1

Telecom Equipment Warranties

Claims Paid by U.S.-based Manufacturers

(in US$ millions, 2003-2024)

Cisco Systems, in the internet and data communications sub-group, was by far the largest manufacturer in this data set. In 2024, Cisco paid $425 million in warranty claims, a 6% increase from 2023.

Juniper Networks paid $39 million in clims in 2024, a 22% increase from the year prior. EnerSys paid $28 million, a -6% decrease. Vertiv paid $24 million, a 9% increase. Extreme Networks paid $13 million in warranty claims, a -7% decrease. And Lumentum paid $11 million, a 44% increase.

In the landline and mobile phone sub-group, Ciena paid $27 million in warranty claims in 2024, a 36% increase from 2023. And Adtran paid $4 million in claims, a -5% decrease.

In the broadcast and cable TV sub-group, CommScope paid $19 million in claims in 2024, a -45% decrease. Infinera paid $16 million, a -21% decrease. And SPX Technologies paid $15 million in claims, no change from the year prior.

In the satellite and microwave sub-group, Aviat Networks paid $2 million in claims, a 4% increase. And Comtech Telecommunications paid $2 million in claims in 2024, a -15% decrease from the year prior.

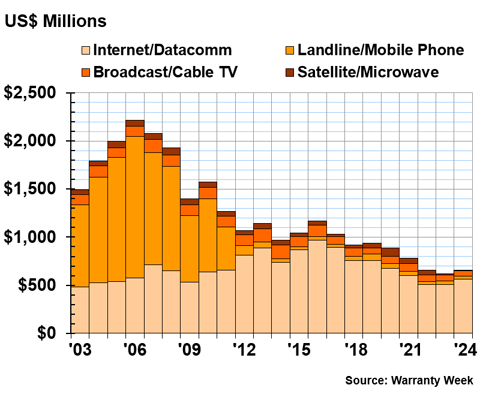

Warranty Accrual Totals

Figure 2 shows the total warranty accruals made by the four sub-groups in the telecom industry, from 2003 to 2024.

Figure 2

Telecom Equipment Warranties

Accruals Made by U.S.-based Manufacturers

(in US$ millions, 2003-2024)

In 2024, Cisco Systems set asied $432 million in warranty accruals, a 12% increase from the year prior. Juniper Networks set aside $40 million in warranty accruals, a 26% increase. EnerSys accrued $33 million, a 1% increase. Vertiv accrued $26 million, a 13% increase. Extreme Networks accrued $12 million, a -14% decrease. And Lumentum Holdings accrued $9 million, more than double 2023's total warranty accruals of $4 million.

In the landline and mobile phone sub-group, Ciena set aside $26 million in warranty accruals in 2024, a -19% decrease from 2023. Adtran accrued $2 million, a -25% decrease. And Motorola Solutions accrued $2 million in 2024 as well, but it was the manufacturer's first time since 2021 reporting any warranty accruals.

In the broadcast and cable TV sub-group, SPX Technologies set aside $20 million in warranty accruals in 2024, a 20% increase from 2023. CommScope set aside $18 million in warranty accruals in 2024, a -14% decrease from the year prior. And Infinera set aside $16 million in accruals, a -26% decrease.

In the satellite and microwave sub-group, Aviat Networks set aside $2 million in warranty accruals, a 77% increase from the year prior. Commtech Telecommunications set aside $2 million in accruals, a -61% decrease.

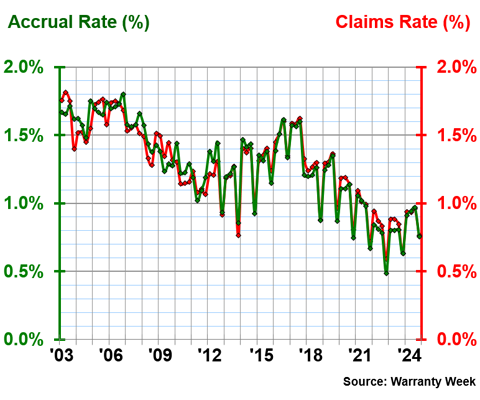

Warranty Expense Rates

Figure 3 shows the average quarterly warranty expense rates for the entire U.S.-based telecom industry, from 2003 to 2024. Several of the industry sub-groups are too small to present warranty expense rate charts for each.

Figure 3

Telecom Equipment Manufacturers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2024)

Over 22 years, the U.S.-based telecom equipment manufacturers had an average warranty claims rate of 1.28%, with a standard deviation of 0.30%.

Over 22 years, the U.S. telecom industry had an average warranty accrual rate of 1.28%, with a standard deviation of 0.31%.

In 2024, the U.S.-based telecom manufacturers had an average warranty claims rate of 0.90%. The quarterly values ranged from 0.76% in the fourth quarter, to 0.96% in the third quarter.

In 2024, the U.S. telecom manufacturers had an average warranty accrual rate of 0.90%. The quarterly values ranged from 0.76% in the fourth quarter, to 0.97% in the third quarter.

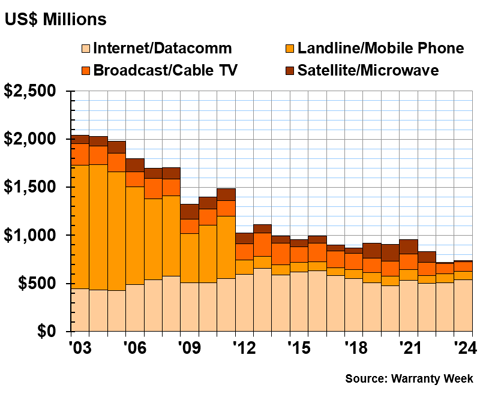

Warranty Reserve Balances

Figure 4 shows the warranty reserve year-end balances for the U.S.-based telecom manfuacturers, divided into four industry sub-groups, from 2003 to 2024.

Figure 4

Telecom Equipment Warranties

Reserves Held by U.S.-based Manufacturers

(in US$ millions, 2003-2024)

In the internet and data communications sub-group, Cisco Systems held $357 million in its warranty reserve fund at the end of 2024, an 8% increase from the end of 2023. EnerSys held $62 million in its warranty reserve fund, a 6% increase. Juniper Networks held $31 million in warranty reserves, a 5% increase.

Vertiv Holdings held $28 million in warranty reserves at the end of 2024, a 5% increase from the end of 2023. Itron held $22 million in reserves, the same as the end of 2023. Lumentum Holdings held $13 million in reserves, a 27% increase. Extreme Networks held $10 million, a -12% decrease.

In the landline and mobile phone sub-group, Ciena held $55 million in warranty reserves at the end of 2024, a -3% decrease from the end of 2023. Motorola Solutions held $24 million in warranty reserves at the end of 2024, a 9% increase.

In the broadcast and cable TV sub-group, SPX Technologies held $45 million in warranty reserves at the end of 2024, an 18% increase from the end of 2023. Infinera held $26 million in reserves, a -23% decrease. And CommScope held $20 million, a -27% decrease.

In the satellite and microwave sub-group, Comtech Telecommunications held $8 million, a -15% decrease. And Aviat Networks held $4 million in warranty reserves at the end of 2024, a 43% increase from the end of the year prior.

2025 Warranty Industry Awards Nominations Open

5 Award Categories Showcase Best of Industry

The warranty industry announces the 2nd Annual Best-of-Industry Awards! Strategic Solutions Network (SSN) opens nominations for the Warranty & Service Contract Industry Annual Awards on August 4, 2025. These are peer-nominated industry awards to recognize and showcase innovation and excellence in the warranty and extended warranty/service contract industries. All industry professionals invited to submit nominations. www.warrantyawards.org

The awards feature 5 categories with one winner per category. The awards will honor companies in each category with the exception of the "Warranty Industry Champion" award, which will recognize the most significant individual contributor to the industry.

AWARD CATEGORIES:

- Innovative Product Design

- Transformative Technology Innovation Leadership

- Customer Experience Excellence

- Operational Performance & Administrative Excellence

- Warranty Industry Champion

Please visit: www.warrantyawards.org for detailed criteria for each category and to submit your nomination. Deadline for nominations is September 5, 2025.

The 2025 Award nominees will be announced the week of September 15, 2025. Voting for one of the top 3 finalists will open September 22, 2025, and winners will be announced on October 28, 2025, at The 16th Annual Extended Warranty & Service Contract Innovations, scheduled for October 27-29, 2025, The Drake, Chicago, Illinois. www.warrantyinnovations.com

The awards steering committee will oversee the voting process to ensure fairness and transparency:

- Eric Arnum, Publisher, Warranty Week

- Travis Moore, General Counsel, Service Contract Industry Council (SCIC)

- Paul Swenson, Senior Vice President, Domestic and General

- Dan Tafel, Chief Development Officer, Ironwood Warranty Group

- Gregory Myers, Executive Managing Director, Brown & Brown

- Roz Applebaum, Vice President, Warranty Innovations Conferences, Strategic Solutions Network

Please visit www.warrantyawards.org for more detailed information and to submit your nominees. Deadline for nominations is September 5, 2025.

Strategic Solutions Network (SSN) is also the producer of highly acclaimed industry-wide events including:

The 16th Annual Extended Warranty & Service Contract Innovations, scheduled for October 27-29, 2025, The Drake, Chicago, Illinois www.warrantyinnovations.com

The 4th Annual Warranty & Service Contract Innovations for Vehicle, Home, Smart Products & Consumer Goods, Spring 2026. www.globalwarrantyinnovations.com

For more information, contact: Roz Applebaum at roz@strategicsolutionsnet.com.

Catch the rest of our series of 22-year charts:

- "Twenty-Second Annual Product Warranty Report"

- "New Home Builder Warranty Report"

- "U.S. Small Vehicle Warranty Expenses"

- "U.S. Truck, Bus, & Heavy Equipment Warranty Expenses"

- "U.S. Auto Parts & Powertrain Warranty Expenses"

- "U.S. Aerospace Warranty Expenses"

- "U.S. New Home & Building Materials Warranty Expenses"

- "U.S. HVAC & Appliance Warranty Expenses"

- "U.S. Power Generation Equipment Warranty Expenses"

- "U.S. Electronics Warranty Report"

- "U.S. Semiconductor Warranty Expenses"