Other U.S. Product Warranties:

Some manufacturers defy categorization into an industry group, but still issue product warranties for their goods. "Other" products sold with limited warranties attached include vapes and e-cigarettes, exercise equipment, jewelry, watches, golf clubs, firefighting equipment, surveillance cameras, police body cameras, water management infrastructure, oil and gas pipelines, and hazardous site investigation robots.

Over 13 newsletters, we have explored the warranty expenses of 15 of the 18 U.S.-based industry groups that we outlined in the "Twenty-Second Annual Product Warranty Report." This week, we're finishing this series of 22-year charts with an analysis of the warranty costs of the final three industries, material handling, sports equipment, and security systems.

Unlike the other industry groupings, these three are only loosely related. And the sports category serves as a bit of a catch-all for manufacturers that somewhat defy classification.

Overall, we had 111 manufacturers left that we have not yet discussed in this newsletter series. 51 were in the material handling industry, 28 were in the security industry, and 32 were in the sports industry.

For each manufacturer, we perused their annual reports and quarterly financial statements, and gathered three key warranty metrics: the amount of claims paid, the amount set aside in warranty accruals, and the end-balance of the warranty reserve fund.

Material Handling

Of the 55 manufacturers in the material handling industry, 14 reported warranty expenses in 2024. These companies deal with infrastructure and specialized systems for controlling, compressing, manipulating, and transporting water, oil, gas, and waste.

In the material handling industry, the largest manufacturers were: Xylem Inc., Flowserve Corp., Ingersoll Rand Inc., Mueller Water Products Inc., Lindsay Corp., Idex Corp., Ampco-Pittsburgh Corp., Zurn Elkay Water Solutions Corp., Gorman-Rupp Co., and Geospace Technologies Corp.

Note that the Ingersoll Rand Inc. we're discussing in this newsletter is a different company from the former Ingersoll-Rand plc. In early 2020, Gardner Denver Holdings Inc. acquired Ingersoll-Rand plc's industrial segment in a Reverse Morris Trust transaction. The former Ingersoll-Rand plc first spun off its Industrial Technologies and Services segment into a separate company, and then Gardner Denver acquired that spin-off. The former Ingersoll-Rand plc, left with its HVAC and refrigeration business, renamed itself Trane Technologies plc, while the former Gardner Denver Holdings Inc. renamed itself Ingersoll Rand Inc.

Security

Of the 28 manufacturers in the security industry, 10 reported warranty expenses in 2024. This industry consists mainly of makers of firearms, security systems, and robots. Several are also police and/or military contractors, making police robots, surveillance equipment, body cameras, weapons, riot gear, tactical gear, etc. Some manufacturers also dip into the consumer electronics industry, such as surveillance camera doorbells, baby monitors, home security cameras, and robotic vacuums. Furthermore, some of the manufacturers make equipment for investigating and mitigating hazardous sites, such as respirators, gas masks, and firefighter equipment.

Note that product warranty costs related to military contracts are not published in annual reports. However, some of these products are sold to police, military, and civilians alike. And some household products have a hidden police and surveillance undertone that the average consumer typically doesn't notice.

The 10 security manufacturers that reported warranty expenses in 2024 were: iRobot Corp., MSA Safety Inc., Allegion plc, Smith & Wesson Brands Inc., Axon Enterprise Inc., Arlo Technologies Inc., Cadre Holdings Inc., American Outdoor Brands Inc., Astrotech Corp., and Lifeloc Technologies Inc..

iRobot makes the Roomba vacuums, as well as military robots, police robots, and robots that investigate hazardous sites. Amazon, another company that engages in both consumer products and military contracts, announced its intent to acquire iRobot in 2022, but the deal was canceled in January 2024 after facing scrutiny and opposition from European and U.S. antitrust regulators.

American Outdoor Brands Inc. was formerly known as Smith & Wesson Holding Corp. until 2016. The Smith & Wesson brand was a unit of American Outdoor Brands from 2016 until 2020, when they split into two separate companies, Smith & Wesson Brands Inc. and American Outdoor Brands Inc. Both spin-off report their product warranty costs separately.

Axon Enterprise was known as Taser International Inc. until 2017. The rebranding was prompted by the manufacturer de-emphasizing its eponymous Taser (technically "handheld electroshock weapons," since "Taser" is a copyrighted brand name, not the name of the product itself). Axon has started focusing on surveillance camera products, including body cameras and dashboard cameras.

Arlo Technologies was spun-off from Netgear in 2018, and makes camera doorbells, security cameras, and baby monitors.

Sports

Of the 32 manufacturers in the sports industry, 16 reported warranty expenses in 2024. The largest manufacturers were: Philip Morris International Inc., Peloton Interactive Inc., Signet Jewelers Ltd., Johnson Outdoors Inc., Fossil Group Inc., Cricut Inc., Bowflex Inc., Latham Group Inc., and Acushnet Holdings Corp.

Some of these manufacturers make items that would traditionally fall under the sports umbrella, such as exercise equipment, camping gear, golf clubs, swimming pools, skis, and bicycles. Additionally, there are manufacturers in this category that make products that are used for recreation, but not exactly the sporting kind. These include makers of vapes, cannabis cultivation equipment, crafting machines, jewelry, and stock ticker displays for national stock markets. The "Sports" category is more like a loosely associated group of manufacturers, rather than an industry, per se.

Philip Morris International Inc. is a U.S.-based company, but only engages in business outside of the U.S. Phillip Morris International (PMI) is responsible for the Marlboro brand outside of the United States. Its former parent, Altria Group Inc., does business within the United States. PMI was spun-off from Altria in 2008.

PMI, like the rest of the cigarette industry, saw the writing on the walls, and has pivoted to smoke-free nicotine products, including the Zyn brand of nicotine pouches, the Iqos brand of heated tobacco products (similar to vapes but burning tobacco rather than liquid), and the Veev brand of electronic cigarettes. In 2023, Iqos surpassed Marlboro as the PMI brand that generated the most revenue, and all of those vapes and heating apparatuses come with product warranties attached.

While we assume that most vapes come with product warranties attached (if not the disposable ones, definitely the reusable ones), PMI is the only Big Tobacco manufacturer that reports its warranty expenses.

Peloton Interactive makes the eponymous high-end exercise equipment. Signet Jewelers owns the Jared and Kay jewelry brands. Fossil Group is a watch brand, and makes licensed accessories for mid-luxury brands such as Tory Burch and Michael Kors, and DKNY.

Johnson Outdoors makes scuba diving gear, and camping equipment such as tents and camp stoves. Cricut makes crafting and cutting machines. Latham Group makes in-ground residential swimming pools. Acushnet makes golf clubs, balls, and other gear.

Bowflex was renamed from Nautilus Inc. in 2023, and made a variety of exercise equipment. The company filed for Chapter 11 bankruptcy in March 2024, and was subsequently acquired by the Taiwanese exercise equipment manufacturer Johnson Health Tech Co. Ltd.

Now that we have a sense of the manufacturers we're analyzing in this newsletter, let's take a look at the total warranty claims paid, accruals made, and reserves held by the three industry groups.

Warranty Claims Totals

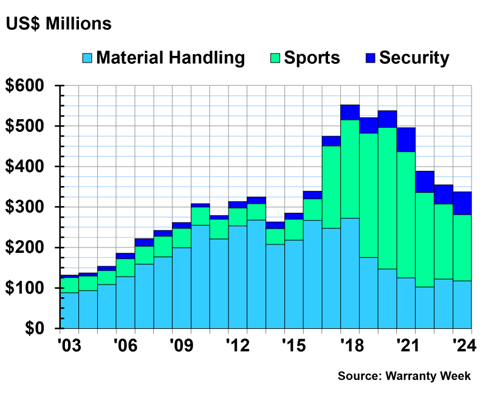

Figure 1 shows the total warranty claims paid by the manufacturers in these three industry groups, from 2003 to 2024.

Figure 1

Other Product Warranties by Industry

Claims Paid by U.S.-based Manufacturers

(in US$ millions, 2003-2024)

In 2024, Philip Morris International paid $77 million in warranty claims, a -7% decrease from 2023. Peloton paid $36 million in claims in 2024, a 1% increase from the year prior. Signet Jewelers paid $11 million in claims, a -6% decrease. Johnson Outdoors paid $10 million, a 11% increase.

In the material handling industry, Xylem paid $37 million in warranty claims in 2024, a 16% increase from the year prior. Ingersoll Rand paid $31 million in claims, a -2% decrease. Flowserve paid $21 million, a -2% decrease. Lindsay Corp. paid $8 million in claims, a -20% decrease.

In the security industry, iRobot paid $21 million in warranty claims in 2024, a -3% decrease from 2023. MSA Safety paid $12 million, a 21% increase. Allegion paid $13 million, a 33% increase. And Axon Enterprise paid $6 million, quadruple 2023's total of $1.5 million.

Warranty Accrual Totals

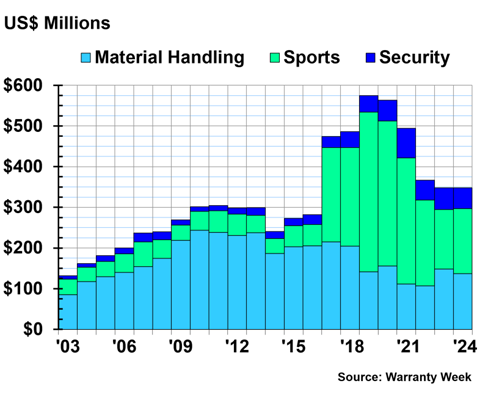

Figure 2 shows the total warranty accruals set aside by the manufacturers in the three industry groups, from 2003 to 2024.

Figure 2

Other Product Warranties by Industry

Accruals Made by U.S.-based Manufacturers

(in US$ millions, 2003-2024)

In 2024, Philip Morris International set aside $76 million in warranty accruals, a 27% increase from 2023. Peloton set aside $35 million in accruals, an 88% increase from the year prior. Johnson Outdoor set aside $12 million in accruals, an 8% increase.

Signet Jewelers set aside $9 million in warranty accruals in 2024, a -42% decrease from the year prior. Acushnet accrued $7 million, a -6% decrease. Latham Group accrued $4 million, a -34% decrease.

In the material handling industry, Xylem set aside $36 million in warranty accruals, a 24% increase from the year prior. Ingersoll Rand set aside $38 million in accruals, a -16% decrease.

Flowserve accrued $26 million, a -1% decrease from the year prior. Mueller Water Products accrued $13 million, a -9% decrease. Lindsay Corp. accrued $8 million, a -32% decrease. And Idex accrued $5 million in 2024, a -12% decrease from 2023.

In the security industry, iRobot set aside $14 million in warranty accruals in 2024, a -23% decrease from the year prior. Allegion accrued $16 million, a 25% increase. MSA Safety accrued $11 million, a 20% increase. Axon Enterprise accrued $6 million, a -31% decrease. Smith & Wesson accrued $3 million, a 12% increase. And American Outdoor Brands accrued $2 million in 2024, a 40% increase from 2023.

Warranty Reserve Balances

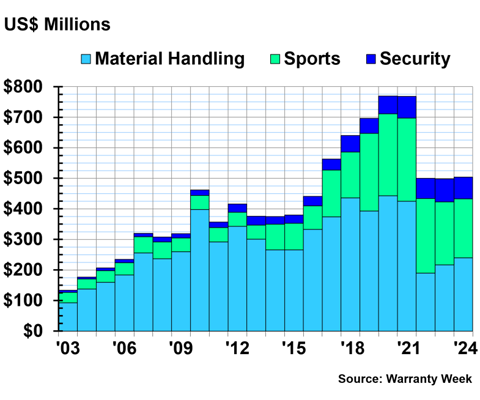

Figure 3 shows the end-balances of the warranty reserve funds for the manufacturers in the three industry groups, from 2003 to 2024.

Figure 3

Other Product Warranties by Industry

Reserves Held by U.S.-based Manufacturers

(in US$ millions, 2003-2024)

At the end of 2024, PMI held $76 million in warranty reserves, a -5% decrease from the end of 2023. Signet Jewelers held $41 million in reserves, a -5% decrease.

Peloton held $21 million in warranty reserves at the end of 2024, a -4% decrease from the end of the year prior. Johnson Outdoors held $12 million, a 10% increase. Fossil Group held $6 million in reserves, a -40% decrease. And Topgolf Callaway Brands Corp. held $15 million in warranty reserves at the end of 2024, a 14% increase.

In the material handling industry, Xylem held $57 million in warranty reserves at the end of 2024, a -10% decrease from the year prior. Ingersoll Rand held $68 million, a 10% increase.

Flowserve held $32 million in reserves, an 18% increase. Mueller Water Products held $26 million in reserves, a 45% increase. Idex held $14 million in reserves, a 49% increase. Lindsay Corp. held $13 million, a -6% decrease. CECO Environmental Corp. held $12 million in reserves at the end of 2024, a 140% increase from the end of 2023.

In the security industry, iRobot held $18 million in warranty reserves at the end of 2024, a -26% decrease from the end of 2023. Allegion held $23 million in reserves, a 10% increase from the end of the year prior. MSA Safety held $14 million, a -4% decrease. Axon Enterprise held $8 million, a 12% increase. And Smith & Wesson held $4 million in warranty reserves at the end of 2024, a -3% decrease.

Warranty Expense Rates of Top Manufacturers

Since the industry groups are more loosely associated, we decided to highlight the warranty expense rates of individual manufacturers, rather than calculate the industry average warranty expense rates. Figures 4 through 8 show the warranty expense rates of the largest manufacturers in each industry group.

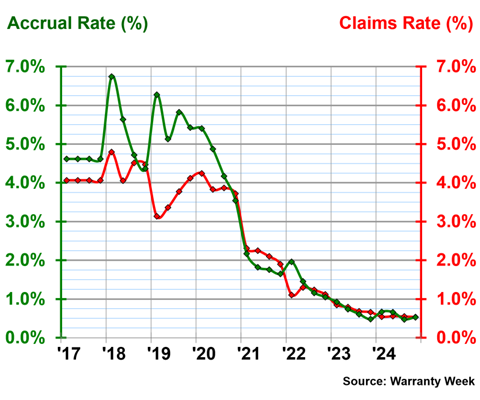

Figure 4 shows the warranty claims and accrual rates of Philip Morris International, from 2017 to 2024.

Figure 4

Philip Morris International Inc.

Quarterly Warranty Claims & Accrual Rates

(as a % of product sales, 2017-2024)

At the end of 2024, Philip Morris International had a warranty claims rate of 0.54%, and a warranty accrual rate of 0.53%.

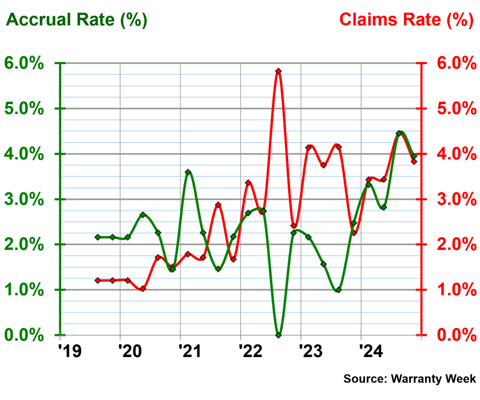

Figure 5 shows the warranty expense rates of Peloton Interactive, from 2019 to 2024.

Figure 5

Peloton Interactive Inc.

Quarterly Warranty Claims & Accrual Rates

(as a % of product sales, 2019-2024)

At the end of 2024, Peloton had a warranty claims rate of 3.83%, and a warranty accrual rate of 3.95%. The company's warranty expense rates have fluctuated a lot since it started reporting in mid-2019.

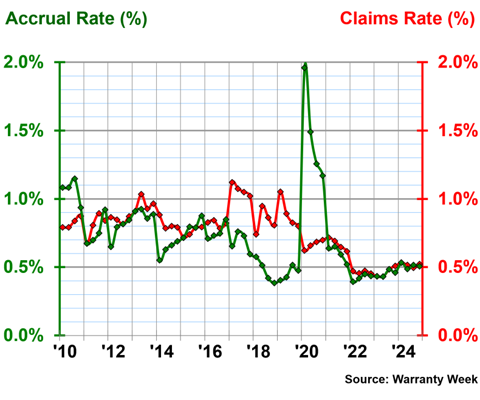

Figure 6 shows the warranty expense rates of Xylem from 2010 to 2024.

Figure 6

Xylem Inc.

Quarterly Warranty Claims & Accrual Rates

(as a % of product sales, 2010-2024)

At the end of 2024, Xylem had a warranty claims rate of 0.52%, and a warranty accrual rate of 0.51%.

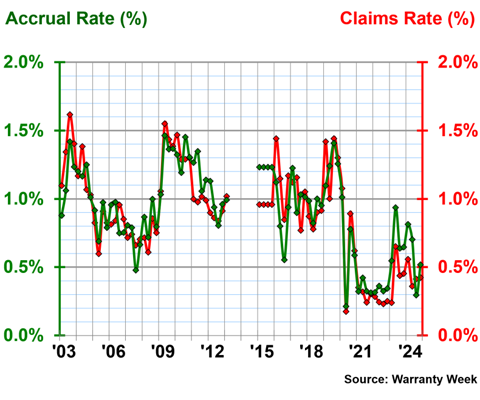

Figure 7 shows the quarterly warranty expense rates of Gardner Denver, and later Ingersoll Rand Inc., from 2003 to 2024, with a small gap in reporting in 2013 and 2014.

Figure 7

Ingersoll Rand Inc.

Quarterly Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2024)

At the end of 2024, Ingersoll Rand Inc. had a warranty claims rate of 0.42%, and a warranty accrual rate of 0.52%.

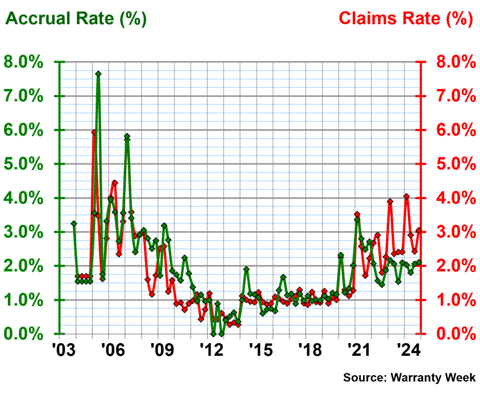

Figure 8 shows the quarterly warranty expense rates of iRobot, from 2003 to 2024.

Figure 8

iRobot Corp.

Quarterly Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2024)

At the end of 2024, iRobot had a warranty claims rate of 3.05%, and a warranty accrual rate of 2.11%. iRobot's claims rate has exceeded its accrual rate every quarter since the beginning of 2022.

Check out the entire series of 22-year charts:

- "Twenty-Second Annual Product Warranty Report"

- "New Home Builder Warranty Report"

- "U.S. Small Vehicle Warranty Expenses"

- "U.S. Truck, Bus, & Heavy Equipment Warranty Expenses"

- "U.S. Auto Parts & Powertrain Warranty Expenses"

- "U.S. Aerospace Warranty Expenses"

- "U.S. New Home & Building Materials Warranty Expenses"

- "U.S. HVAC & Appliance Warranty Expenses"

- "U.S. Power Generation Equipment Warranty Expenses"

- "U.S. Electronics Warranty Report"

- "U.S. Semiconductor Warranty Expenses"

- "U.S. Telecom Equipment Warranty Expenses"

- "U.S. Medical & Scientific Equipment Warranties"

- "Other U.S. Product Warranties"